As a value investor, the search for stocks trading at useful values gets more difficult the longer bullish conditions extend themselves. In the last week week, the market has broken above top-end resistance and appears set to extend the market’s bullish run even more. That’s generally good news for stocks you’re already holding, but it complicates the process when it comes to finding new ones. One of the methods I’ve found useful to find value even under extended bullish conditions is to start looking through sectors or industries that most have been dismissing for one reason or another.

The Auto industry has been experiencing quite a bit of bearish pressure for most of the past few years. Even before COVID-19 became a global health and economic crisis, sales were down globally, reflecting economic slowing in various parts of the world as well as the effects of an extended trade war between the U.S. and China that held investor’s attention through most of 2018 and all of 2019. Just as that headwind seemed ready to fade away with a trade deal at the end of 2019, the global economy ground to a halt amid massive quarantine and shelter-in-place orders that closed down businesses and sent consumers home to limit the spread of coronavirus. Until just the last few months of this year, the industry continued to struggle as sales remained tepid, even though stocks in the industry have generally performed well. The exception to those unimpressive sales results come from the emerging electric vehicle segment, which has been getting more and more market buzz throughout the past year and a half.

BorgWarner Inc. (BWA) is an example of a U.S. company that provides parts and services to major auto manufacturers, and that until last year I wouldn’t have considered as having a significant role in the electric vehicle segment. At the beginning of 2020, however, the company announced it had entered into an agreement to acquire Delphi Technologies. The deal closed in October of last year, giving the company exposure and opportunity in hybrid and electronic vehicles, which I think puts the company at an interesting intersection of future growth with established presence and strength. In fact, BWA’s most recent reports indicate that this new segment has provided the biggest lift to the company’s sales and earnings over the past year. BWA agreed to pay $3.3 billion for the deal, which some analysts criticized as “paying too much” at the time; but the company’s ability to pay down debt from that deal, along with the major contributions this segment is now providing to the bottom line really confirm it was simply the price they had to pay to gain entry into the next important source of industry growth.

Even before that deal was announced, the stock began a strong downward trend in November of 2019, dropping from a peak at around $47 to a March 2020, bear market low at around $17 per share. The Delphi deal notwithstanding, another remarkable thing about BWA is that while the pandemic absolutely had an impact on the company, its earnings reports throughout the pandemic show that the company actually managed to absorb the initial blow better than most of its industry brethren. The stock has rallied from its March 2020, $17 low to a a recent peak at around $42 in September of 2020, then dropped back to about $34 in November. From that point, the stock has extended its impressive upward trend even more, hitting its latest peak in June at around $55.50. From that point, the stock has dropped back into a downward trend that has shaved more than -21.5% from the stock’s June high. It looks like it could be finding useful support to begin reversing that trend, which could be a positive, bullish indication in the near-term; but what about the value proposition? Let’s dig in.

Fundamental and Value Profile

BorgWarner Inc. is engaged in providing technology solutions for combustion, hybrid and electric vehicles. The Company’s segments include Engine and Drivetrain. The Engine segment’s products include turbochargers, timing devices and chains, emissions systems and thermal systems. The Engine segment develops and manufactures products for gasoline and diesel engines, and alternative powertrains. The Drivetrain segment’s products include transmission components and systems, all-wheel drive (AWD) torque transfer systems and rotating electrical devices. The Company’s products are manufactured and sold across the world, primarily to original equipment manufacturers (OEMs) of light vehicles (passenger cars, sport-utility vehicles (SUVs), vans and light trucks). The Company’s products are also sold to other OEMs of commercial vehicles (medium-duty trucks, heavy-duty trucks and buses) and off-highway vehicles (agricultural and construction machinery and marine applications. BWA has a current market cap of about $10.4 billion.

Earnings and Sales Growth: Over the last twelve months, earnings grew more than 871% (not a typo), while revenues improved more than 163.5% (again, not a typo). In the last quarter, earnings declined by about -10.75% while sales were about -6.26% lower. The company’s margin profile is generally narrow, but is strengthening; over the last twelve months Net Income as a percentage of Revenues was 5.49%, and eroded to 6.57% in the last quarter.

Free Cash Flow: BWA’s free cash flow is healthy and growing, at $845 million over the last year. That marks an improvement from $573 million a year ago. The current number translates to a Free Cash Flow Yield of 8.1%.

Debt to Equity: BWA has a debt/equity ratio of .62. This is a very manageable number that suggests the company should have no trouble servicing their debt. Their balance sheet shows $1.56 billion in cash and liquid assets against about $4.3 billion in long-term debt. The long-term number is made up mostly of debt assumed at the beginning of 2020 ahead of finalization of its Delphi acquisition.

Dividend: BWA’s annual divided is $.68 per share and translates to a yield of 1.56% at the stock’s current price. It is also noteworthy that BWA has maintained its dividend, where other companies in the industry that previously paid useful dividends have cut or suspended their dividend payouts to help weather the pandemic.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target around $54 per share. That means that BWA is nicely undervalued by 24%. It is also worth noting that at the end of 2020, my price target for this stock was around $42.

Technical Profile

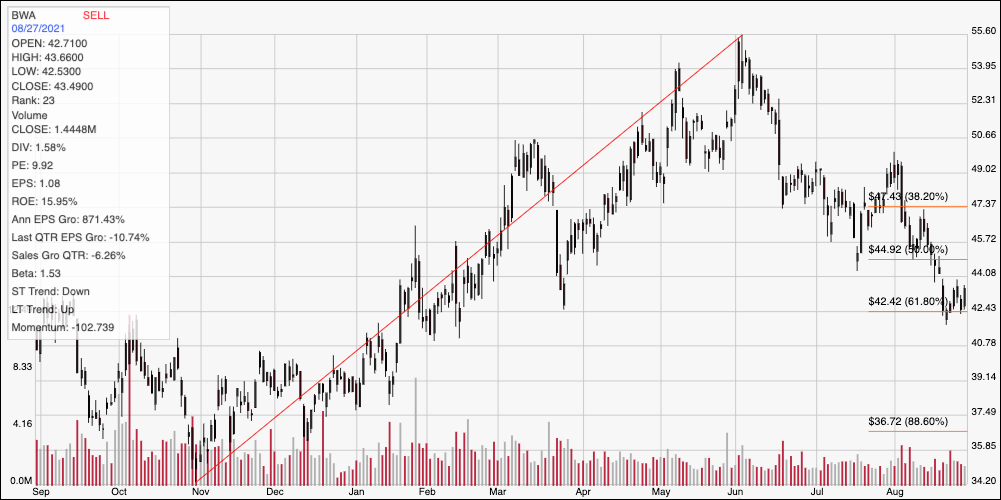

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The red diagonal line measures the length of the stock’s upward trend over the past year, and also informs the Fibonacci trend retracement lines shown on the right side of the chart. The stock’s downward trend gained strength at the beginning of August, after showing signs of stabilization in late June and July. BWA is now holding around current support at around $42.50, which is also inline with the 61.8% retracement line. Immediate resistance is at around $45 where the 50% retracement line waits. A drop below current support could see additional downside to about $40 based on pivot activity in late 2020, while a push above $45 should see bullish upside to about $49, where the stock’s early August peak occurred.

Near-term Keys: BWA’s strengthening fundamental profile includes a number of elements – improving Free Cash Flow and Net Income, for example – that I think help to confirm the stock’s attractive value proposition. If you prefer to work with short-term strategies, you could us a push above $45 as a signal to buy the stock or work with call options, looking for a peak at around $49 as a useful profit target on a bullish trade. A drop below $42.40 would be a useful sign to think about shorting the stock or buying put options, with $40 providing a good target to close a bearish trade.