In the Energy sector, there are a lot of different industries to think about, with a wide range of types of businesses related to it. It’s easy to correlate Energy to crude oil, because that is the single commodity that most of the companies in the sector are tied to in one way or another; but there are a lot of other product types that make up a significant part of this sector’s make up. One of those is natural gas liquids (NGL), which like crude itself have uses in a number of other segments of the economy such as petrochemicals, home heating, cooking and refrigeration, synthetic rubber for tires, vehicle fuel blends and more.

NGLs are an area that has experienced a growing level of exploration and production in the U.S., which means that companies that operate in this segment of the Energy sector, along with standard crude operations, have a useful second business leg to work from. As the economy continues to reopen, energy demand is expected to increase – and I think that include demand for NGLs. That means that prices for Energy commodities, which have generally recovered from pandemic-driven disruptions and major declines, should remain at current levels or possibly even go higher. Many of the most interesting companies in this sector that have been able to survive the difficult conditions of the last year did so in part by figuring how to operate successfully even amid depressed commodity prices, which means that healthy demand should boost these company’s profitability and long-term results even more.

Energy Transfer LP (ET) is a mid-cap company in the oil, gas & consumable fuels industry that focuses a primary portion of its business in natural gas assets, including storage facilities and transportation assets. This is a company whose balance sheet has been among the most healthy in its industry, even during the pandemic, and that more recently has demonstrated significant gains in some of my most heavily weighted profitability metrics, including Free Cash Flow and Net Income. This is also a stock that has more than doubled in price from its 2020 low point at around $5, and almost 70% from the start of the year; but even with that increase the stock’s value proposition remains attractive.

Fundamental and Value Profile

Energy Transfer LP owns and operates a portfolio of energy assets. The Company’s operations include complementary natural gas midstream, intrastate and interstate transportation and storage assets; crude oil, natural gas liquids (NGL) and refined product transportation and terminalling assets; NGL fractionation; and various acquisition and marketing assets. Its segments include intrastate transportation and storage, interstate transportation and storage, midstream, NGL and refined products transportation and services, crude oil transportation and services, investment in Sunoco LP, investment in USAC, and all other. Through its intrastate transportation and storage segment, the Company owns and operates natural gas transportation pipelines and three natural gas storage facilities located in the state of Texas. Its intrastate transportation and storage segment focus on the transportation of natural gas to markets from various prolific natural gas producing areas. ET has a current market cap of $27.9 billion.

Earnings and Sales Growth: Over the last twelve months, earnings were 533% higher (not a typo), while sales increased about 46%. In the last quarter, earnings were also 500% higher while sales grew by a little over 69%. ET’s margin profile is showing significant signs of strength; over the last twelve months Net Income was 7.88% of Revenues, but strengthened to 19.33% in the last quarter.

Free Cash Flow: ET’s Free Cash Flow is healthy, at almost $6.5 billion. That marks a major improvement from $2.2 billion in the quarter prior, and $1.2 billion a year ago and translates to an impressive Free Cash Flow yield of 23.77%. The strength in this number is a useful confirmation of Net Income pattern I just described and implies that the company’s ability to service its debt, maintain its dividend and keep business growing remains very healthy even though cash and liquid assets are limited.

Debt to Equity: ET has a debt/equity ratio of 1.39. As of the last quarter, cash and liquid assets were $355 million versus $47.7 billion in long-term debt. Liquidity from cash and liquid assets is limited, however the company’s strong free cash flow and strengthening margin profile are strong indications of the company’s ability to service its debt without a problem.

Dividend: ET pays an annual dividend of $.61 per share, which at its current price translates to a dividend yield of about 5.86%.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target a little above $13 per share, which suggests that ET is nicely undervalued, with 26% upside from its current price.

Technical Profile

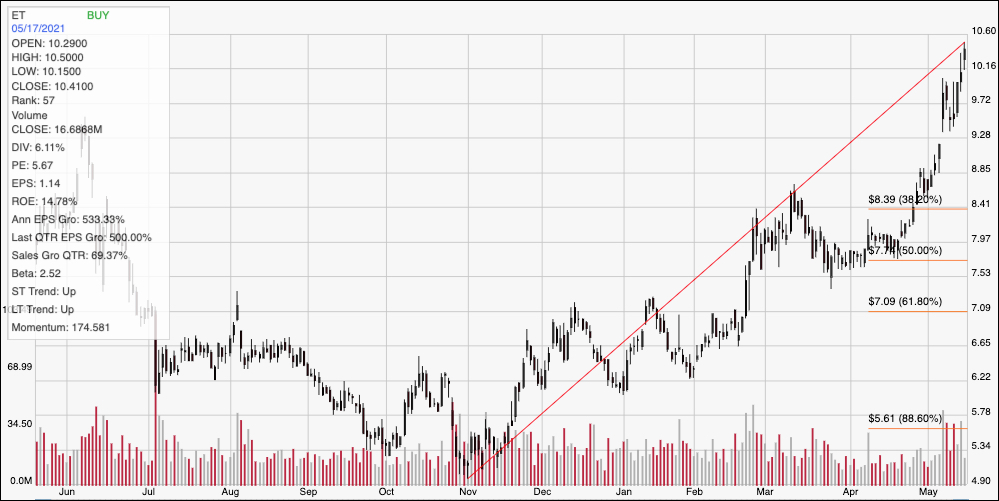

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The chart above displays the last year of price activity for ET. The red diagonal line traces the stock’s upward trend from November 2020 at around $5 to its recent high a little above $10; it also provides the baseline for the Fibonacci retracement lines shown on the right side of the chart. Immediate resistance is around $10.60 where the stock peaked yesterday, with current support sitting at around $9.50. A drop below $9.50 should find next support at the 38.2% retracement line around $8.50, while a push above $10.60 should have about $2 of immediate upside to about $12.50 per share.

Near-term Keys: ET’s strong pattern of healthy Free Cash Flow and margin growth over the last quarter are strong signs of fundamental strength that validate the stock’s increase in price over the last several months; it is very interesting that even with a nearly 100% increase in price since November 2020, the stock continues to offer a useful value proposition, with what I expect to be favorable headwinds from reopening economic activity providing additional support for demand. If you prefer to focus on short-term trading strategies, a push above $10.60 could offer a signal to consider buying the stock or working with call options, using $12.50 as a near-term profit target. A drop below $9.50, on the other hand could offer a signal to think about shorting the stock or working with put options with an eye on $8.50 as a useful price target on a bearish trade, or $7.50 if bearish momentum accelerates.