Increasing concerns about the pace of inflation – and what that might mean for a host of issues like whether the Fed will need to start increasing interest rates earlier and faster than they have forecast or than most economists have predicted – have given the market a reason to be a little bit choppier in the last few weeks. Along with those issues is the fact that, no matter how much everybody wants to be able to say that the worst of COVID is behind us, that question remains a thorny one, as new strains are leading to brand new spikes in infections and hospitalizations across the world and even starting to prompt some to ask if a new wave of government-imposed restrictions might be needed and so put a brand new stranglehold on economic activity.

That uncertainty has led a number of sectors to retrace off of fresh sets of 52-week highs, and that includes the Technology sector, which has unsurprisingly been leading the market’s charge higher for the past year. That includes stocks like Jabil Inc. (JBL), a company that provides electronic design and manufacturing services to customers throughout the Tech sector like Apple, Amazon, Cisco Systems, and Hewlett-Packard, to name just a few. This is a stock that nearly doubled in value from a September low at around $30 to its peak in June at $59, but has dropped off of that high point about -10% as of this writing.

JBL is an interesting company, with a very solid balance sheet that includes increasing Free Cash Flow, healthy liquidity and manageable debt. The stock’s increase in price into last month was a great thing for growth-oriented investors, which means that the current pullback could be setting up a new opportunity to “buy the dip” to take advantage of the stock’s longer trend. What about its value proposition? Are the fundamentals strong enough to suggest that value investors should also be paying attention, or is the stock’s price still too high to represent a useful long-term opportunity? Let’s check it out.

Fundamental and Value Profile

Jabil Inc., formerly Jabil Circuit, Inc., provides electronic manufacturing services and solutions throughout the world. The Company operates in two segments, which include Electronics Manufacturing Services (EMS) and Diversified Manufacturing Services (DMS). The Company’s EMS segment is focused on leveraging information technology (IT), supply chain design and engineering, technologies centered on core electronics, sharing of its large scale manufacturing infrastructure and the ability to serve a range of markets. Its DMS segment is focused on providing engineering solutions and a focus on material sciences and technologies. It provides electronic design, production and product management services to companies in the automotive, capital equipment, consumer lifestyles and wearable technologies, computing and storage, defense and aerospace, digital home, emerging growth, healthcare, industrial and energy, mobility, packaging, point of sale and printing industries. JBL’s current market cap is $8 billion.

Earnings and Sales Growth: Over the last twelve months, earnings increased more than 429% (not a typo), while revenues increased almost 14%. In the last quarter, earnings increased a little over 13%, while sales were 5.65% higher. JBL operates with a very narrow, but improving margin profile; over the last twelve months, Net Income was 2.02% of Revenues, and strengthened in the last quarter to 2.35%.

Free Cash Flow: JBL’s free cash flow is healthy, at about $524.98 million, and translates to a Free Cash Flow Yield of 6.72%. It also marks an improvement from $460.9 million a year ago.

Dividend Yield: JBL’s dividend is a modest $.32 per share, and translates to an annual yield of about 0.58% at the stock’s current price. The more interesting note is that the company pays a dividend, period, in an industry where most stocks do not. The size of the dividend is also not a reflection of pandemic-driven pressures, as JBL has historically maintained a very conservative dividend payout that has also been maintained at its current level for the past three years.

Debt to Equity: JBL has a debt/equity ratio of 1.34. This is a high number, and usually reflects a high degree of leverage. In JBL’s case, however their balance sheet shows healthy liquidity, with cash and liquid assets of $1.24 billion in the last quarter versus $2.87 billion of long-term debt. It is also noteworthy that the company’s cash grew from around $838 million at the end of 2020. Their healthy liquidity and Free Cash Flow, are effective counters to their narrow margin profile, and strongly suggest they should have no problem servicing their debt; however any kind of reversal of Net Income could complicate the question.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to worth with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term target at about $37.50 per share. That suggests JBL is significantly overvalued, by about -32% right now, with a useful discount price at around $30 per share. It is also worth noting that earlier this year, this measurement yielded a fair value target at around $29 per share.

Technical Profile

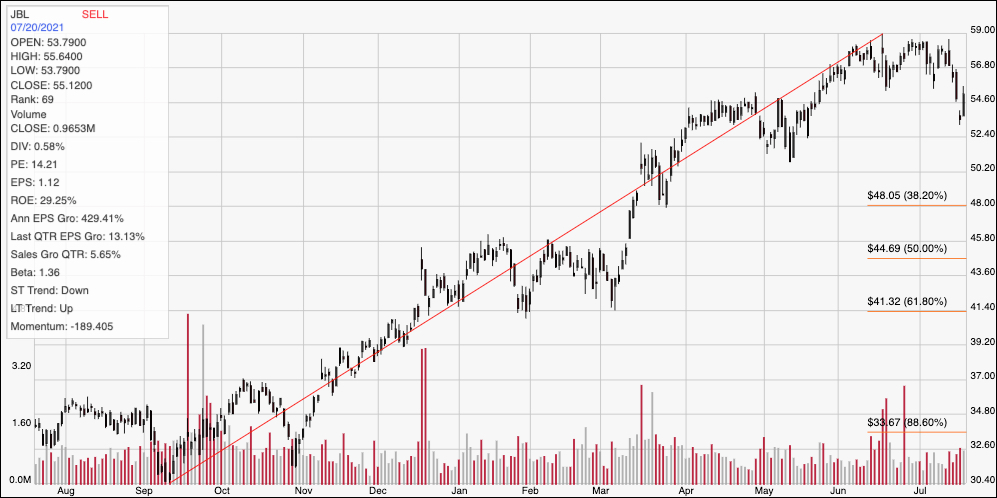

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: This chart traces the stock’s movement over the last year. The red diagonal line marks the stock’s upward trend from its September 2020 low at around $30 to its peak last month at about $59; it also provides the baseline for the Fibonacci retracement lines on the right side of the chart. The stock retraced off of its peak beginning this month, and appears to have found strong support at around $53.50 per share, with immediate resistance at around $57. The stock has limited upside to next resistance above $59, but if bullish momentum picks up it could break $59 and push into the mid-$60 range. A drop below $53.50, on the other hand should see about $3 of downside to next support at around $50.50, with additional support below that at the 38.2% retracement line around $48.

Near-term Keys: If you’re looking for a short-term, bullish trade, a break above $57 could offer a signal to buy the stock or work with call options, with an eye on a quick exit target at around $59. A drop below support at $53.50, on the other hand, could offer a useful signal to consider shorting the stock or working with put options, with an eye on $50.50 as a quick bearish profit target, with additional room to $48 if bearish momentum picks up. At its current price, however, there isn’t a value case to be made for JBL. Despite other fundamental strengths, I see the company’s narrow operating profile – which is also far more narrow than is typical for the industry – as a significant risk factor in its operations, which means that any misstep could be costly. I would prefer to see margins improving, with a useful value price for the stock at around $30 per share.