Over the last couple of weeks, the market has dropped off of its latest high, and really started picking up bearish momentum at the end of last week as investors turned their attention to the Fed’s monthly governor’s meeting and whether signs of increasing economic activity would mean that interest rates might finally start going up. Along with other increasing fears – COVID infections are back up to January levels, and hospitals are once again strained by resulting hospitalizations, unemployment has started to tick back higher, and supply chain constraints continue to plague a variety of industries – it isn’t too surprising to see investors starting to look at this month as a critical point for the market.

September is a month that historically tends to be a bit shaky; some like to explain it as the month that Wall Street traders have come back to work after taking the summer off, but I think it makes just as much sense to point to the last quarter of the year and the typical attempt to look ahead and try to predict how the end of the year is, or isn’t going to work out as a catalyst for increasing uncertainty. All of it together is just one more reason that I think it is smart to keep an idea for what you might want to do to identify constructive ways to add defensively positioned investments to your portfolio.

Defensive industries in the stock market tend to be those that have historically proven to be less susceptible to ebb and flow of economic cycle. I like to work with the Food Products industry, but even those kinds of stocks can be pretty volatile from time to time. Another industry that just about any expert will describe as defensive is the Utilities industry. That makes sense, because we all need to keep the lights on, and the heat and air conditioning working. That gives the stocks in this industry a decidedly less sensitive profile to economic highs and lows, with most of the companies in the industry also paying useful dividends.

The AES Corp. (AES) is one of the world’s largest independent power producers, with operations across the globe. The company’s fundamental profile highlights some useful strengths, such as its dividend payout, improving Free Cash Flow, and a niche in renewable electricity that is on the right side of the Biden administration’s agenda to pus the United States away from its dependence on fossil fuels. It is also a stock that dropped off of a peak at around $29 earlier this year and has settled over the past two months into a consolidation range between $25 and $24. The stock’s historical price activity isn’t exactly exciting, but if you’re looking for a way to minimize your exposure to the broad market’s overall volatility, this is an example of the kind of stock that could work for you. If you also prefer to focus on value as I do, however, the picture becomes a little less clear. Let’s take a look.

Fundamental and Value Profile

The AES Corporation is a holding company. The Company, through its subsidiaries, operates a diversified portfolio of electricity generation and distribution businesses. The Company is organized into four market-oriented strategic business units (SBUs): US and Utilities (United States, Puerto Rico and El Salvador); South America (Chile, Colombia, Argentina and Brazil); MCAC (Mexico, Central America and the Caribbean), and Eurasia (Europe and Asia). It has two lines of business: generation and utilities. The generation business owns and/or operates power plants to generate and sell power to customers, such as utilities, industrial users, and other intermediaries. The Company’s utilities business owns and/or operates utilities to generate or purchase, distribute, transmit and sell electricity to customers in the residential, commercial, industrial and governmental sectors within a defined service area. AES’ current market cap is $15.8 billion.

Earnings and Sales Growth: Over the last twelve months, earnings increased 24% while revenue grew by almost 22%. In the last quarter, earnings rose by 10.7%, while revenues increased almost 2.5%. AES operates, like most Utilities companies, with a historically narrow operating profile; over the last twelve months Net Income was -1.29% of Revenues, but improved to 1.04% in the last quarter.

Free Cash Flow: AES’ free cash flow for the last twelve months is $1.01 billion. This number translates to a Free Cash Flow Yield of 6.34% and marks an increase from a year ago at $620 million.

Debt to Equity: BKE has a debt/equity ratio of 4.29, a high number that shows the company carries a large amount of long-term debt. This isn’t particularly uncommon for the industry, so it isn’t automatically a bad thing, but it does make the balance sheet an important element to pay attention to – since their operating profile gives them very little room for error. Their balance sheet also shows $1.9 million in cash and liquid assets – a decrease from $2.4 billion in the quarter prior against $18.6 billion in long-term debt.

Dividend: BKE pays an annual dividend of $.60 per share, and which translates to a yield of 2.54% at the stock’s current price.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target around $21.75 per share. That means that AES is overvalued, with -8% downside from that fair value price, and a useful discount price at around $17.50 per share.

Technical Profile

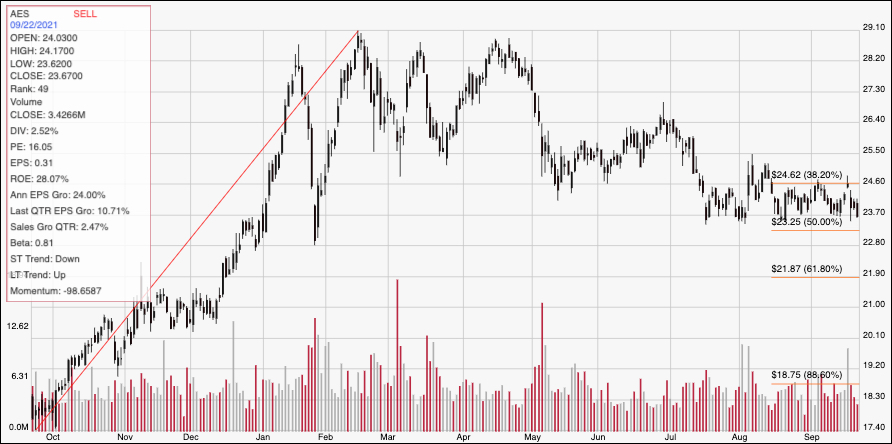

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The chart above displays AES’ price action over the past year. The diagonal red line traces the stock’s upward trend from a low point in October 2021 at around $17.50 to its February high at around $29 per share; it also provides the reference for calculating the Fibonacci retracement levels indicated by the horizontal red lines on the right side of the chart. The stock found a downward trend low point at around $24 in late July, and has settled since then into a narrow trading range, with $24 acting as consistent, current support and $25 (inline with the 38.2% retracement line) providing immediate resistance. A push above $25 could see the stock rally to about $26.50 before finding next resistance, while a drop below $23 (where the 50% retracement line sits) could see downside to about $21 based on pivot activity in November and December of last year.

Near-term Keys: AES is an interesting stock in the Utilities industry; its current consolidation range, along with its core fundamental strength, could make it a useful, defensive part of a diversified portfolio. There isn’t a practical way to describe the stock as a useful value, however, so if you aren’t willing to work with the stock on a long-term basis, the best probabilities lie in short-term trades. A break above $25 could have some useful upside to about $26.50 if you want to buy the stock or work with call options, while a drop below $23 could be a good signal to consider shorting the stock or buying put options, with $21 offering a good profit target on a bearish trade.