At the beginning of this week, I was intrigued to see media reports and commentary centering around 5G adoption. That’s probably because a number of companies in the Semiconductor industry, who have been investing heavily in developing the technology that 5G relies on for years, have released their latest earnings reports. Like a lot of stocks in every industry saw drawdowns in 2020 of some sort, a lot of Tech stocks – including most of the most recognized names in the Semiconductor industry – were rallying as corporate America pivoted quickly to keep operations going on a remote, work-from-home base.

Despite current concerns about new infection spikes in many areas of the United States and worries about the severity of the coronavirus Delta variant, economy activity throughout most of this year has been pretty robust, and in fact a lot of industries have seen big increases in demand that are now starting to approach pre-pandemic levels. When it comes to 5G and the Internet of Things, that has actually put supply shortages that Semi stocks were dealing with before the pandemic into even sharper focus. Those shortages are still in place, as production facilities are still not running at full capacity to keep up with chip demand; another interesting element is an undercurrent of nationalist fervor about chip manufacturing that even the current Presidential administration has carried over from the Trump years. That sentiment has put difficult barriers in place for Semiconductor companies relying on chip production out of China and other parts of Asia, which just adds a little more fuel to the already-burning fire. The anti-Asia production trend is strong enough, for example that Intel Corp (INTC) announced at the beginning of the year it would begin investing billions of dollars to build its own forge operations in Arizona, creating a new business segment that stands not only to service INTC’s own needs, but also to potentially act as a production partner for the entire industry in the United States.

At the end of July, Skyworks Solutions (SWKS), a company that specializes in radio frequency (RF) ships for smartphones and other “smart” technologies that make up the Internet of Things released its most recent earnings report. All of the issues I just described have carried an impact on the company’s operations for the past year, but at the same time, it has also seen significant growth in Free Cash Flow, and surprisingly stable operating profitability over the last year. Part of that was the inclusion of SWKS’ products in the iPhone 12 in 2020, which was Apple’s (AAPL) first entry into 5G, and also a bit of serendipity owed to the political climate, as SWKS reported the capture of market share that had previously been attributed to Chinese producers like Xiaomi. Industry analysts also predict the company will continue to benefit from increasing 5G adoption as well as WiFi infrastructure improvements that will include SWKS RF solutions.

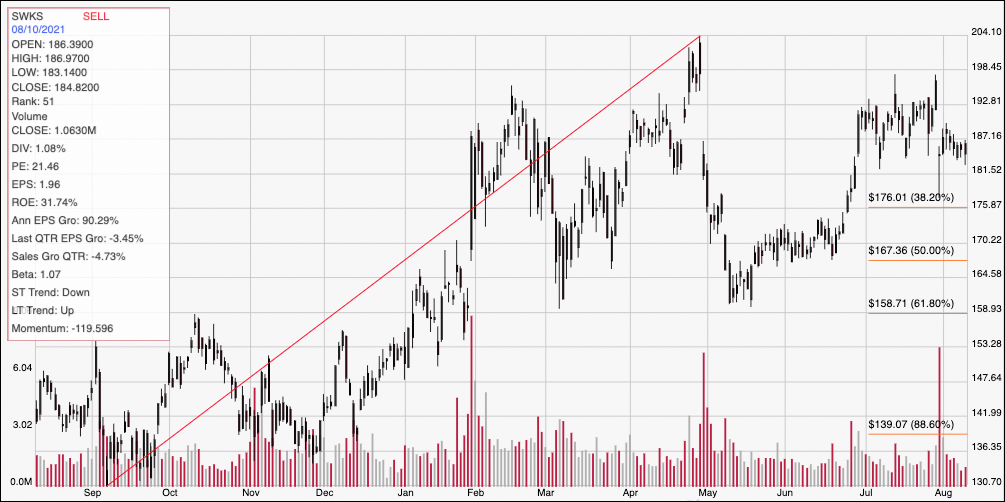

This is a stock that saw a BIG run up in price from a September low at around $131 to a late April peak at around $204 per share. After temporarily dropping in May to a low around $159, the stock started pushing higher again to find a new short-term peak at around $193 in July. It’s a little below that point now. The increase in price is interesting for growth-oriented investors and market timers; but for a value investor it begs the question of whether the stock’s price movement has outpaced its improving fundamental profile. Unfortunately, I think it has, which then begs the second question: what price would represent a fair value for this stock? Let’s find out.

Fundamental and Value Profile

Skyworks Solutions Inc. designs, develops, manufactures and markets semiconductor products, including intellectual property. The Company’s analog semiconductors are connecting people, places, and things, spanning a number of new and unimagined applications within the automotive, broadband, cellular infrastructure, connected home, industrial, medical, military, smartphone, tablet and wearable markets. Its geographical segments include the United States, Other Americas, China, Taiwan, South Korea, Other Asia-Pacific, Europe, Middle East and Africa. It operates throughout the world with engineering, manufacturing, sales and service facilities throughout Asia, Europe and North America. It is engaged with key original equipment manufacturers (OEM), smartphone providers and baseband reference design partners. Its product portfolio consists of various solutions, including amplifiers, attenuators, detectors, diodes, filters, front-end modules, hybrid, mixers, switches, and modulators. SWKS has a current market cap of $30.5 billion.

Earnings and Sales Growth: Over the last twelve months, earnings increased by more than 90%, while sales grew by more than 51.5%. In the last quarter, earnings dropped about -3.45% and sales about -4.73%. SWKS operates with an impressive margin profile that has held up very well over the past year; Net Income was 29.84% of Revenues over the last twelve months, and strengthened in the last quarter to 30.26%.

Free Cash Flow: SWKS has healthy and improving free cash flow, of about $1.1 billion over the last twelve months. This number has improved over the last year when it was $815.1 million, and translates to a Free Cash Flow Yield of 3.65%.

Debt to Equity: While SWKS had zero debt on its balance sheets since the beginning of 2015, the company took on a significant amount of debt at the beginning of the year to help bolster its balance sheet. Cash and liquid assets as of the last quarter were $2.9 billion versus a little under $1.5 billion in long-term debt. Even with the sudden, large assumption of long-term debt, their strong cash position, along with very healthy operating profile gives the company more than adequate ability to service their debt and invest in growing their business.

Dividend: SWKS pays an annual dividend of $2.24 per share, which at its current price translates to a dividend yield of about 1.21%. It should be noted the company boosted its dividend after its last earnings statement by 12% – a strong signal of management’s confidence in its business strategy.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target around $116 per share, which means that SWKS is extremely overvalued, with about -37% downside from its current price, and a practical discount price at around $93.

Technical Profile

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The chart above displays the stock’s price activity over the past year. The red diagonal line traces the stock’s upward trend beginning in September of last year at around $131 to its April peak at around $204. It also provides the baseline for the Fibonacci retracement lines shown on the right side of the chart. After hitting a temporary peak in July at around $193, the stock has started retracing since the beginning of this month, with expected current support at around $181, and immediate resistance at $192. A drop below $181 should have immediate downside to next support at around $176 where the 38.2% retracement line sits, with additional room to about $167 at the 50% retracement line. A push above $193, on the other hand should have about $8 of near-term upside to the stock’s 52-week high at around $204 before finding next resistance.

Near-term Keys: Unfortunately, the stock’s current high trading price, and performance over the last year has outpaced the stock’s generally improving fundamental profile, which means there is really no practical way to think about SWKS as a solid, long-term, value-oriented investment. There could be some useful opportunities, however to work with the stock using short-term trading strategies. A push above $193 could offer an interesting signal to buy the stock or work with call options, using the stock’s 52-week high at around $204 as a useful bullish profit target. A drop below $181, on the other hand could be a signal to consider shorting the stock or buying put options, using $176 as a quick-hit profit target and $167 if bearish momentum accelerates.