Since mid-June, the broad market has pushed above a consolidation range that lasted the better part of two months and has spent the summer extending its upward trend. This week some of that momentum has waned just a bit, but at the same time the S&P 500 Index has continued to establish new, all-time highs that seem to indicate there could be even more to come as we begin to move into the end of 2021.

While I want to be hopeful, I think there is more than enough remaining risk – recent comments from members of the Federal Reserve Board seem to indicate that inflation could be rising enough to see the central bank begin making gradual adjustments – including the possibility of raising rates – in an effort to continue to hold center. That is always a delicate, difficult prospect, given the volume of variables to consider – to say nothing of the possibility of unpredictable events – think COVID-19 – that can derail the best-laid plans in a heartbeat. That’s why I tend to hold fast to the belief that a cautious, conservative approach continues to be practical, with defensively-positioned stocks playing a role even under the best circumstances. It’s also why I continue to believe that the smart way to keep your money working for you is to be very selective about looking for growth opportunities and to focus on stocks that continue to offer good value.

One area that has remained resilient throughout the past year and a half is the Food Products industry. For most of this year, stocks in this industry haven’t just kept pace with the market, but in many cases outperformed the sexier, growth-driven industries and names; as measured by the S&P 500 Consumer Staples SPDR (XLP), the sector that these stocks reside in has moved nearly 20% higher since November of 2020. Diving into the fundamentals of many of these companies show balance sheets that continue to weather the pandemic storm better than most other industries in 2020, and in a number of cases have managed to improve even more in 2021. That increasing fundamental strength has been a big driver in stock price performance, but even with significant moves higher, the fundamental strength has also grown enough to keep the value proposition attractive.

Tyson Foods Inc. (TSN), is a stock I’ve followed for some time. 2020 wasn’t good for the stock; from a January peak at around $94, the stock began a downward slide that only accelerated in March as the entire stock market moved into bear market territory. TSN did find a bottom at around $44 with the rest of the market, and then managed to recover to an August 2020 peak at around $65 per share. After fading back to about $55 in early November, the stock started picking up bullish strength, moving into a new, intermediate upward trend that peaked in May a little above $80 before dropping back to support at around $70 at the end of July. The stock picked up a lot of momentum in early August, pushing to a new 52-week high at $82.50 by mid-month. It has slid back by about $4 from that point and looks to be finding a new support level that many technical traders like to think of as an opportunity to “buy the dip.”

The company has invested heavily over the past year and a half to address safety concerns, and that is something that in the early stage of the health crisis acted as a drag on the bottom line; but the company’s most recent earnings reports suggest not only that it continues to navigate those short-term, coronavirus-driven headwinds, but that it has benefited from increases in protein demand in the U.S. and overseas. An epidemic of African Swine Flu in 2018 ravaged the domestic hog population in China, the world’s largest pork producer and exporter, leaving a long-term protein shortage that is expected to continue for years to come, and puts U.S. protein producers like TSN in a position to benefit. Those strengths mean that the stock’s recent drop in price make the stock’s value proposition look even better than it did just about a month ago.

Fundamental and Value Profile

Tyson Foods, Inc. is a food company, which is engaged in offering chicken, beef and pork, as well as prepared foods. The Company offers food products under Tyson, Jimmy Dean, Hillshire Farm, Sara Lee, Ball Park, Wright, Aidells and State Fair brands. The Company operates through four segments: Chicken, Beef, Pork and Prepared Foods. It operates a vertically integrated chicken production process, which consists of breeding stock, contract growers, feed production, processing, further-processing, marketing and transportation of chicken and related allied products, including animal and pet food ingredients. Through its subsidiary, Cobb-Vantress, Inc. (Cobb), the Company is engaged in supplying poultry breeding stock across the world. It produces a range of fresh, frozen and refrigerated food products. Its products are marketed and sold by its sales staff to grocery retailers, grocery wholesalers, meat distributors, warehouse club stores and military commissaries, among others. TSN has a current market cap of $28.6 billion.

Earnings and Sales Growth: Over the last twelve months, earnings increased almost 93%, while sales increased 24.5%. In the last quarter, earnings were 101.5% higher while sales grew about 10.4%. TSN operates with a modest, but strengthening margin profile; in the last twelve months, Net Income was 5.13% of Revenues, but increased to 6% in the last quarter.

Free Cash Flow: TSN’s Free Cash Flow is healthy, at a little more than $2.6 billion. That number has increased from about $1.6 billion at the beginning of 2020, but dipped from about $3.2 billion two quarters ago. Its current level translates to a useful Free Cash Flow yield of 9.34%.

Debt to Equity: TSN has a debt/equity ratio of .53, which is conservative. Cash and liquid assets were about $437 million at the end of 2019 and increased to $2.4 billion at the end of 2020, dropped to $877 million two quarters ago and rose in the last quarter to $1.6 billion. TSN carries about $8.7 billion in long-term debt. The company’s operating profile indicates there should be no problem servicing debt, with the company demonstrating the ability to navigate cyclical and economic challenges successfully from quarter to quarter as they come.

Dividend: TSN increased its annual dividend from $1.68 per share to $1.78 per share in 2020, which at its current price translates to a dividend yield of 2.27%. TSN’s dividend has also increased from $1.20 per share in late 2018, and $1.52 at the end of 2019. The fact that management not only maintained the higher dividend, but increased it during the pandemic despite the early challenges it had to deal with in adjusting to pandemic-driven operating conditions is noteworthy since so many other companies have been reducing or suspending their dividends.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target around $91 per share. That means that even with the stock’s sizable increase this year, it still offers an interesting bargain proposition, with 16% upside from its current price.

Technical Profile

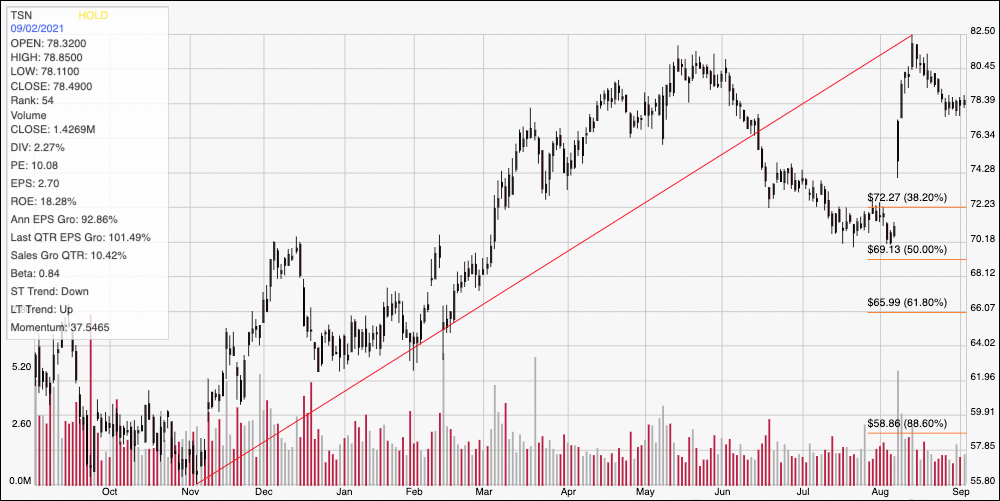

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The diagonal red line outlines the stock’s upward trend from July of last year beginning at around $55 and tracing to its August high at around $82.50. It also provides the baseline for the Fibonacci retracement lines shown on the right side of the chart. The stock has dropped back to find new, current support at around the $78 level, and for most of the past week has stabilized in that range. Immediate resistance is at $80. A push above $80 should see the stock test its 52-week high at $82.50, with room to push to about $85 if bullish momentum increases. A drop below $78 should find next support in the $76 price around based on pivot activity in that range at multiple points earlier this year; additional support levels beyond that should be seen sit at $74 and $72, respectively, with the 38.2% also sitting in wait in the $72 price area.

Near-term Keys: TSN’s value proposition has remained attractive for the last few months, with improving fundamentals that I think make it hard to ignore as a good long-term investment. I also think that global conditions, not merely related to coronavirus, but also to protein shortages around the world from African Swine Flu will generally continue to work in TSN’s favor. If you prefer to work with short-term term trading strategies, you could also use a push above $80 as a signal to buy the stock or work with call options, with a useful profit target between $82.50 and $85 if bullish momentum accelerates. A drop below $78 could offer a signal to consider shorting the stock or buying put options, using $76 as a first, quick-hit profit target on a bearish trade.