As a conservative-minded, value and fundamental-driven investor, my natural tendency is to shy away from stocks that market experts and popular market media analysts tend to talk to the most about. That means that my investments rarely look very sexy – but I’m far less interested in being sexy than I am in being able to keep my money working for me in any market condition. That’s one of the biggest reason that throughout the course of the last couple of years I’ve found the Consumer Staples sector, and specifically the Food Products industry a good place to find useful investing opportunities.

In 2018 and 2019, a lot of that opportunity was being driven by international trade concerns that increased uncertainty in the marketplace. 2020 reaffirmed the industry as a good place to be as the pandemic prompted a massive, albeit unexpected consumer shift back towards value-based packaged foods. In most areas of the country, dining out has only just begun to be a thing for most of the past year and a half. Social distancing requirements and dine-in restrictions around the country put a massive amount of pressure on restaurants, bars, and clubs that we normally associate with enjoyable social activities that is really only beginning to recede. The latest jobs numbers show that unemployment remains well above the levels seen prior to the pandemic, which means that a large number of American families remain financially pressured. That means that food storage and home dining is likely to continue to follow a similar trend throughout this year as last.

Economic and industry analysts all expect that the consumer trends I just described will show “stickiness” in 2021, meaning that instead of being simple reflections of temporary pressures, they likely represent long-term behavioral shifts. In addition, a lot of these companies have shown improving fundamental profiles throughout the last year, including material improvements in cash flows, debt reduction, and overall balance sheet strength. Contrast those positives to the current downward pressure on the industry, and I think that means that Consumer Staples will still have its place as a smart place to keep in mind in 2021.

You still have to be careful, though; it’s pretty easy to gravitate to well-known, established names like GIS, CPB, and KR, to name just a few, but just because a company has a great name and brand, it doesn’t mean the stock is a good opportunity right now. It is still important to pay attention to a company’s underlying business – in fact, I would argue that it may be more important than ever, because even with strong relative price performance since March 2020, a number of Food Products stocks continue to reflect very attractive valuation levels.

Kraft-Heinz Co. (KHC) is an example of what I mean. Look in your pantry or fridge, and you’ll probably find a lot of their products on your shelves. In terms of recognizability, there aren’t too many food brands that can claim the brand recognition this company has. Heinz condiments including ketchup, mustard, mayonnaise have been a mainstay of my fridge for years, and Kraft brands like Oscar Meyer are regulars, too. That should mean the company has a stable, strong business, right? Not so fast. One of the big struggles a lot of traditional names in the Food Products business have been fighting is the trend away from pre-packaged products and into healthier, organic options. While some, like CPB and GIS, seem to finding ways to stay relevant, KHC has struggled. They’re in the midst of a multiyear, long-term transformation strategy, and the pandemic prompted a stock-your-pantry mindset that gave a lot of companies in this industry, including KHC an opportunity to recapture lost customer and gain new ones. That is a positive, along with the divestiture of “non-core” portions of its business, such as the $3.2 billion sale of its natural cheese business to French food company Lactalis. 2021 will be an important year to determine if they can retain that new market share, continue to trim the business, shed debt and improve their long-term profitability prospects. Let’s dive in to the numbers so you can decide if this is a company that is worth putting to work for you.

Fundamental and Value Profile

The Kraft Heinz Company is a food and beverage company. The Company is engaged in the manufacturing and marketing of food and beverage products, including condiments and sauces, cheese and dairy, meals, meats, refreshment beverages, coffee and other grocery products. The Company’s segments include the United States, Canada and Europe. The Company’s remaining businesses are combined as Rest of World. The Rest of World consists of Latin America and Asia, Middle East and Africa (AMEA). The Company provides products for various occasions whether at home, in restaurants or on the go. The Company’s brands include Heinz, Kraft, Oscar Mayer, Philadelphia, Planters, Velveeta, Lunchables, Maxwell House, Capri Sun, and Ore-Ida. The Company’s products are sold through its own sales organizations and through independent brokers, agents and distributors to chain, wholesale, cooperative and independent grocery accounts, convenience stores, drug stores, value stores, bakeries and pharmacies. KHC’s market cap is about $48.6 billion.

Earnings and Sales Growth: Over the last twelve months, earnings improved by a little over 24%, while sales grew 3.85%. In the last quarter, earnings declined by -10% while sales dipped by about -7.85%. KHC’s margin profile appears to be improving; Net Income as a percentage of Revenues was 2.05% over the last twelve months, but strengthened markedly in the last quarter, to 8.81%.

Free Cash Flow: KHC’s free cash flow was a little over $4.6 billion (a sizable improvement from $560 million in mid-2019) over the past twelve months and translates to a useful Free Cash Flow Yield of 9.51%. It is worth noting that this number declined from almost $6.2 billion in the last quarter of 2020.

Dividend Yield: KHC’s dividend is $1.60 per share, and translate to an above-average yield of 4.04% at its current price.

Debt to Equity: KHC has a debt/equity ratio of .54. This is a low number that I think is a bit misleading given a high proportional level of debt versus cash and liquid assets. Their balance sheet shows $2.36 billion in cash and liquid assets against more than $27 billion in long-term debt. While debt is below the $31 billion mark it saw in mid-2020, cash has also declined from about $5.4 billion at the beginning of 2020.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target just little under $57 per share. That means the stock is trading at a big discount, with about 44% upside from the stock’s current price.

Technical Profile

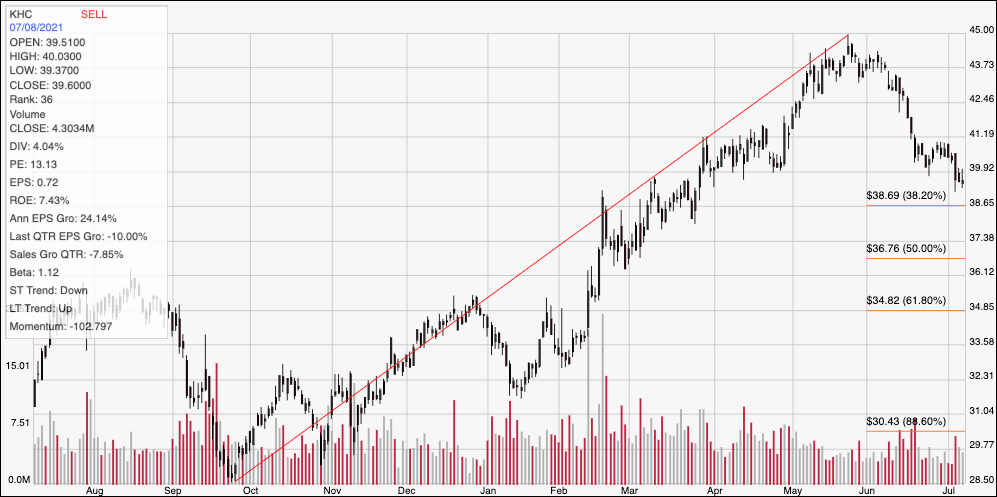

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: This chart traces the stock’s movement over the last year. The diagonal red line traces the stock’s upward trend from an October low at around $28.50 to its high point in late May at about $45 per share. It also provides the baseline for the Fibonacci retracement lines shown on the right side of the chart. The stock has retraced to a little below $40 from that high, and is now approaching expected support at the 38.2% retracement line, which is around the $38.50 price level. Immediate resistance is at $41; a push above that point would mark a useful reversal of the stock’s current bearish momentum and should see upside to between $44 and $45. A drop below $38.50 should find next support at around $37, in the area of the 50% retracement line.

Near-term Keys: Given the stock’s momentum, the best probabilities of success right now lie more strongly on the bearish side for KHC – but the smart bet is to wait to see if the stock can find support at around $39. A good bullish signal would come from a bounce off of $39 per share, using $43 as a useful, bullish short-term exit target. A drop below support at around $38.50 could offer a signal to consider shorting the stock or buying put options, but keep in mind that downside is limited to about $37 per share. The stock’s value proposition is very compelling, and the fundamentals have mostly been improving for the past year, which makes the long-term potential very interesting. At the very least, KHC is a Food Products stock that is worth keeping in your watchlist.