From late March to the first part of April, one of the attention-grabbing stories in the market was the fall of ViacomCBS Inc. (VIAC) from a peak at around $102 in less than one week to below $50. VIAC announced announced it would be selling new shares to the market. The news diluted the value of existing shares, precipitating a 25% drop shortly afterward. The real story started from that point, as “family offices” – large investment funds set up exclusively to manage its own money rather than soliciting client funds – who were over-leveraged on this stock were forced to start selling other positions to cover margin calls on its borrowed assets. Increased selling – not just by this family office, but other investors as well – precipitated more declines in VIAC’s stock price, accelerating the decline even more.

The tendency for most investors is to shun stocks in free fall, which means that for the average growth investor, VIAC quickly became a radioactive stock. That perception is countered, however by the fact that VIAC’s underlying fundamentals are very strong, with management’s latest earnings call clearly demonstrating they are getting even better. This is a company that was formed by the merger of two broadcast media giants – Viacom and CBS – to be more effective as a combined company in an ever more competitive landscape in in the broadcasting and entertainment industry.

Traditional broadcast channels – cable, satellite TV, and so on – continue to be affected by “cord-cutters” that are shifting more and more to streaming channels. Cord-cutting doesn’t just apply to movies and TV series, but also for sports programming. Amazon, for example just paid a king’s ransom for exclusive rights to Thursday Night Football, and VIAC is moving to stay just as relevant, having overpaid for an extension of its NFL contract, and also adding Euroleague soccer to its streaming lineup as well.

This is a stock that rose from a March 2020, bear market low at $12 a year ago to about $35 by the start of 2020; but from that point the stock soared, rising to its March high at around $102 per share. From that peak and initial collapse, the stock has settled into a practical consolidation level, with consistent support just a little below the stock’s current price. Altogether, that suggests that VIAC continues to represent one of the best values in the market right now. Let’s dive in.

Fundamental and Value Profile

ViacomCBS Inc., formerly CBS Corp, is a global media and entertainment company. The Company is focused on creating premium content and experiences for audiences worldwide. It operates through various brands, including CBS, Showtime Networks, Paramount Pictures, Nickelodeon, MTV, Comedy Central, BET, CBS All Access, Pluto TV and Simon & Schuster, among others. It also offers production, distribution and advertising solutions for partners across five continents. BET is the primary channel of BET Networks, that provides entertainment, music, news and public affairs television programming for the African-American audience. CBS Sports brand is a broadcaster of television sports. Its Paramount Pictures brand is a producer and global distributor of filmed entertainment. Its CBS Television Studios is a supplier of programming with more than 70 series in production across broadcast and cable networks, streaming services and other platforms. Its brands also include Bellator MMA and COLORS. VIAC has a current market cap of about $25.7 billion.

Earnings and Sales Growth: Over the last twelve months, earnings increased by about 34.5%, while revenue increased by 11.14%. In the last quarter, earnings were more than 46% higher, while revenues grew 7.8%. VIAC operates with a healthy, strengthening operating profile; over the last twelve months, Net Income was 10.56% of Revenues, increasing to 12.3% in the last quarter.

Free Cash Flow: VIAC’s free cash flow is very healthy, at $3.3 billion. This number increased from about $1.6 million a year ago, and $1.9 billion in the last quarter. The current number translates to a Free Cash Flow Yield of 12.91%.

Dividend: VIAC’s annual divided is $.96 per share, which translates to a yield of 2.41% at the stock’s current price.

Debt/Equity: VIAC carries a Debt/Equity ratio of .90, which is a significant drop from 1.23 in the last quarter. Their balance sheet shows almost $5.5 billion in cash and liquid assets versus $17.7 billion in long-term debt. Their operating profile suggest that the company should have no problem servicing their debt, with good flexibility and liquidity to go along with it.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target a little below $107 per share. That suggests that the stock is massively undervalued right now, with about 181% upside (not a typo) from its current price. It is also worth noting that before the latest earnings report, my analysis put the stock’s long-term target at around $89.50 per share – implying that the value proposition has gotten even more compelling.

Technical Profile

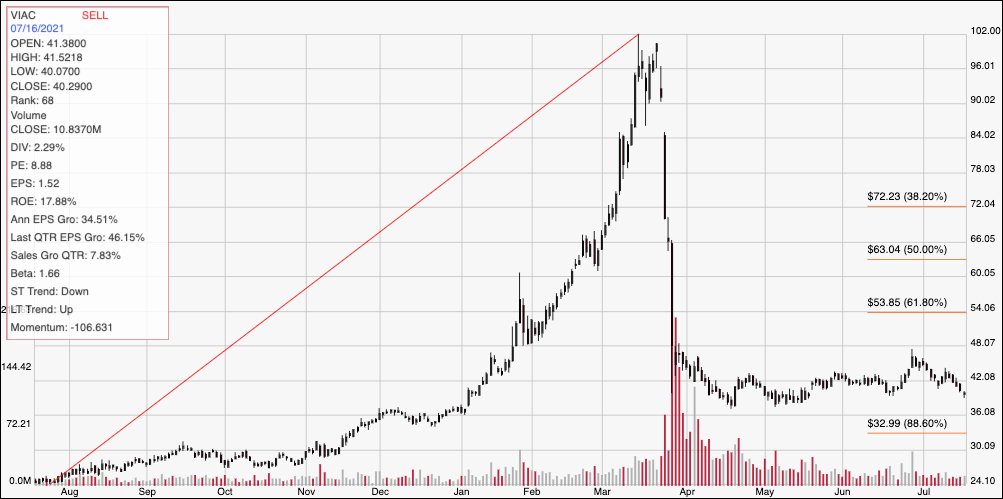

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: This chart looks at the last year of price activity for VIAC. The red diagonal line measures the length of the stock’s upward trend from a low at around $24 to its peak in March at around $102; it also informs the Fibonacci trend retracement lines shown on the right side of the chart. The stock’s fall didn’t find a bottom until mid-April at around $37 per share, but from that point has started to define a consolidation range with support at $37 and resistance at around $42 per share. The stock is sitting near the middle of the range right now. A push above $42 should have short-term upside to about $47 per share, while a drop below $37 could see downside to around $33 before finding next support.

Near-term Keys: VIAC’s consolidation range has extended for more than four months now, which strengthens the importance of the upper and lower bands of that range if you are a short-term trader. With the stock’s current level sitting near to support, a pivot low and move higher could be a signal to think about buying the stock or working with call options, using $42 as a useful initial profit target and $47 achievable if bullish momentum accelerates. A drop below $37 would be a signal to consider shorting the stock or buying put options, with an eye on $33 to take profit on a bearish trade. From a value-oriented perspective, the stock’s consolidation range, along with its strong fundamental profile, only serve to improve the attractiveness of the value proposition right now.