Over the years, I’ve learned to pay attention to the Energy sector as a way to measure a number of different aspects of the global economy. One of the those elements that is very interesting is the difference between U.S. oil production versus the rest of the world. The financial markets use futures contracts on two primary types of crude oil to track oil prices. Contracts for Brent crude are the basic barometer for oil produced mostly in the Middle East by OPEC countries, while West Texas Intermediate (WTI) crude contracts act as the gauge for U.S. crude.

Over the last ten years, shale oil exploration and production have helped the U.S. narrow the gap between Brent and WTI crude production, with a major portion of shale oil coming from the Permian Basin, which is located primarily in Texas and parts of New Mexico and Oklahoma. The challenge associated with U.S. production – and one of the things that contributed to keep oil prices relatively low prior to this year’s pandemic, which cratered demand for oil and many petrochemical products – is that exploration and production of shale oil has exceeded the capacity of midstream companies to transport the oil to its primary distribution centers before it is sold throughout the world.

Midstream oil companies include those that have been involved in the ongoing construction and maintenance of pipelines and storage facilities out of the Permian Basin; limitations of existing pipeline and storage capacity have been the primary reason that inventory out of that area remained stuck in the Basin through 2019 and kept the entire industry waiting for new pipeline projects to be completed. Many of those projects were delayed this year because of the pandemic, but were near enough to completion that a resumption of activity in the expected post-pandemic phase should increase the flow of crude out of the Permian in 2021.

Enterprise Products Partners (EPD) is one of the biggest midstream companies with operations in crude oil, natural gas and liquified natural gas (LNG) transport and storage among other things. It isn’t an easily recognizable company by name, but its fundamental profile is very interesting – including a large dividend – and its value proposition is extremely attractive. Assuming projections for a broader economic recovery in 2021 hold, Permian pipeline production should also continue to improve through 2021, as ongoing pipeline projects boost transport capacity. Other projects that were suspended because of the pandemic That means that companies like EPD are likely to be strong bets to grow profits in the next year. EPD’s management has also noted that operating margins ticked higher this year, driven primarily by strong export demand for natural gas liquids logistics and consumer-led demand for petrochemicals such as cleaning products. These look to provide a good launching point for 2021 as previously suspended or deferred projects are brought back online. Let’s dive into the numbers.

Fundamental and Value Profile

Enterprise Products Partners L.P. (Enterprise) is a provider of midstream energy services to producers and consumers of natural gas, natural gas liquids (NGLs), crude oil, petrochemicals and refined products in North America. The Company’s segments include NGL Pipelines & Services; Crude Oil Pipelines & Services; Natural Gas Pipelines & Services, and Petrochemical & Refined Products Services. The Company’s midstream energy operations include natural gas gathering, treating, processing, transportation and storage; NGL transportation, fractionation, storage, and import and export terminals, including liquefied petroleum gas (LPG); crude oil gathering, transportation, storage and terminals; petrochemical and refined products transportation, storage, export and import terminals, and related services, and a marine transportation business that operates primarily on the United States inland and Intracoastal Waterway systems. EPD has a current market cap of about $42.7 billion.

Earnings and Sales Growth: Over the last twelve months, earnings decreased by about -4%, while revenues declined almost -13%. in the last quarter, earnings improved by 2% while sales grew by 20%. The company’s margin profile is healthy; in the last quarter, Net Income as a percentage of Revenues in the last quarter was 15.2% – just a little below 16.1% over the last twelve months.

Free Cash Flow: EPD’s free cash flow is healthy, at almost $2.1 billion over the last twelve months. That a decline from about $2.9 billion in March of this year, but is also marginally above the $2 billion reported at the beginning of 2020. The current number also translates to a modest Free Cash Flow Yield of 4.86%.

Debt to Equity: EPD’s debt to equity is 1.09, which is a little higher than I prefer to see; however the company’s balance sheet indicates operating profits should be adequate to service their debt. Their balance sheet also shows $1.1 billion million in cash and liquid assets versus $28.5 billion in long-term debt, with no major near-term debt obligations.

Dividend: EPD’s annual divided is $1.78 per share, which translates to a much larger-than-normal yield of about 9.05% at the stock’s current price. Management had planned to increase the dividend at the beginning of the year, but instead chose to simply keep it at its current level. A number of other companies in the Energy sector have been forced to reduce or even eliminate dividend payments, so EPD’s ability to maintain their attractive dividend is a solid sign of strength.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target at nearly $24 per share. That means the stock is nicely undervalued, with about 21% upside from its current price.

Technical Profile

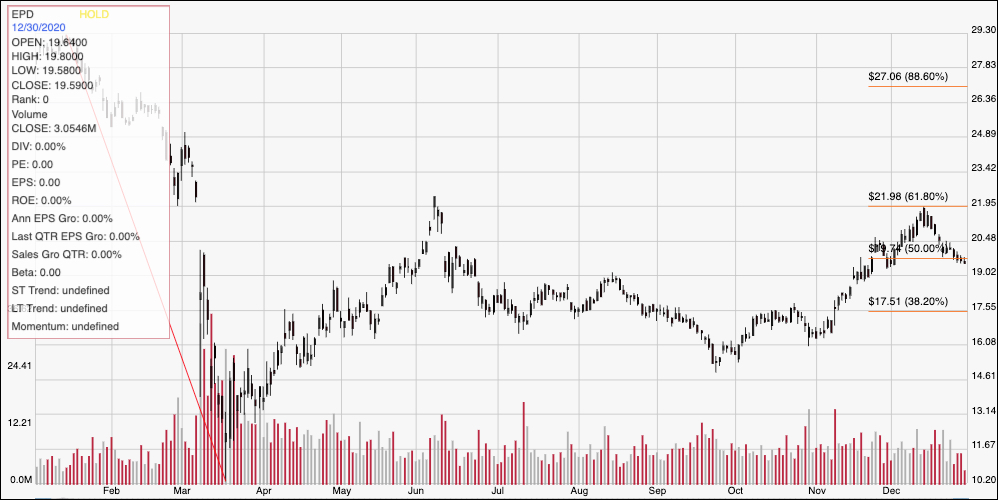

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The chart above covers the last year of price activity. The red diagonal line traces the stock’s slide into bear market territory from January to March of this year. From that bottom at around $10, the stock rallied to a peak at about $22 in June before dropping back again until October, when it moved into a short-term upward trend that saw the stock rally from about $15 to retest its June peak at the 61.8% retracement line around $22 earlier this month. The stock has faded back from that point and is current a little below the 50% retracement line, with near-term support expected to be at around $19 based on pivot high activity in August. A bounce off support in that area should see upside to resistance at about $22, while a drop below $19 could have additional downside to about $17.50 where the 38.2% retracement line sits.

Near-term Keys: EPD’s fundamental strength and value proposition make it look attractive as a long-term investment opportunity. If you prefer short-term trading strategies, you could use a pivot off of support at around $19 as a signal to consider buying the stock or working with call options, using its recent peak at around $22 as a good near-term profit target. A drop below $19 could be an interesting signal to consider shorting the stock or buying put options, with $17.50 providing a quick-hit target on a bearish trade.