There are tens of thousands of publicly traded stocks on U.S. exchanges, from small, micro-cap stocks that most people wouldn’t recognize by name to many of the largest, most established, multinational companies in the world. With so many stocks to choose from, one of the biggest challenges for the average investor is how to sift through them all to find the opportunities that best fit their investing needs, goals, and style.

One of the central pieces of my personal investing system is to filter through the mass using dividends. While dividends – or the lack of them – doesn’t automatically mean a stock is fundamentally strong or weak, it is a good starting point for doing a more detailed analysis, if for no other reason than the simple fact that the majority of publicly traded stocks don’t pay any dividend at all.

During the pandemic, the list of companies that paid a regular dividend got quite a bit smaller, as more and more companies eliminated their dividend payouts in order to preserve cash and bolster their balance sheets for an increasingly unpredictable future. Some of those companies have resumed dividend payouts, which is an encouraging, if somewhat overlooked sign of economic recovery. Another sign comes when companies that haven’t previously paid a dividend announce a new, quarterly dividend payout program. Micron Technology (MU) did just that after their most recent earnings announcement, instituting a first-ever dividend distribution with a record date of today, with their CFO also explaining that while the dividend will start at modest levels, it will increase on a gradual pace over time.

Dividend-paying stocks in the Technology sector aren’t entirely uncommon – some of the biggest Tech names have paid dividends for years – but the percentage of companies that do is even smaller for the sector than for the broad market. I also find it interesting that MU is instituting their dividend payout even as the sector struggles with supply chain challenges – especially in the Semiconductor industry, where chip shortages are creating supply chain issues that are impacting numerous other sectors in the economy. Does MU’s entry into the dividend payout world mean that long-term, value-oriented investors should think about using the stock as a new, useful opportunity?

Fundamental and Value Profile

Micron Technology, Inc. (MU) is engaged in semiconductor systems. The Company’s portfolio of memory technologies, including dynamic random-access memory (DRAM), negative-AND (NAND) Flash and NOR Flash are the basis for solid-state drives, modules, multi-chip packages and other system solutions. Its business segments include Compute and Networking Business Unit (CNBU), which includes memory products sold into compute, networking, graphics and cloud server markets; Mobile Business Unit (MBU), which includes memory products sold into smartphone, tablet and other mobile-device markets; Storage Business Unit (SBU), which includes memory products sold into enterprise, client, cloud and removable storage markets, and SBU also includes products sold to Intel through its Intel/Micron Flash Technology (IMFT) joint venture, and Embedded Business Unit (EBU), which includes memory products sold into automotive, industrial, connected home and consumer electronics markets. MU’s current market cap is $80.8 billion.

Earnings and Sales Growth: Over the last twelve months, earnings increased by 141.33%, while revenues increased by nearly 36.5%. In the last quarter, earnings were 101.11% higher, while sales increased a little more than 19%. The company’s operating profile is impressive, with signs that it is getting even stronger; over the last twelve months, Net Income was 14.9% of Revenues, and increased to nearly 33% in the last quarter.

Free Cash Flow: MU’s free cash flow dropped into negative territory earlier this year as the company grappled with the chip shortage and supply issues described earlier. The increase in Net Income in the last quarter appears to be a good indicator that the company may have worked through the most difficult parts of those issues, however, and their Free Cash Flow also appears to reflect this possibility. Over the last twelve months, Free Cash Flow was $560 million versus -$682 million in the last quarter and -$756 million in the quarter prior.

Debt to Equity: MU has a debt/equity ratio of .15. This number reflects the company’s manageable debt levels. The company’s balance sheet indicates cash and liquid assets are a little over $8.6 billion (an increase over about $7 billion two quarters ago, and $5 billion at the end of 2018) versus debt of about $6.6 billion.

Dividend: MU’s newly announced dividend is $.40 per share, per year, and which translates to a minimal yield of 0.56% at the stock’s current price.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target around $68 per share. That suggests that MU is somewhat overvalued, by -5%, with a useful discount price at around $54.

Technical Profile

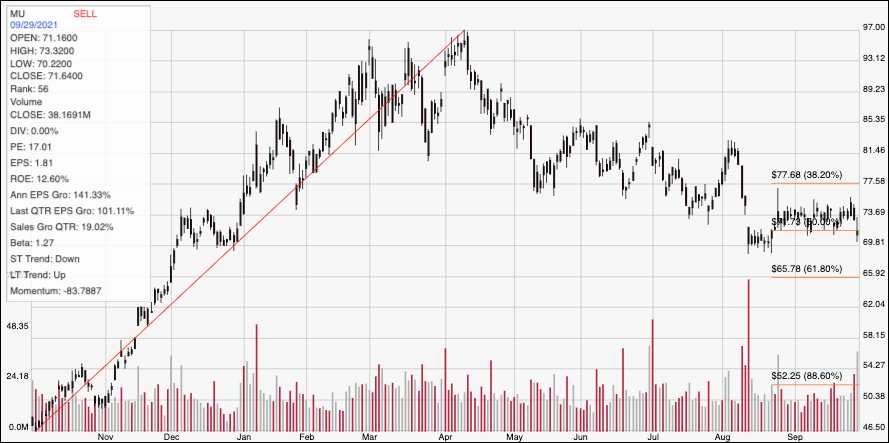

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The red diagonal line measures the length of the stock’s upward trend from October of last year to its peak in April at around $97 per share. It also informs the Fibonacci trend retracement lines shown on the right side of the chart. The stock has slid into a clear downward trend from that high that looks like it finally reached bottom in August at around $70. This month, the stock has settled into a tight consolidation range with current support around $71 (roughly inline with the 50% retracement line), and immediate resistance at around $74. A push above $74 should find next resistance at the 38.2% retracement line around $77.50 per share, while a drop below support at $71 could fall to the 61.8% retracement line around $66 before finding next support.

Near-term Keys: MU’s addition to the dividend-paying fraternity is a good piece of news for investors like me who like to focus on dividends to filter through market noise; unfortunately, however the stock doesn’t offer a practical value at its current price. That means that the best probabilities right now lie in short-term trading strategies. Use a push above immediate resistance at around $74 to think about buying the stock or working with call options, with an exit target price at around $77.50. A drop below $71 would be a strong signal to consider shorting the stock or working with put options, using $66 as a practical exit target on a bearish trade.