This week I’ve turned my focus primarily back on the Food Products industry in the Consumer Staples sector. It’s an area of the market that doesn’t get much buzz from market media types because it isn’t very sexy – but it is one of very few segments of the market that has seen consumer-driven improvements in demand over the past year, and whose stocks still offer interesting, useful values. Some analysts thought that eating-at-home, and an increase in demand for food storage, pantry and freezer goods would be a short-term trend; but new data, and an increasing number of economic forecasts predict this trend will see quite a bit of “stickiness” – meaning that what may have initially been a natural reaction to extreme conditions is likely to constitute a long-term change in consumer behavior.

The longer consumers have to rely on cooking and eating at home, for example, the more likely that behavior is to become ingrained – which creates that stickiness about demand trends. That doesn’t mean we as consumers don’t, or won’t appreciate the opportunity to go out and enjoy the socialization associated with restaurants, theaters, and so on. Even so, I think food-at-home is something that will stick as a natural behavior for fiscally conservative families – and the longer the pandemic persists in 2021, along with pressures on employment rates and income, the more families are going to continue to have that mindset enforced on their household budget.

Another interesting layer of the stay-at-home trend relates to pets. Pet food is a highly competitive segment of the Food Products industry, but something that analysts like to see as part of a diversified company portfolio. A secondary increase in demand in pet food is likely to see very healthy stickiness because of increased pet purchases and adoptions in the last year. Makes sense, doesn’t it? Being forced to stay at home, which earlier this year included having parents with young children begin schooling at home, means that the emotional support offered by a cuddly puppy or kitty becomes more compelling. That means that the Food Products companies that have pet food and pet products as part of their business portfolio have a useful second leg to keep revenues healthy on a long-term basis.

While Consumer Staples stocks aren’t immune from market momentum, and can certainly turn lower with the rest of the market, they also typically display lower volatility characteristics than the most buzz-worthy stocks. That’s why this industry has always made a lot of sense to me in these kinds of circumstances. General Mills, Inc. (GIS) is a stock that I’ve followed for quite some time, and even used on a few different occasions over the last couple of years in my value-based, income-oriented investments. Its usefulness as a defensive position was proven out in 2020, as the stock dropped only about -10% during the initial broad market push to bear market levels, but then pushed more than 22% above its pre-pandemic highs by the beginning of August. After dropping back down to a low at around $55 to start 2021, the stock has rebounded strongly, setting up a new short-term upward trend that has the stock around $60 as of this writing. Along with its strong fundamental profile, that short-term pattern could be providing an interesting opportunity to take advantage of market momentum in a stock that still has an interesting value proposition.

Fundamental and Value Profile

General Mills, Inc., is a manufacturer and marketer of branded consumer foods and pet food products sold through retail stores. The Company is a supplier of branded and unbranded consumer food products to the North American foodservice and commercial baking industries. It also provides pet food products through its subsidiary Blue Buffalo Pet Products Inc. The Company has four segments: U.S. Retail, International, Pet operating, and Convenience Stores and Foodservice. The Company offers a range of food products with a focus on categories, including ready-to-eat cereal; convenient meals, including meal kits, ethnic meals, pizza, soup, side dish mixes, frozen breakfast and frozen entrees; snacks, including grain, nutrition bars and frozen hot snacks; yogurt, and super-premium ice cream. The Company’s other product categories include baking mixes and ingredients, and refrigerated and frozen dough. It also provides food products for dogs and cats. GIS’s current market cap is $37 billion.

Earnings and Sales Growth: Over the last twelve months, earnings increased about 6.5%, while revenues improved a little more than 8%. In the last quarter, earnings were -22.6% lower, while sales declined by a little more than -4%. GIS operates with a healthy, improving margin profile; over the last twelve months, Net Income was 13.68% of Revenues, and narrowed only somewhat in the last quarter to 13.18%.

Free Cash Flow: GIS’s free cash flow is healthy, at almost $3.19 billion, and translates to a Free Cash Flow Yield of 8.58%. This marks an improvement from the quarter prior, when Free Cash Flow was $3.1 billion. For a more complete context, consider that Free Cash Flow for GIS one year ago was $2.5 billion, which along with the company’s solid, improving margin profile, implies year-over-year profitability is increasing nicely.

Dividend Yield: GIS’s dividend is $2.04 per share, and translates to an annual yield of about 3.33% at the stock’s current price. It is also worth noting the company increased their dividend in 2020 – a rarity in the market last year – from $1.96 per share.

Debt to Equity: GIS has a debt/equity ratio of 1.06. This is a high number, but is pretty typical of stocks in the Food Products industry, and is indicative in part of the debt the company assumed to complete the acquisition of Blue Buffalo Pet Foods in 2018. Their balance sheet shows liquidity, which had weakened through most of 2019, is improving measurably; in the last quarter, cash and liquid assets were a little over $2.75 billion. This number was about $532.7 million at the beginning of 2019 and $626 million in February 2020 before the pandemic began. They also currently have $9.7 billion of long-term debt. The company’s margin profile indicates that they should have no problem servicing their debt.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to worth with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term target at about $69.50 per share. That suggests GIS is undervalued by about 14% right now.

Technical Profile

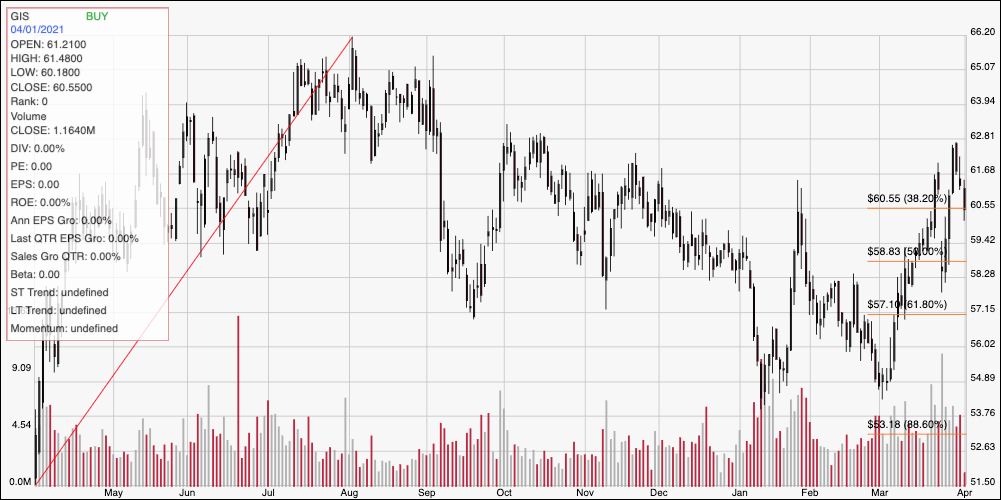

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: This chart traces the stock’s movement over the last year. The red diagonal line marks the stock’s upward trend from a 52-week low at around $46.50 in March 2020 to its high point at the beginning of August 2020 a little above $66; it also provides the baseline for the Fibonacci retracement lines shown on the right side of the chart. From that high, the stock slid into an intermediate-term downward trend that bottomed at around $55 at the beginning of March, with the stock picking up momentum that peaked earlier this week at around $62.50 per share. The stock is currently sitting on the 38.2% retracement line, marking current support at around $60.50, with resistance at that $62.50 peak. A drop below 60.50 should find next support around $58, a little below the 50% retracement line but inline with previous pivot activity around that price at multiple points since September. A push above resistance at $62.50 could have room to test the stock’s 52-week high between $65 and $66.

Near-term Keys: If you’re looking for a short-term, bullish trade, you could use a bounce off of support around $60.50 as an opportunity to buy the stock or work with call options, using $62.50 as an initial, useful profit target, and $65 from there if bullish momentum accelerates. A drop below $60.50, on the other hand could offer an interesting signal to consider shorting the stock or buying put options, with a useful target price in the $58 range on a bearish trade. The stock’s value proposition is the most interesting element of its overall profile, which remains attractive even with the pick-up in bullish momentum in the last month. With a healthy dividend to boot, there is a strong argument to make for using the stock as a solid, long-term position.