The “herd mentality” can be a funny thing to think about in societal terms – but it’s a real thing in the stock market. The sheer number of publicly traded stocks on U.S. exchanges alone creates a wave of market data that no single person can handle alone, and that’s a big reason why it makes sense to use market media sources – business TV, radio and Web streams, for example – to keep track of what’s going on the market at any given time. The challenge is that, more often than not, most of those different channels end up talking about the same issues, and breaking news events. That tends to narrow the focus for the broader investing community to a common theme – creating the “herd mentality” where everybody gravitates to many of the same stocks.

The herd mentality is a big reason why pandemic-driven concerns for the past year and a half have driven most of the market’s attention to stocks in sectors like Technology and Healthcare. That doesn’t mean it’s wrong – but it’s one of the biggest reasons that a lot of those stocks are now trading a valuations that even the most bullish, growth-focused analysts are finding hard to justify. Herd mentality that drives stocks to extreme highs is a manifestation of investor’s tendency to want to invest in the “next big thing.” Along the way, other stocks tend to get less attention, simply because they’re not as fun to talk about.

One of the most “un-sexy” segments of the market is Food, Food Products, and Food Retailing. That shouldn’t too surprising – after all, Food is just a regular part of daily life – and grocery shopping is just another chore that everybody has to get out of the way to keep pantries and fridges stocked. COVID-19 pandemic-driven restrictions created big increases in home consumption, however, and that is something that has been a good thing for a lot of stocks in the Consumer Staples sector. While that is a trend that has also helped stocks in this sector rebound from their own bear-market lows last year, it has also kept them from enjoying the same kind of massive herd-driven increase that tech stocks have seen over the same period.

The divergence has actually provided a good opportunity for value-focused investors, because while many tech stocks are trading at unreasonably high value multiples, there are a number of stocks in the Consumer Staples sector that have performed well, but are still trading at very attractive multiples. That’s because while most sectors in the market are still having to contend with declines in revenues, earnings, and cash flow, strong home consumption has helped a lot of Food-related stocks improve their balance sheet strength and overall fundamental profile, and so their “fair value” estimated prices have also been doing up at the same time.

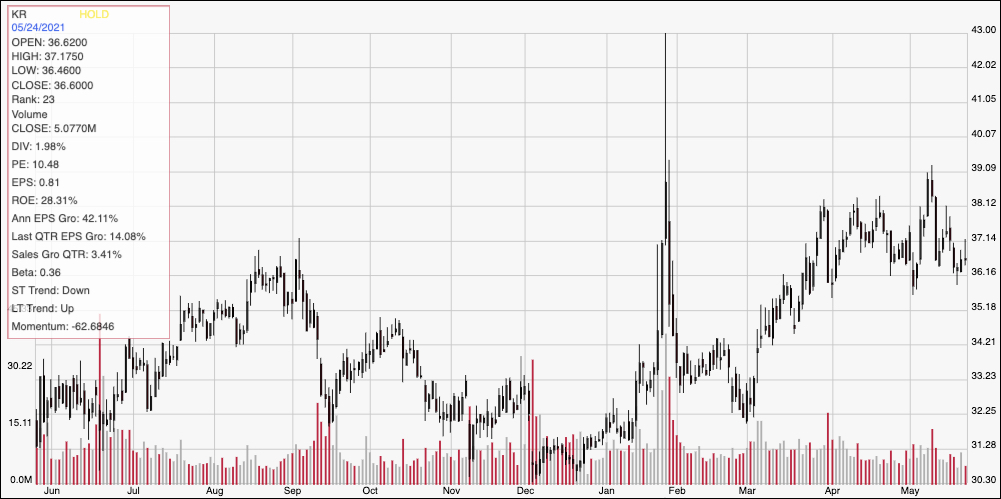

Kroger Company (KR) is a stock that clearly reflects the pattern I described earlier. After falling from a high at around $36 to a bear market low last year at around $28, the stock rallied strongly into August 2020 near to its pre-pandemic high, then dropped back again before the end of the year. The stock moved into a steady upward trend from December 2020 to April of this year, rising to a high at $39 in early May, but has dropped back a bit to the $36 range as of this writing.

KR has been among the most proactive companies in the entire Consumer Staples industry over the past couple of years, investing heavily in alternative revenues streams like Kroger Personal Finance and Kroger Precision Marketing, as well as online shopping and curbside delivery that is now in place in 95% of its coverage area. These have yielded positive results on the company’s earnings reports, and have enhanced the company’s ability to compete against larger rivals like Wal-Mart and Target Stores. Are the stock’s fundamentals strong enough to say the stock is still a big value? Let’s dive in and take a look.

Fundamental and Value Profile

The Kroger Co. (KR) manufactures and processes food for sale in its supermarkets. The Company operates supermarkets, multi-department stores, jewelry stores and convenience stores throughout the United States. As of February 3, 2018, it had operated approximately 3,900 owned or leased supermarkets, convenience stores, fine jewelry stores, distribution warehouses and food production plants through divisions, subsidiaries or affiliates. These facilities are located throughout the United States. As of February 3, 2018, Kroger operated, either directly or through its subsidiaries, 2,782 supermarkets under a range of local banner names, of which 2,268 had pharmacies and 1,489 had fuel centers. As of February 3, 2018, the Company offered ClickList and Harris Teeter ExpressLane, personalized, order online, pick up at the store services at 1,056 of its supermarkets. P$$T, Check This Out and Heritage Farm are the three brands. Its other brands include Simple Truth and Simple Truth Organic. KR has a market cap of $27.7 billion.

Earnings and Sales Growth: Over the last twelve months, earnings increased by about 42%, while sales increased almost 6.38%. In the last quarter, earnings improved more than 14% while revenues improved almost 3.41%. Like most Food retailers, KR operates with razor-thin margins, as Net Income was about 1.95% of Revenues for the last twelve months; this number weakened in the most recent quarter to -0.25%. That, along with a flattening of revenues over the last couple of quarters, could be an indication that pandemic-correlated demand could be normalizing.

Free Cash Flow: KR’s free cash flow is healthy, and growing strongly, at $4.1 billion over the last twelve months. That marks an improvement from $1.8 billion at the end of 2019 and $3.9 billion in mid-2020, and translates to a free cash flow yield of 14.93%. Their strong, improving cash flow is a strong positive, and a reason that the company has good liquidity, with about $2.78 billion in cash and liquid assets.

Debt to Equity: KR has a debt/equity ratio of 1.31. This is higher than I usually prefer to see, but isn’t unusual for Food Retailing stocks. The company’s balance sheet indicates that operating profits are more than adequate to repay their debt. This number is a reflection of the capital-intensive investments in itself the company has made to stay competitive in its market.

Dividend: KR pays an annual dividend of $.72, which marks an increase from $.64 per share early 2020, and translates to a yield of about 1.97% at the stock’s current price.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target around $48 per share. That means that KR is undervalued by 31% from its current price a little above $36.

Technical Profile

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The chart above marks the last year of price movement for KR. After pushing to a temporary peak at around $43 in February, the stock fell back into the range it had been following through most of 2021. From a low around $31 in December of last year, the stock started building a steady upward trend that peaked at around $39 earlier this month. Current support is around $36, with immediate resistance at around $38. A drop below $36 should find next support between $35 and $34, while a push above $38 will find next support at around $39.

Near-term Keys: For a short-term trade, the probability right now is clearly on the bullish side; if you want to be aggressive with a short-term trade by buying the stock or working with call options, you could use a continued push off of support around $36 as a good opportunity to initiate a bullish trade, with $38 to $39 offering reasonable profit targets. If the stock drops below $36, you could consider shorting the stock or working with put options, with an eye on a very short-term profit target at around $34 per share. I like KR’s value proposition and overall fundamental profile; it is among very few companies that has showed positive signs of growth in the current pandemic world. I think KR remains a solid stock to consider as a long-term investment right now.