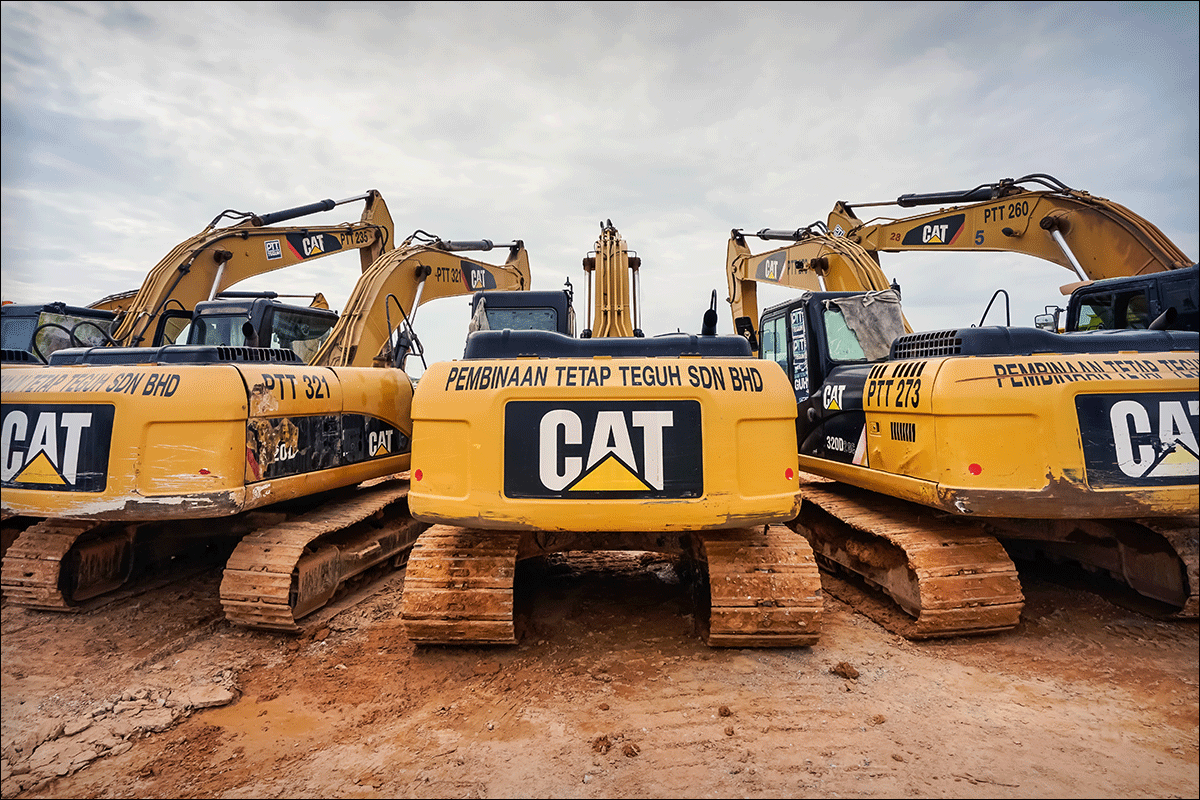

Analysts at JPMorgan reiterated an overweight rating on Caterpillar (CAT) – Get Caterpillar Inc. Report Friday, calling the industrial group’s stock their “top pick into 2022.”

Shares of the Deerfield, Il., company ended off 59 cents, or 0.3%, at $195.16.

“We believe Caterpillar’s earning power and free cash flow conversion over this upcoming cycle, supported by solid global GDP growth, continue to merit our Overweight rating,” JPMorgan analysts Anne Duignan, Thomas Simonitsch and Sean P McMullen wrote to investors.

Duignan added that, “The company has been able to cut fixed costs by restructuring its resource business, which should provide earnings upside as volumes recover in what we expect to be a multi-year upcycle in mining (despite near term headwinds). Additionally, we view Caterpillar as the biggest winner of an extended US construction cycle.”

TheStreet Recommends

The analysts also made overall remarks about the sector and said that demand for machine, engineering and construction sector, “remains strong and pricing power is broadly positive.” But they warned of choppy recovery due to supply constraints.

“We continue to be cautious around the magnitude of a 2022 recovery and remain mostly below consensus earnings estimates,” she said.

JPMorgan analysts said a slower-than-expected global macro recovery could result in “lower demand for Caterpillar’s products, especially in mining.”

“Lower spending by oil/gas customers may weigh on demand for drilling, well completion, and infrastructure equipment going forward,” the analysts cautioned.

JPMorgan has a price target of $248 a share on Caterpillar.