Over the last year, COVID-19 has forced businesses in just about every segment of the economy to find ways to adjust. The adoption by corporate America to work-from-home models helped keep a lot of people working, and one of the most intriguing success stories that I think will continue to be told for years to come about the pandemic is the way many businesses were able to not only survive during this difficult period, but even to thrive in unexpected ways that changed the way managers think about the day-to-day details of running their business. I think one of the long-term effects will be a greater reliance than ever on remote work. It is true that once vaccinations have been widely distributed and administered enough to reach “herd immunity,” a lot of businesses currently relying on work-from-home models will begin to shift back to traditional in-office operations; but even in these cases, I won’t be surprised to see elements of remote work remain in place on a permanent basis.

One of the business segments that has really suffered over the last year has been in Business Services; companies that provide services and solutions to corporate America for its regular (meaning, mostly traditional, in-office) business operations have been forced to weather major drawdowns in revenue and profitability simply because of the shift to remote work. If I’m right about the long-term, even permanent impact on those remote models being folded into permanent operational models, even on a modified basis, then it isn’t enough for the companies that provide workplace solutions to simply survive the COVID storm; they are also going to have find innovative new ways to adopt their own business models to serve that new reality as well.

One of the companies that I think offers an interesting case in point right now is Xerox Holdings Corporation (XRX). This is a company whose business is built around digital printing technology and workplace solutions. The last few earnings reports for this company have indicated big impacts on their business from the COVID-19 pandemic. After suspending forward guidance in 2020, management used its last earnings report to forecast modest revenue and cash flow improvement in 2021 as businesses begin reopening. They also intend to continue to explore merger and acquisition opportunities, despite failed attempts prior to the pandemic to merge, first with Fujifilm Holdings and then with HPQ. The stock had held through the spring and summer months in a narrow trading range below $20, but beginning in August of last year began to pick some bullish momentum to push to a new, higher trading range between $21 and $24. Despite the pandemic’s impact over the last few months, the company’s balance sheet has held up pretty well, suggesting that the company well-positioned to ride through the economic turmoil of current conditions. The open question, of course is whether business activity will return to previous levels, or will some of the shifts of the past year force XRX to adapt to a new operating reality. What does that mean for the stock’s value proposition and long-term prospects? Let’s find out.

Fundamental and Value Profile

Xerox Corporation is a provider of digital print technology and related solutions. The Company has capabilities in imaging and printing, data analytics, and the development of secure and automated solutions to help customers improve productivity. The Company’s primary offerings span three main areas: Managed Document Services, Workplace Solutions and Graphic Communications. Its Managed Document Services offerings help customers, ranging from small businesses to global enterprises, optimize their printing and related document workflow and business processes. Managed Document Services includes the document outsourcing business, as well as a set of communication and marketing solutions. The Company’s Workplace Solutions and Graphic Communications products and solutions support the work processes of its customers by providing them with printing and communications infrastructure. XRX’s current market cap is about $4.6 billion.

Earnings and Sales Growth: Over the last twelve months, earnings declined by about -56.3%, while sales decreased by -21%. In the last quarter, earnings improved by about 21% while revenues were 9.2% higher. XRX’s operating profile before the pandemic set in was very healthy, but the extended effect of the last year has narrowed their figures in a big way; over the last twelve months, Net Income was a little over 2.73% of Revenues, and strengthened somewhat to 3.99%. The quarterly number does mark an improvement compared to June 2020 when Net Income was 1.84% of Revenues, and the beginning of 2020, when it was -0.11% – which means that the new quarterly number marks an improvement that I believe is a good indication that the company has managed to absorb the worst. Even so, this measurement remains a risk element that bears monitoring in the quarters ahead.

Free Cash Flow: XRX’s free cash flow is healthy despite its sustained decline over the past year, at about $474 million over the last twelve months. That number did drop from a little more than $674 million in the quarter prior, and $775 million and $1.2 billion in the quarters prior to that; but given the severity of the impact the pandemic has had, the turn isn’t surprising. The current Free Cash Flow number still translates to an attractive Free Cash Flow Yield of 10.58%. It is also worth noting that XRX’s Free Cash Flow was $0 in June of 2018, with the company showing consistent improvement in this critical metric from that point until 2020. That acts as an interesting counterpoint to the company’s Net Income story, however the decline also bears watching in quarters ahead to determine if Free Cash Flow deteriorates further, or follows the Net Income pattern to start moving back higher.

Debt to Equity: XRX has a debt/equity ratio of .72. That’s generally a conservative number that reflects management’s approach to debt management. Since the beginning of 2018, the company’s long-term debt has decreased from a little more than $5.2 billion to its current level of $4 billion. Their balance sheet also shows more than $2.6 billion in cash and liquid assets, which means that servicing their debt isn’t a problem, and for now provides an important buffer, even if Net Income and Free Cash Flow remain challenged. It is worth mentioning that over the last six months, long-term debt increased from $2.2 billion – meaning that the company took on about $1.8 billion in new, long-term debt to weather the challenges of the pandemic.

Dividend: XRX pays a dividend of $1.00 per share, which translates to an annual yield of 4.38% at the stock’s current price. As things stand now, the dividend appears stable; it could also provide signals of fundamental weakness or strength, depending on whether management chooses to leave it as is, or as some companies have been forced to do in the last year, decides to reduce or even eliminate it to save cash.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to worth with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term target at about $23.35 per share. The stock is only about 2% below that level now, meaning that the stock is fairly valued as things stand now. An interesting counterpoint is the fact that stock’s Book Value is $28.21 per share – which is a little more than 23% above the stock’s current price.

Technical Profile

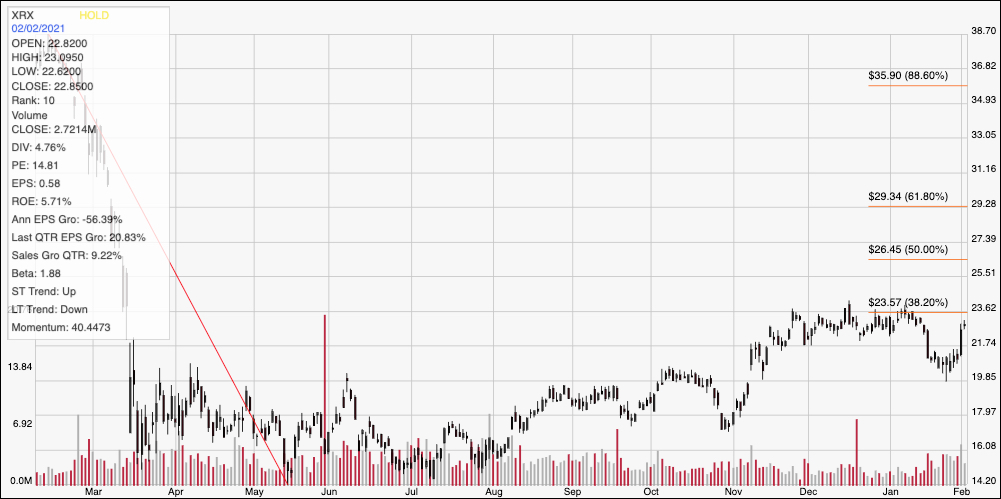

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The diagonal red line traces the stock’s downward plunge from its high at around $38.70 at the beginning of 2020 to the stock’s low point, reached in mid-May at around $15. It also provides the baseline for the Fibonacci retracement lines shown on the right side of the chart. The greatest portion of that drop came in one month, from February to March 2020, with the broad market’s nosedive into bear market territory. While the broad market indices, and the largest tech stock rebounded from that point, the stock languished until July, hovering in a narrowing range between support at $15 and resistance at around $18. Since the end of July, the stock started picking up bullish momentum, forming a gradual upward trend into November, pushing to a high at nearly $24 and inline with the 38.2% retracement line in January before dropping back to a recent low at around $20. The stock is picking up bullish momentum again, with immediate resistance at around $23.50. A break above that point should see the stock push to at least $26.50, and possibly to about $29 where the 61.8% retracement line rest. Current support is at around $22, with downside to about $20 if the stock drops below that point.

Near-term Keys: XRX’ value proposition isn’t as useful in the current market environment as it has been; however management’s ability to steer the company through an incredibly difficult year is impressive, and is reflected by its the overall core strength in its balance sheet. The fundamental, and value proposition would be strengthened by continued improvement in Net Income on a quarterly basis, with a stabilization in Free Cash Flow, cash, and long-term debt levels that would be a good sign that the this year’s challenges are really a simple reflection of a unique moment in time for the market. If you prefer to work with short-term trading strategies, you could use a break above $23.50 as a signal to buy the stock or work with call options, with a near-term price target at around $26.50. If the stock drops below $22, you can consider shorting the stock or buying put options, using $20 as a quick-hit profit target on a bearish trade.