Melt-ups typically lead to big meltdowns, and this long-time market bull sees just that on the horizon. Here’s what he’s forecasting for the year ahead.

We’re just half-way through January and 2021 has already been a crazy year.

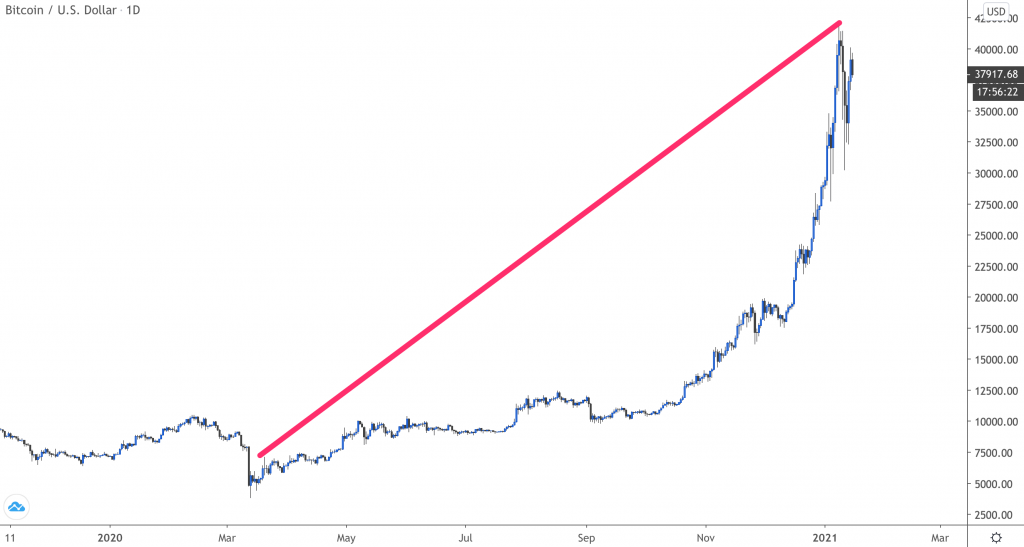

Within the first five trading days, all three major indexes hit new all-time highs. Bitcoin soared to nearly $42,000 before retreating back to $38,000. The cryptocurrency’s meteoric rise from 2020 has continued on into this year and is already up 31%.

In what feels like an everything bull market, long-time bull Ed Yardeni is worried the market could see a swift meltdown.

“The Nasdaq from late 1998 to early 2000 went up over 200%. Now, we’re up almost 100%, and we may very well be on that same track,” Yardeni said. “Everything I’m looking at points to a melt-up.”

Since the March 23 bottom last year, the tech-heavy Nasdaq has risen 91% and is looking frothy. Meanwhile, the S&P 500 is up nearly 70% and the Dow is up by 67% in the same timeframe. And bitcoin? Since the March bottom it has risen more than 460%.

“It’s just part of the bull market in everything,” Yardeni said. “It’s very important whether you’re in or not in bitcoin to just stare at the chart, and realize when it’s going straight up – it’s certainly a sign of exuberance, of speculative excess.”

But even with such exuberance, Yardeni isn’t sounding the alarm bells just yet. The Yardeni Research president is optimistic on the economic recovery coming out of the coronavirus pandemic, as well as the current fiscal and monetary landscape.

“The first half of this year, the blue wave will probably continue to be bullish,” Yardeni said. “We’re going to get more government spending. We’re going to have the Federal Reserve front a lot of that government spending through quantitative easing. I think interest rates will remain pretty low.”

And the increased government spending could come sooner rather than later.

On Thursday, President-elect Joe Biden unveiled the details of a $1.9 trillion coronavirus rescue package, called the American Rescue Plan, that he will seek in the first few months of his presidency.

The proposed package is designed to support households and businesses through the pandemic and includes another round of direct payments to most Americans of $1,400, increasing the federal unemployment benefit to $400 per week through the end of September, increases the federal minimum wage to $15 per hour, extends the eviction moratorium through the end of September, $350 billion in state and local government aid, and $20 billion toward a national vaccine program, among other provisions.

“The crisis of human suffering is in plain sight, and there’s no time to waste,” Biden said as he unveiled the plan. “We have to act, and we have to act now. …The consensus among leading economists is, we simply cannot afford not to do what I’m proposing.”

Beyond stimulus, Yardeni also believes that widespread distribution of the coronavirus vaccine later this year will help to normalize the economy in the last half of the year. But that is when he becomes cautious.

With the economy back up and booming, Yardeni says there will be inflation risks due to the massive amounts of stimulus and as demand increases.

“In the second half of the year, we may be on the lookout for some consumer price inflation which would not be good for overvalued assets,” Yardeni said, adding that the Fed may be challenged to keep the benchmark 10-year Treasury Note yield at around 1%.

“We do see upward pressure on the bond yield,” he continued. “I think at some point the Fed says ‘Maybe bond yields should be higher since the economy is doing well.’”

But for now, Yardeni is keeping an eye on fundamentals and market indicators and is keeping his fingers crossed they will disprove his argument that we’re nearing a market melt-up that will likely end in a meltdown.

“This market keeps stampeding ahead of my forecasts,” Yardeni said. “I hope we get to 4,300, my S&P 500 [year-end] target, in a leisurely fashion.”

The S&P 500 closed at $3,795.54 on Thursday, less than 1% from its all-time high hit last Friday.