It is interesting to observe the distinction in performance between different sectors and industries, and their possible correlation to broader economic activity. One of the places where I think that can be seen more easily is in evaluating large-cap versus small-cap stocks. If you look at most of the biggest and most recognizable names in the market over the past year, the general tendency in practically every sector has been to follow the the broad indices higher. If you look at the fundamentals of many of those companies, there are clear indications that they have been able to navigate the uncertainty of 2020 better than their smaller brethren. That isn’t surprising, and it is a natural reason any smart investor, myself included, focuses on many of these companies first under these kinds of market conditions.

Small-cap stocks can be harder to evaluate – not because their management teams are less capable, or exercise less financial discipline, but simply because the size, scale and breadth of their respective businesses are usually more narrowly focused. That can put those companies at greater risk to economic forces that may be entirely out of their control. The divide can become even wider if the sector or industry the company operates in also happens to lie on the wrong side of shifting economic winds.

Over the past year, the market has proven that all sectors are not created equal. There are sectors that have held up extremely well though global economic shutdowns last spring sent workers home and closed just about every kind of traditional business activity. Most of those included companies that offer services and solutions that facilitate remote organizational connectivity and collaboration, which have helped a large portion of corporate America continue to function even while normal, in-office operations haven’t been possible. That shift helped shield many of those companies from the worst economic impacts of the pandemic, and represented a significant shift away from traditional business operations, creating a ripple effect that impacted other businesses in a negative way.

One of the business segments that was forced to absorb a negative impact, but that could be poised to begin a gradual recovery as increasing economic activity driven by rising vaccinations and the resumption of at least some traditional working arrangements is the Commercial Services and Supplies industry. These are businesses that provide products and services to organizations – such as businesses, schools, and governments – in traditional office settings. That could mean that companies like ACCO Brands Corp (ACCO) may be in a position to see its business activity finally begin to recover. Along with the shift to remote work is the complexity most states have seen in reopening schools; across the United States, back to school also corresponded with significant increases in infections among high school and college-age groups last fall. This is another area that could act as either headwind or tailwind depending on the degree to which schools at all levels throughout the country resume their regular activities.

ACCO’s stock mirrored the broad market’s dip to bear market lows last year, with a sizable bounce from that point into June that then tapered back a bit to a late October low at around $5 before rebounding again to about $9.50 in February of this year. The stock has dropped back a bit from that point, which could be setting up an intriguing opportunity to buy a stock with good fundamental strength with an interesting value proposition.

Fundamental and Value Profile

ACCO Brands Corporation is engaged in designing, marketing and manufacturing of branded business, academic and selected consumer products. The Company operates through three segments: ACCO Brands North America, ACCO Brands International and Computer Products Group. The Company’s brands include Artline, AT-A-GLANCE, Derwent, Esselte, Five Star, GBC, Hilroy, Kensington, Leitz, Marbig, Mead, NOBO, Quartet, Rapid, Rexel, Swingline, Tilibra and Wilson Jones. The Company’s ACCO Brands North America and ACCO Brands International design, market, source, manufacture and sell traditional office products, academic supplies and calendar products. ACCO Brands North America consists of the United States and Canada, and ACCO Brands International consists of the rest of the world, primarily Northern Europe, Australia, Brazil and Mexico. Its Computer Products Group designs, sources, distributes, markets and sells accessories for laptop and desktop computers and tablets. ACCO’s current market cap is about $781.1 million.

Earnings and Sales Growth: Over the last twelve months, earnings declined nearly -30.5%, while sales decreased by about -14.4%. In the last quarter, earnings improved dramatically by almost 68.5% while revenues were 3.6% higher. ACCO’s operating profile is was narrow, but generally healthy, and appears to be getting stronger. Over the last twelve months, Net Income was 3.75% of Revenues and strengthened to about 6.5% in the last quarter. This is a sign that the company’s profitability is improving.

Free Cash Flow: ACCO’s free cash flow is healthy, at a little more than $103.9 million, but has narrowed in the past year as a confirmation of the pressures the company has faced. This metric narrowed from $128.3 million in the quarter prior and $225.3 million at mid-year 2020. The current number also translates to an attractive Free Cash Flow Yield of 13.6%. It is also worth noting that ACCO’s Free Cash Flow was just $40 million in March of 2019.

Debt to Equity: ACCO has a debt/equity ratio of 1.42. That is a high number that signals the company’s heavy reliance on leverage. Their balance sheet shows $1.05 billion in long-term debt versus just about $36.6 million in cash and liquid assets. For now, the company should be able to service the debt it has; however any deterioration of Net Income could force the company to extend their debt even further (which management indicates they have the ability to do) – in essence pushing the issue further out in time on the expectation that an eventual improvement in business activity will make up the difference.

Dividend: ACCO pays a dividend of $.26 per share, which translates to an annual yield of 3.21% at the stock’s current price. ACCO differs from many small-cap stocks in that it pays a dividend at all; but under the circumstances, it is uncertain how stable the dividend is.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to worth with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term target at about $9.31 per share. That suggests the stock is modestly undervalued by about 14% right now.

Technical Profile

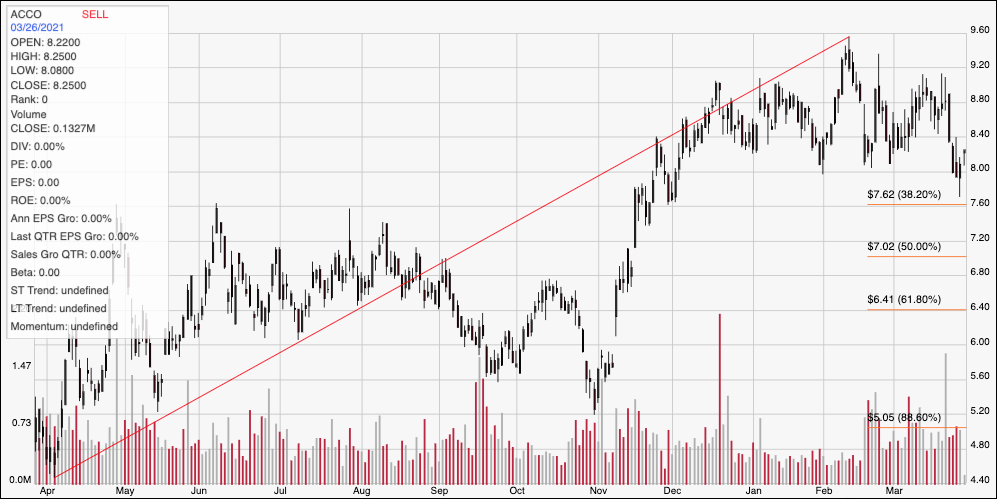

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The red diagonal line traces the stock’s upward trend over the past year to its peak in February at around $9.60. It also provides the baseline for the Fibonacci retracement lines on the right side of the chart. The stock has retraced since the February high to approach the 38.2% retracement line and currently appears to be bouncing off of support at $8. Immediate resistance is between $9 and $9.60, with additional room to about $11 if bullish momentum increases. A drop below support at $8 should find additional support between $7.50 and $7.00.

Near-term Keys: ACCO has a very attractive value proposition, and some intriguing fundamental strengths that may make it a tempting target for a long-term opportunity. If you prefer to work with short-term strategies, there could be an interesting short-term opportunity to buy the stock or work with call options right now, with the stock bouncing off support, with a short-term target at around $9.60. The narrow distance between current to next support implies a bearish trade, either by shorting the stock or buying put options is a low-probability trade right now.