Good news about continued vaccine approval and deployment, along with Congress’ approval of a second stimulus package over the weekend has the major indices very near the highs they set last week. There is a not-too-surprising temptation to think about the end of the pandemic and start looking for all of the ways that the economy should recover in the year ahead. I think we’re all tempted to do it, if for no other reason than what I’ve come to call “pandemic exhaustion” is a real thing. Everybody wants to put COVID behind us and look ahead to brighter days.

Even with the likelihood that national and global herd immunity will be reached by mid-2021, and the expected resumption of “normal” activities by then, however I think it is still important to remember that there are lots of risks to keep in mind. There is still an entire winter that has to be traversed, with all of the near-term exposure and infection risks that have to be managed while vaccines are deployed, first to those than need them most, and then to the broader population. That also says nothing about an undercurrent of anti-vaccine sentiment that I think could extend the pandemic’s effects longer than anticipated. I’ve noted health experts on news media sources making a point of bringing this issue up in an effort to get ahead of the question. It’s something that bears paying attention to.

History has shown that the transition to a new presidential administration generally has a pretty limited effect on the financial markets, but one of the things I’m also starting notice increasing commentary about is the fact that the Biden administration intends to roll back some of the Trump administration’s business-friendly initiatives and replace them with policies that likely include raising taxes. Consider that the forward-looking nature of the financial markets used the expectation of tax cuts, increased infrastructure spending, and some of the current administration’s policies to build bullish momentum throughout the past four years (they even came up with a name, the Trump Trade, to describe stocks expected to benefit from a business-friendly White House), and it’s reasonable to suggest some of the incoming administration’s policies could provide a proportional headwind in 2021. Enough to start a new bear market? Maybe not; but when you stack that possibility with the reality of continued, high unemployment from the pandemic and the massive levels of debt incurred to provide both rounds of stimulus and it seems that it is still a good idea to be conservative and cautious.

Maintaining a careful, deliberate and conservative approach to the market also means that paying attention to defensive-oriented industries can be a good way to keep you money working for you even as you try to minimize risk. Utilities and food stocks are two examples of basic needs industries that often work well when you think market risk could be increasing. These are businesses whose models are less sensitive to economic cyclicality, because consumers still need to purchase those products and services even when the economy is forcing us to think more carefully about where we spend our money. That means these are industries that are less likely to be forced to discount their products to keep generating useful revenue.

Food stocks are an area that I like to focus on, for the simple reason that no matter what the economy is doing, consumers aren’t going to stop providing for their families. Employment difficulties, or a decrease in income may force a family to tighten their belts, but they will still make allowances for food in their monthly budgets. The problem, of course, is that not all stocks are created equal, even when they’re in the same industry. That means that even if an industry is getting positive attention and building bullish momentum in the market, there will still be stocks in that industry that underperform and represent risks to your investment dollars that other stocks in the industry don’t. The challenge for a value investor is that the market is pretty good at pricing a company’s fundamental strength or weakness into its stock, and so a company with poor fundamentals will often be found trading in the lower extremes of its historical ranges. That lower price could make the stock look appealing at first glance for a value investor; but it is also the classic definition of a value trap – a stock that looks like a great bargain but really isn’t.

Fresh Del Monte Produce (FDP) is an example of a recognizable name in the food industry that is trading at a significant discount compared to its historical levels. As of this writing, it is even below the bear market bottom it hit with the rest of the stock market in March and appears to be fading off a recent attempt to rally into a new short-term upward trend. The company’s fundamental profile is a bit mixed, with some elements that look favorable at first glance but others found a deeper level of examination that might suggest there is a reason the stock has underperformed against the market and its industry.

Fundamental and Value Profile

Fresh Del Monte Produce Inc. is a holding company. The Company, through its subsidiaries, is engaged in sourcing, transportation and marketing of fresh and fresh-cut produce together with prepared food products in Europe, Africa and the Middle East. Its operations are aggregated into business segments on the basis of its products: bananas, other fresh produce and prepared food. It sources its fresh produced products, such as bananas, pineapples, melons, tomatoes, grapes, apples, pears, peaches, plums, nectarines, cherries, citrus, avocados, blueberries and kiwi from Central and South America, Africa, the Philippines, North America and Europe. It sources its prepared food products from Africa, Europe and the Middle East. It distributes its products in North America, Europe, Asia, the Middle East, Africa and South America. It markets its products under the DEL MONTE brand, as well as under other brands, including UTC, Rosy, Fruit Express, Just Juice, Fruitini and other regional brands. FDP’s current market cap is $1.1 billion.

Earnings and Sales Growth: Over the last twelve months, earnings were flat (exactly 0%), while revenues declined -7.52%. The picture got worse in the last quarter, as earnings declined -35%, and revenues by a little over -9%. The company’s margin profile is razor thin, but appears to be strengthening; over the last twelve months, Net Income was a marginal 0.53% of Revenues, but improved to 1.76% in the last quarter.

Free Cash Flow: FDP’s free cash flow is generally healthy, at a little over $112 million. That translates to a Free Cash Flow Yield of 9.75%. That sounds pretty good, but this number also decreased from the quarter prior, at $170 million, and is below the $139 million reported at the beginning of the year. The net decline offers an interesting counterpoint to the improving Net Income picture just described.

Debt to Equity: FDP has a debt/equity ratio of .29. I believe this number, which looks conservative, is also misleading, and the reason is simple. The company has very poor liquidity, with only $14 million in cash and liquid assets in the last quarter against almost $520 million in long-term debt. Cash has also declined, from about $21 million at the beginning of the year, which means that FDP’s liquidity is -33% worse than it was a year ago. To be fair, that reflects the reality many companies have faced this year, but the pattern I’m describing for FDP also tracks consistently all the way back to late 2018. That doesn’t suggest that things are likely to change quickly.

Dividend: FDP pays an annual dividend of $.30 per share, which translates to a yield of about 1.23% at the stock’s current price.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target around $39.50 per share. That suggests the stock is deeply undervalued, with about 64% upside from its current price.

Technical Profile

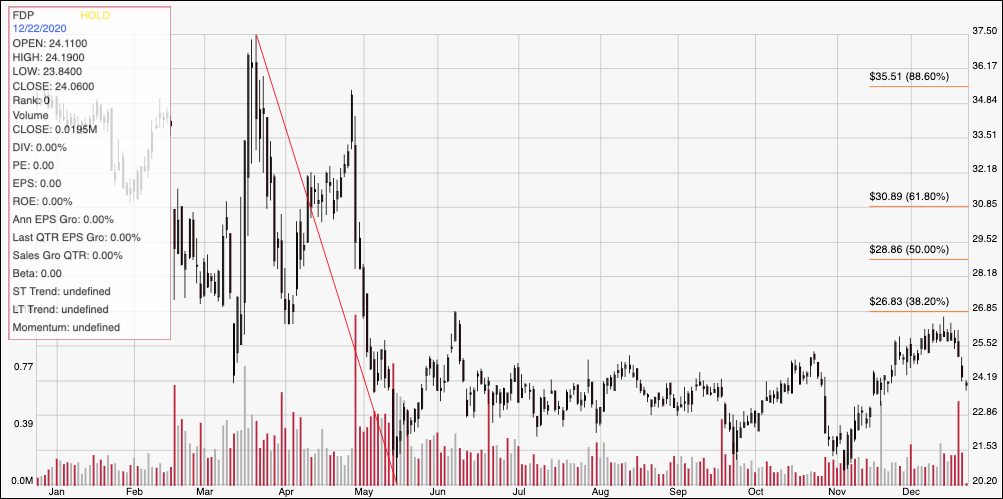

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The chart above displays FDP’s price action over the past year. The red diagonal line traces the stock’s drop from February to a bear market bottom in May at around $20; it also provides the baseline for the Fibonacci retracement lines shown on the right side of the chart. From that bottom until late November, the stock held a range between about $21 for support and $25 for resistance; the stock broke above that to set a new high above that range just a little below the 38.2% retracement line at around $26 before fading back in the last few trading sessions. Bearish momentum appears to be picking up, as the stock has dropped below support from previous resistance at around $25, with next support expected to lie at around $23. Realistically, the stock would need to push above $27 – a little above the 38.2% retracement line – to establish a new upward trend. If that happens, the stock should see next support somewhere between $30 and $31 where the 61.8% retracement line sits. A drop below $23 could give the stock bearish momentum to test its 52-week lows around $20.

Near-term Keys: FDP’s value proposition looks tempting, given the 64% projected upside to my “Fair Value” price; but I believe the stock’s current momentum, and the underlying fundamental concerns I’ve outlined – declining Free Cash Flow with deteriorating liquidity and high debt are concern enough to keep a disciplined value hunter away. If you prefer to work with short-term trading strategies, a reversal of current momentum, with a break above $27 could offer a good signal to buy the stock or work with call options, using $30 as a good near-term profit target. If the stock breaks below $23, there could be a useful opportunity to short the stock or buy put options with a target price around $20 per share.