Through a big portion of 2020, one of the areas that I was able to find some interesting valuations to work with was in the Telecommunications industry. Some of the largest players in the industry do much more than just telecommunications; AT&T Inc. (T) has, of course long been one of the largest telecommunications companies in the United States, which has also given them the ability to branch out and diversify their business into the entertainment world. 2020 has proven to be a challenging year for many of this “diversified telecomm services” company’s businesses; that has helped to keep the stock price relatively low for the last year, but the latest earnings report shows some serious signs of deterioration that a material recovery could take longer than expected.

In 2015, the company acquired DirecTV, a segment that has struggled for the last couple of years, following a longer-term theme as consumers are increasingly “cutting the cord” on traditional cable or satellite TV services. T has been looking to sell DirecTV, along with other underperforming segments to private equity investors, but would be unlikely to recoup the $49 billion it paid (latest estimates put final expected bids from unnamed, interested parties in the $15 billion range). In 2018, T’s acquisition of Time Warner gave it a foothold in the same space occupied by media companies like Viacom and Disney – but a lot of people are saying that a new deal, to spin off the WarnerMedia unit into a new company merged with Discovery is sign that AT&T is admitting it made a bad decision with the acquisition; but it is worth noting that T will receive $43 billion that will be used to reduce debt, and still retain 71% ownership of the new company.

T is an interesting mix of opportunity and risk right now, as the spinoff creates a new publicly traded company, with an expanded portfolio of programming to offer on both traditional and streaming platforms; it will also allow T to put its primary focus back on its core telecommunications businesses. The pandemic forced a practically complete shutdown of all WarnerMedia production, which put the company’s operating margins into negative territory over the last year; but it appears that the company is starting to emerge from that challenging period with material gains in Net Income, and improving Free Cash Flow as well as greater liquidity than it had a year ago. Are the those improvements enough to make T’s stock a good bet for a long-term, value-oriented investor?

Fundamental and Value Profile

AT&T Inc. is a holding company. The Company is a provider of telecommunications, media and technology services globally. The Company operates through four segments: Communication segment, WarnerMedia segment, Latin America segment and Xandr segment. The Communications segment provides wireless and wireline telecom, video and broadband services to consumers.The business units of the Communication segment includes Mobility, Entertainment Group and Business Wireline. The WarnerMedia segment develops, produces and distributes feature films, television, gaming and other content over various physical and digital formats. The business units of the WarnerMedia segment includes Turner, Home Box Office and Warner Bros. Latin America segment provides entertainment services in Latin America and wireless services in Mexico. Viro and Mexico are the business units of the Latin America segment. The Xandr segment provides advertising services. T has a current market cap of about $205.7 billion.

Earnings and Sales Growth: Over the last twelve months, earnings increased by about 2.38%, while revenue grew about 2.71%. In the last quarter, earnings were 14.67% higher, while revenues declined -3.83%. T operates with an operating profile that sunk into negative territory over the last year but is showing significant improvement in the most recent quarter. Over the last twelve months, Net Income was -1.29% of Revenues, but strengthened to more than 17% in the last quarter.

Free Cash Flow: T’s free cash flow is healthy, at more than $29.4 billion. This number has increased steadily since early 2015, from about $10 billion and $25 billion a year ago. The current number translates to a useful Free Cash Flow Yield of 14.33%.

Dividend: T’s annual divided is $2.08 per share, which translates to a compelling yield of 7.23% at the stock’s current price. It should be noted that management intends to cut the dividend after the WarnerMedia spinoff is completed (expected sometime in 2022) to reflect the smaller size of the remaining company.

Debt/Equity: T carries a Debt/Equity ratio of .88, which is generally considered a pretty conservative number that doesn’t really paint a complete picture. Their balance sheet shows $11.3 billion in cash and liquid assets versus $160 billion in long-term debt. Much of that debt is associated with the Time Warner acquisition. The spinoff will pay down a large portion of long-term, but T has also historically carried a lot of debt, with more than $100 million in long-term debt on the books since mid-2015. T’s positive growth in Free Cash Flow and improving Net Income indicate they should have no problem servicing the debt they have.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target at almost $34 per share. That suggests that, the stock is undervalued, with 17% upside from its current price. It is also worth noting that at the end of the second quarter of last year, my Fair Value target for T was closer to $40.

Technical Profile

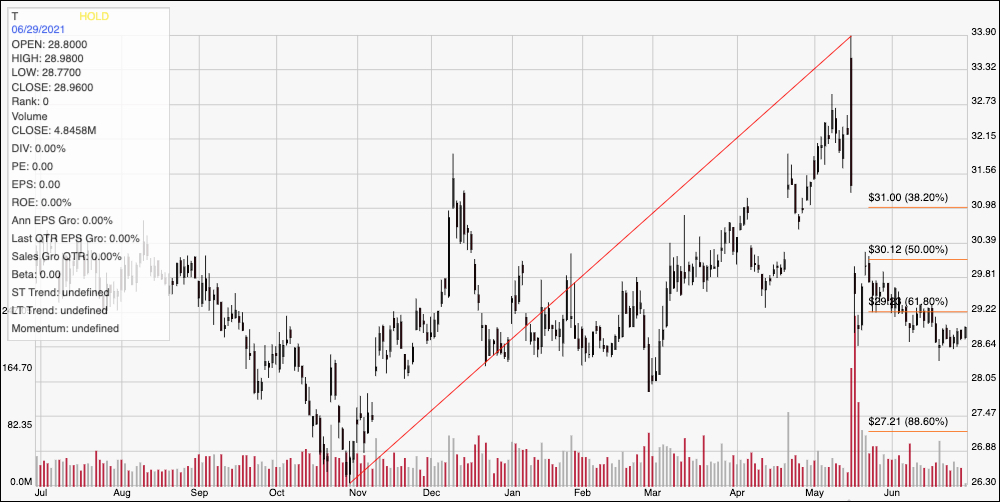

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The red diagonal line measures the length of the stock’s upward trend from a November low at around $26 to a peak in mid-May at around $34; it also informs the Fibonacci trend retracement lines shown on the right side of the chart. The stock made a big overnight move on the down side after the company’s last earnings report, which included the WarnerMedia spinoff announcement. The stock continued to fade lower from that point, but in the last week appears to have found support in the $28.50 price area. Immediate resistance is around $29, inline with the 61.8% retracement line. A drop below $28.50 could see the stock find next support anywhere between $28 and $27, while a push above $29 should have short-term upside to about $31 where the 38.2% retracement line would be expected to provide next resistance.

Near-term Keys: T offers a high dividend that makes for tempting bait for income-seeking investors; but don’t ignore the fact that the dividend will be reduced in 2022 once the WarnerMedia spinoff has been completed. The market appears to be dismissing the generally improving fundamentals the company has reported in the last quarter or so, and that is one of the main reasons T’s value proposition has been improving lately. If you prefer to work with short-term trading strategies, you might be able to use T for some useful momentum-based trades, but be aware that the ranges between support and resistance levels is narrow, which means no matter whether you are looking for a bearish or bullish trade, you should be working with quick exit targets. A bullish signal would come from a push above $29, with a profit target at around $31 if you buy the stock or work with call options; while a drop below $28.50 would provide an opportunity to consider shorting the stock or buying put options, using $27 as a practical exit target on the bearish side.