One of the sources of a lot of conversation among talking heads and market analysts in general lies around the “reopening” concept. With social and business restrictions easing across the United States, many of the activities we all enjoyed prior to the global pandemic are coming back into a vogue. The most recent Memorial Day holiday seems to have provided a good sample for proof of that idea, as consumer demand for travel and leisure activities left many experts encouraged about the economic path ahead.

Market enthusiasm and economic growth driven around the reopening of business and social activity should be a net positive for the Consumer Discretionary sector. The sector has shown quite a bit of resilience over the past year and a half, driven by a massive shift to e-commerce services and solutions. Among the pandemic-driven shifts that worked in the favor of a lot of different industries in the sector, including stocks in the Textiles, Apparel & Luxury Goods industry has been an increased focus on personal health and wellness. That is an industry that includes well-known players like Under Armour (UA), NKE, Hanesbrands Inc (HBI) and today’s highlight, Gildan Activewear (GIL). GIL doesn’t have the same cachet that comes from immediate name recognition, but is a very interesting stock because of its focus on private label apparel.

An increasing number of retailers are shifting the products they offer, increasing shelf and floor space in favor of brands offered only in their own stores. GIL’s focus is on partnering with those businesses to manufacture those goods. It’s a trend that is expected to continue to grow, since private labels offer higher margins in the always-competitive retailing industry where margins are consistently thin and becoming even narrower – and where traditional brands like NKE, UA and more have been actively working to develop their own direct-to-consumer systems to bypass the traditional, more costly retail arrangement. GIL is a stock that has more than doubled in price over the last year, but has also plateaued not far from its 52-week high price at around $38. Does that mean the stock has “run out of gas,” or do the company’s fundamentals offer signs that there could be even more room to grow?

Fundamental and Value Profile

Gildan Activewear Inc. is a manufacturer and marketer of branded basic family apparel, including T-shirts, fleece, sport shirts, underwear, socks, hosiery and shapewear. The Company operates through two segments: Printwear and Branded Apparel. The Printwear segment designs, manufactures, sources, markets, and distributes undecorated activewear products. The Branded Apparel segment designs, manufactures, sources, markets, and distributes branded family apparel, which includes athletic, casual and dress socks, underwear, activewear, sheer hosiery, legwear, and shapewear products, which are sold to retailers in the United States and Canada. The Company sells its products under various brands, including the Gildan, Gold Toe, Anvil, Comfort Colors, American Apparel, Alstyle, Secret, Silks, Kushyfoot, Secret Silky, Therapy Plus, Peds, and MediPeds brands. The Company distributes its products in printwear markets in the United States, Canada, Mexico, Europe, Asia-Pacific and Latin America. GIL’s current market cap is $7 billion.

Earnings and Sales Growth: Over the last twelve months, earnings increased by 700% (not a typo), while revenues were almost 28.5% higher. In the last quarter, earnings increased by 6.67%, while sales decreased by -14.5%. GIL operates with a margin profile that suffered during the pandemic – which isn’t a big surprise given the conditions – but has shown significant signs of improvement. Over the last twelve months, Net Income as a percentage of Revenues was -1.3%, and increased in the last quarter to 16.71%.

Free Cash Flow: GIL’s free cash flow is $633.12 million, and translates to a useful Free Cash Flow Yield of 8.89%. The current number also marks an improvement over the past year from about $283 million.

Dividend Yield: GIL’s dividend is $.616 per share, which translates to an annual yield of about 1.73% at the stock’s current price. Management suspended its dividend last year at the beginning of the pandemic, but reinstated it after the most recent earnings report.

Debt to Equity: GIL has a debt/equity ratio of .64. This is a conservative number that generally implies management takes a careful approach to leverage. GIL’s balance sheet shows a little over $536 million in cash and liquid assets against about $1 billion in long-term debt. GIL’s margin profile indicates operating profits are more than adequate to service their debt, with healthy liquidity to provide additional flexibility.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. The “reopening” concepts also provides a reasonable argument to factor expected growth rates into the equation, and I think that is applicable to GIL’s case. All together, these measurements provide a long-term, fair value target around $48 per share. That means that even with the stock’s increase in price over the last year, it remains very nicely undervalued right now, with 35% upside from its current price.

Technical Profile

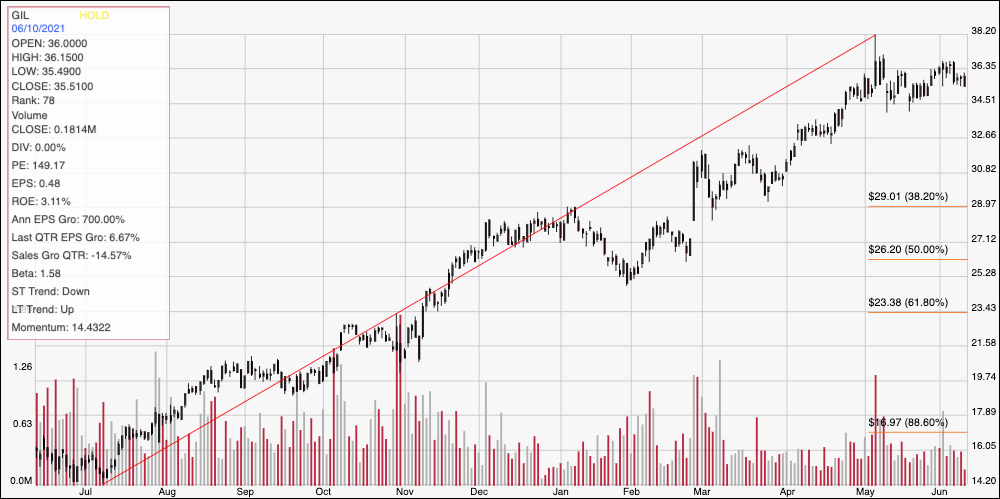

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: This chart traces the stock’s movement over the last year. The red line traces the stock’s upward trend since July of last year to its peak in May; it also provides the baseline for the Fibonacci retracement lines shown on the right side of the chart. The stock has been consolidating just a little off of its high point at around $38, with immediate resistance at around $36.50 and current support at $34.50. A drop below $34.50 could see the stock drop to anywhere between $32.50 and $31.50 based on pivot activity seen in late February, March and early April, with additional downside to about $29 where the 38.2% retracement line sits if bearish momentum accelerates. A push above $36.50 should find next resistance at the stock’s 52-week high at $38.50; if buying sentiment and activity picks up around that point, expect the stock to find its next peak somewhere around $40.50.

Near-term Keys: If you’re looking for a short-term, bullish trade, look for a push above resistance at $36.50 as a good signal to buy the stock or to work with call options. If the stock shows weakness, and pushes below support at $34.50, consider shorting the stock or working with put options. GIL is an interesting stock to pay attention to on a long-term basis; if the reopening scenario that so many experts are forecasting plays out as expected, the long-term upside for this stock could be well above its 52-week high.