Small caps have outperformed so far this year, but stocks like these 6 might be the best way to play the space.

The S&P 500 and Nasdaq both closed at record highs for the second straight day on Thursday as investors bet on the Biden administration to accelerate the nation’s recovery amid the coronavirus crisis.

Today, Biden unveiled new plans for how his administration will battle the pandemic, signing 10 executive orders and invoking the Defense Production Act to compel American companies to prioritize the manufacturing of supplies including N95 masks, swabs, and other equipment to fight the pandemic.

The new president has also pledged to speed up vaccine production and delivery, setting a goal to vaccinate 100 million people in the U.S. within his first 100 days in office, and has already put forth his proposal for a $1.9 trillion COVID-19 relief package to aid the struggling U.S. economy.

Given all this activity, it’s no wonder optimism has pushed the major indexes to all-time highs. But there’s another corner of the market that’s seeing even more action.

The small-cap focused Russell 2000 index has rallied more than 10% so far this year, outpacing the S&P 500’s 4% gain and the Nasdaq’s 6.5% return.

“The number one reason small caps are rallying is [President] Joe Biden,” said Boris Schlossberg, managing director of FX strategy at BK Asset Management. “Mr. Biden has fashioned himself as President Main Street.”

Biden’s proposed stimulus plan includes another round of direct payments to Americans, as well as $400 additional federal unemployment benefits and $350 billion in state and local government aid, among other provisions.

“The market is going to believe that he is going to try to do everything in his power, both from a financial point of view and also from a regulatory point of view, too, to make things much easier for small caps as we go forward,” Schlossberg added.

One of Biden’s top priorities at the start of his term is a national vaccine program, which Schlossberg says should expedite the economic recovery. And that’s good news for small caps.

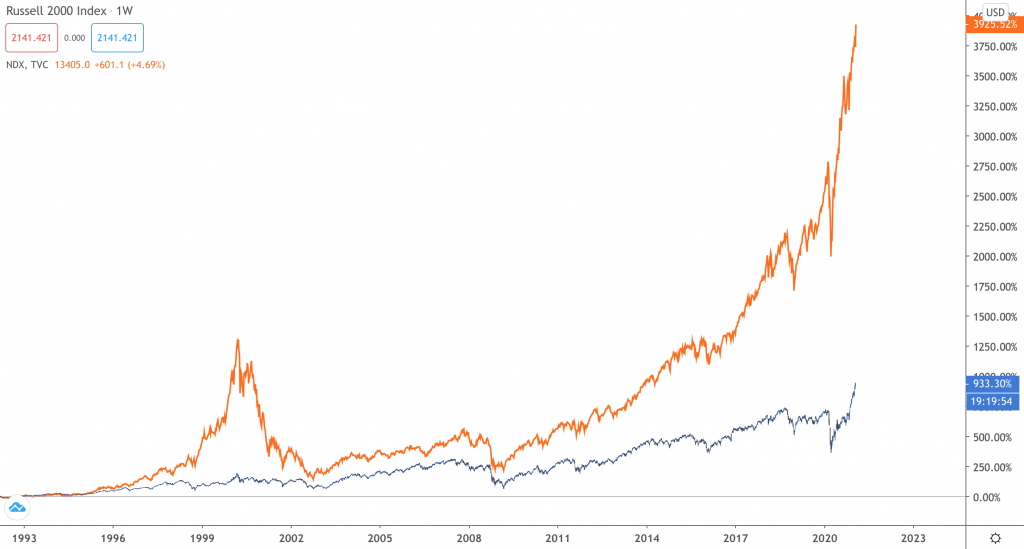

“You have amazing operational leverage on the small-cap size because those companies that survived now have a chance to really rebound with much leaner staff, and therefore much better profit margins,” Schlossberg said. “The much better trade is going to be long Russell, short Nasdaq going forward. That’s a trade that has not worked at all for the last four years but I think is going to work very well in 2021.”

But small caps have a ways to go to catch up to the large-cap tech stocks that have dominated the market in recent years. That’s according to Todd Gordon, founder of TradingAnalysis.com, who noted that the Russell 2000 has slipped to its lowest level relative to the Nasdaq since the tech bubble peak which could indicate the small cap index’s rally so far this year is a “dead-cat bounce.”

But even if he’s right, Gordon says there’s one area of the small-cap space that’s worth betting on now.

“You’ve got to take more of a step back and not say small caps in general are going to outperform,” Gordon said. “I actually think we want to look at small caps and break it into value vs. growth.”

Gordon noted that small-cap growth stocks have been fueling the rally in the Russell 2000. In fact, since the market bottom back in March 2020, small-cap growth stocks have been outperforming small-cap value names.

The VBK Vanguard Small-Cap Growth ETF is up 7% so far this year and has risen more than 121% since the March 23, 2020 market bottom. By comparison, the VBR Vanguard Small-Cap Value ETF has gained 99% in the same timeframe.

The VBK’s top holdings include Enphase Energy (NASDAQ: ENPH), MongoDB (NASDAQ: MDB), Catalent (NYSE: CTLT), Zendesk (NYSE: ZEN), Horizon Therapeutics (NASDAQ: HZNP), and Monolithic Power Systems (NASDAQ: MPWR).

All six of these stocks have staged big rallies over the last year, with clean energy stock Enphase gaining 571% in the last 12 months, MongoDB rising 153%, Catalent adding nearly 92%, Zendesk gaining 73%, Horizon Therapeutics adding 101%, and Monolithic Power Systems surging nearly 122% over the last year.

“It’s not so much a rotation value to growth,” Gordon said. “It’s large-cap growth into small-cap growth. So the growth trade is still there. We’re just sliding down the market capitalization scales a little bit.”