Last week’s spike in the market’s “fear gauge” could be a warning for the market. Here’s what you need to know now.

The market’s “fear gauge” saw a big spike last week.

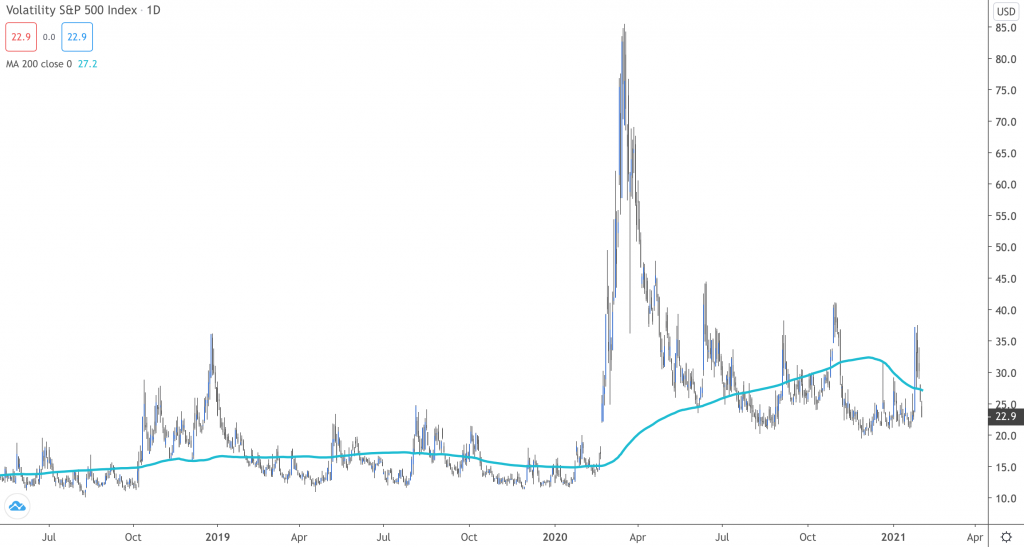

The VIX volatility index, which acts as a barometer of investor expectations for future moves in the market, closed above 33 last week marking its biggest weekly gain since June.

What caused the spike? The Reddit-spawned surge in GameStop (NYSE: GME), AMC Entertainment (NYSE: AMC), and an assortment of some of the market’s other most shorted stocks.

GameStop gained roughly 400% last week, driven higher by an army of retail investors inspired by the WallStreetBets subreddit, with some investors opening calling on others to bid up the shares of the video-game retailer and certain other names in order to trigger losses for hedge funds that had bet their prices would fall.

With the frenzied retail trading, the VIX rose 11.18 in a week spiking as high as 37 last Wednesday – the third-largest surge on record. The spike was enough for Treasury Secretary Janet Yellen to summon U.S. financial regulators to discuss the recent volatility.

“Secretary Yellen believes the integrity of market is important and has asked for a discussion of recent volatility in financial markets and whether recent activities are consistent with investor protection and fair and efficient markets,” the Treasury department said in a statement.

Last week’s market action has raised questions about whether broader risks for the financial system are bubbling up. While the VIX has since fallen to nearly 23 since then, Piper Sandler’s Craig Johnson warned investors this week to heed the message the index is sending.

“You need to heed the warning of what we’re seeing here with the VIX,” Johnson said. “A shorter-term indicator for us has been when you see the VIX above its 200-day moving average, it has been sort of a pretty strong risk-off signal.”

“But if you put this VIX together with the fact that you’ve had a very big ‘breadth thrust’ already happen in the market, you also have got a lot of speculation happening in the market, there’s a lot of reasons why we should be heeding this warning,” Johnson added.

The breadth thrust Johnson refers to measures the momentum in the market by calculating the number of NYSE stocks rising against those that are falling over a 10-day period. The Piper Sandler chief market technician also said that it may make sense for investors to raise cash and rotate their portfolios to play more defensive or cautious in the near term given the increase in volatility.

BK Asset Management’s Boris Schlossberg noted that even in a volatile market, there may still be some winners to watch out for.

“Volatility equals volume – so when volatility spikes, volume is going to increase, which means market makers, brokers, CME… are all going to do I think very well,” Schlossberg, the firm’s managing director of FX strategy, said.

Schlossberg added that there are other signs stocks could soon come under more pressure, pointing to a warning sign in rising bond yields and falling equities prices.

“That’s a signal that the market is getting concerned about credit risk,” Schlossberg said. “We may be setting up ourselves for at least a 5% correction, maybe even a little bit more, especially as we go into the very bad seasonal time in February, which typically tends to be a big sell-off time in the market.”

The S&P 500 has seen losses in February in three of the past five years. The index sank more than 8% last February amid the coronavirus-sparked market sell-off.