One of the best-performing areas of the economy over the past year has been the Consumer Discretionary sector, which has increased in value by about 38% over that period, as measured by the S&P 500 Consumer Discretionary Sector SPDR ETF (XLY). Much of that bullish move was driven by the consumer shift during the restrictive phases of the pandemic to exercise outside and engage in outdoor activities. That gave stocks like Columbia Sportswear Company (COLM) a useful revenue base to weather the pandemic with; over the same period, the stock is up almost 32.5%. With many economists and analysts predicting continued high demand for outdoor activities as economic activity continues to reopen, COLM could continue to benefit.

Depending on your perspective, seeing a stock staging such a strong upward trend over the past year can prompt a couple of different ideas. If you use the long-term trend as a primary indication of trade direction, the stock’s current strength should naturally make you think about placing a bullish trade. If you follow a value-based or contrarian approach, the strength of the long-term upward trend should lead you to wonder if the best opportunity has already passed, and if in fact the downside risk right now outweighs any remaining upside potential.

Based on the company’s most recent earnings report, COLM’s fundamentals are all healthy and seem to indicate not only that business has been growing, but also that it should continue to do so for the foreseeable future. The company’s business is very cyclic in nature, owing to the fact that it is so closely tied consumer preferences and trends, as well as to the ebb and flow of seasonal shifts in those trends; even so, over the past year the company has shown strength in just about every important, measurable area. After hitting a peak in late April at around $115, the stock has faded a bit, but appears to have found a new support level that could give the stock a good technical base to continue its longer-term upward trend. Is it also a good value? Let’s find out.

Fundamental and Value Profile

Columbia Sportswear Company is an apparel and footwear company. The Company designs, sources, markets and distributes outdoor lifestyle apparel, footwear, accessories and equipment under the Columbia, Mountain Hardwear, Sorel, prAna and other brands. Its geographic segments are the United States, Latin America and Asia Pacific (LAAP), Europe, Middle East and Africa (EMEA), and Canada. The Company develops and manages its merchandise in categories, including apparel, accessories and equipment, and footwear. It distributes its products through a mix of wholesale distribution channels, its own direct-to-consumer channels (retail stores and e-commerce), independent distributors and licensees. As of December 31, 2016, its products were sold in approximately 90 countries. In 59 of those countries, it sells to independent distributors to whom it has granted distribution rights. Contract manufacturers located outside the United States manufacture all of its products. COLM has a current market cap of $6.8 billion.

Earnings and Sales Growth: Over the last twelve months, earnings declined by almost -42%, while sales by about 10%. Over the last quarter, both numbers were negative, with earnings still down by about -42% and sales a little over -31.5. This negative pattern is countered by the company’s operating profile; over the last twelve months, Net Income was 6.4% of Revenues, and strengthened to nearly 9% in the last quarter.

Free Cash Flow: COLM’s Free Cash Flow is healthy, at a little over $351 million. Their available cash and liquid assets have increased over the last two quarters from about $233 million to more than $874.5 million in the last quarter.

Debt to Equity: COLM has a debt/equity ratio of 0; they have little to no long-term debt.

Dividend: COLM suspended its dividend in 2020 to preserve cash during the pandemic, but reinstated it after the first quarter of this year, at an annualized rate of $1.04 per share. That compares favorably to its pre-pandemic payout, which was $.96 per share. At the stock’s current price, its current payout translates to a modest dividend yield of 1.01%.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. The “reopening” concepts also provides a reasonable argument to factor expected growth rates into the equation, and I think that is applicable to COLM’s case. All together, these measurements provide a long-term, fair value target at around $141 per share. That means that even with the stock’s increase in price over the last year, it remains very nicely undervalued right now, with 37% upside from its current price.

Technical Profile

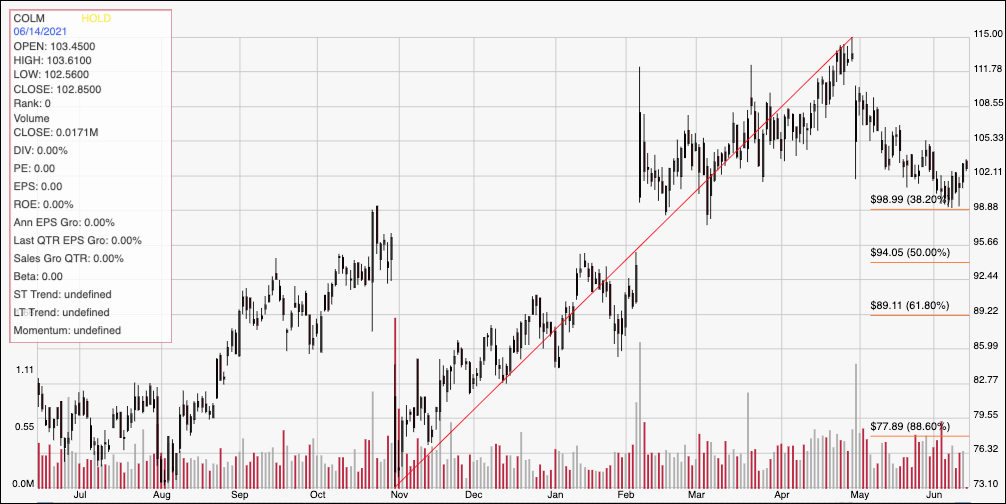

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The chart above displays the last year of price activity; the red diagonal line traces the stock’s upward trend from a November low at around $73 to its April high at around $115 per share. It also provides the baseline for the Fibonacci retracement lines shown on the right side of the chart. From that point, the stock dropped all the way back to the 38.2% retracement line where it found support in the last couple of weeks at about $99 and appears to have pivoted back in an upward direction. Immediate resistance is at around $105; a break above that level should give the stock to push to at least $108, with room to test its $115 high if bullish momentum accelerates. A drop below current support at $99 could see the stock drop to about $94 to find next support around the 50% retracement line.

Near-term Keys: For the stock to resume its longer-term upward trend in the short-term, it would have to break above $105 with considerable buying volume to provide momentum and strength. That could provide a good signal to think about buying the stock or working with call options, using a target between $108 and $115 as useful points to take profits. A drop below support at $99 would be a strong signal to consider shorting the stock or to buy put options, with $94 providing a nice profit target on a bearish trade. The stock’s value proposition, along with prospects for continued strength as economic activity resumes through the rest of the year provide an interesting argument to think about using COLM for a useful long-term buying opportunity.