Having a contrarian temperament generally means doing the opposite of what most people would do. It’s a mindset that I’ve found very useful as an investor, because while most people tend to flock to stocks that are at or near all-time highs, I’m able to find excellent long-term opportunities at much lower, bargain-level prices. It’s a bit like combing through the clearance rack at a department store and finding a high-quality, name-brand piece of clothing for a fraction of its normal cost – you almost feel like you’re getting away with something everybody else is either too ignorant, or at least too impatient to take notice of.

The caveat to bargain hunting in the stock market is that in many cases efficient market theory holds – which is to say that sometimes a stock is cheap because it’s just a cheap stock, and deserves to be. History shows that in the long term, the market is very good at pricing the fundamental strength or weakness of a company into its stock price. Thus, efficient market theory holds that the current price a stock is at is a fair reflection of the market’s perception of the company’s current health – or at least of the market’s expectation of strength or weakness. That’s why for a value-focused investor, simply seeing a stock at or near extreme lows isn’t actually enough to justify a long-term investment. A more detailed look at the underlying business, and how that translates into a dollar value representing how much the business is worth, is also required.

I spend a lot of time combing through stocks in every sector of the market, and every industry of those sectors to try to find opportunities for terrific value. The truth is that, no matter what current market conditions are, there are always stocks that can be found trading at levels below their actual business value. Identifying that “intrinsic value” of a business is a bit of a trick, but I’ve learned to rely on a stock’s Book Value as a primary measurement, with a comparison of the stock’s current price not only to its current Book Value, but also to historical levels to provide a market-driven context to frame the current picture against. Along with a careful look through a company’s fundamentals, I think I’ve developed an effective method for identifying stock’s that aren’t just cheap, but also represent very good long-term value.

Sometimes, broad market conditions work against a company’s fundamentals in ways it can’t entirely control. Some sectors and industries are more susceptible to this kind of risk, which means that their stock prices tend to be more volatile. That generally means that while investing in these kinds of stocks can be very profitable over time, you also have to be willing to ride out periods of high, or even extreme volatility. The energy sector, and stocks in the exploration and production arena in particular is a good example of the volatility that can play a big role in stock prices. 2020 was a tough year for the entire Energy sector, first by a brief, but furious trade war between Saudi Arabia and Russia price war that drove crude prices across the globe as much as -50% lower. Just as most of that pressure was fading, COVID-19 became a global pandemic, collapsing demand for gasoline and crude for most of the year. This year has seen some of that demand come back, but more recently momentum in energy prices is coming from restrictions on a capacity – driven by supply chain issues like labor shortages that are limiting the sector’s ability to meet recovering demand. That has pushed the price of both West Texas Intermediate and Brent crude above the $80 mark – a level that hasn’t been seen since the middle part of the last decade.

Because of pandemic-driven restrictions and pressures, even the strongest, most established companies have absorbed significant hits to their operating margins and balance sheets. Marathon Oil Corporation (MRO) is one of the biggest U.S. companies in the exploration and production space, but the market conditions I just outlined over the year and a half shaved more than -50% of its market cap by November of last year, representing a total loss for shareholders of more than $5 billion in value. The stock has recovered from a low price below $4 per share around that time, and more specifically in the last three or four weeks has really accelerated, pushing above a high-water mark at around $14 to its current price above $16. Does the stock’s price recovery mean that the worst is over, and this is a good time to buy the stock? What about its bargain proposition – has the stock already increased past the point of useful value? Let’s dive in to find out.

Fundamental and Value Profile

Marathon Oil Corporation is an exploration and production (E&P) company. The Company operates through two segments: United States E&P and International E&P. The United States E&P segment explores for, produces and markets crude oil and condensate, natural gas liquids (NGLs) and natural gas in the United States. The International E&P segment explores for, produces and markets crude oil and condensate, NGLs and natural gas outside of the United States, and produces and markets products manufactured from natural gas, such as liquefied natural gas (LNG) and methanol, in Equatorial Guinea (E.G.). MRO’s current market cap is about $12.7 billion.

Earnings and Sales Growth: Over the last twelve months, earnings increased by nearly 136.7%, while sales grew by more than 320%. In the last quarter, earnings improved by a little over 4.75%, while revenues increased by about 6.72%. MRO operates with a narrow margin profile that, not surprisingly has been negative for the past year, but is showing useful signs of improvement; Net Income versus Revenues over the past year was -13.5%, but strengthened in the last quarter to 1.28%. The drop to negative Net Income over the past year is significant, but it is also noteworthy that many larger companies in the energy sector saw far more severely negative numbers. I also take the turn to positive numbers in the last quarter as a positive sign, but this pattern will need to continue in the quarters ahead.

Free Cash Flow: MRO’s free cash flow over the last twelve month is healthy, and has gotten stronger over the past year, which is surprising, given the net income pattern I just described. Free Cash Flow in the last twelve months was $1.17 billion, versus $496 in the quarter prior and just $76 million a year ago. The current number also translates to a Free Cash Flow Yield of 9.21%.

Debt to Equity: MRO has a debt/equity ratio of .46. This is a conservative number that speaks to management’s ability to use debt more effectively than a lot of competitors in the industry. In the last quarter, MRO’s balance sheet reported more than $970 million in cash and liquid assets with about $4.875 billion in long-term debt. Even with the challenges the pandemic has presented, the company’s measures to limit costs throughout, including scaling back cap ex spending, temporarily suspending their dividend, and limiting production in certain shale areas in the U.S. strongly suggest the company should have no trouble servicing their debt.

Dividend: MRO temporarily suspended their dividend in 2020 to preserve cash, but reinstated it in the last quarter of the year at an annualized rate of $.20 per share. At the stock’s current price, that translate to a dividend yield of 1.24%.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target around $17.03 per share. That suggests that MRO is undervalued by about 5% from its current price, with a useful bargain price at around $13.62. It is also worth noting that in mid-2020, this same analysis offered a fair value target at around $9.

Technical Profile

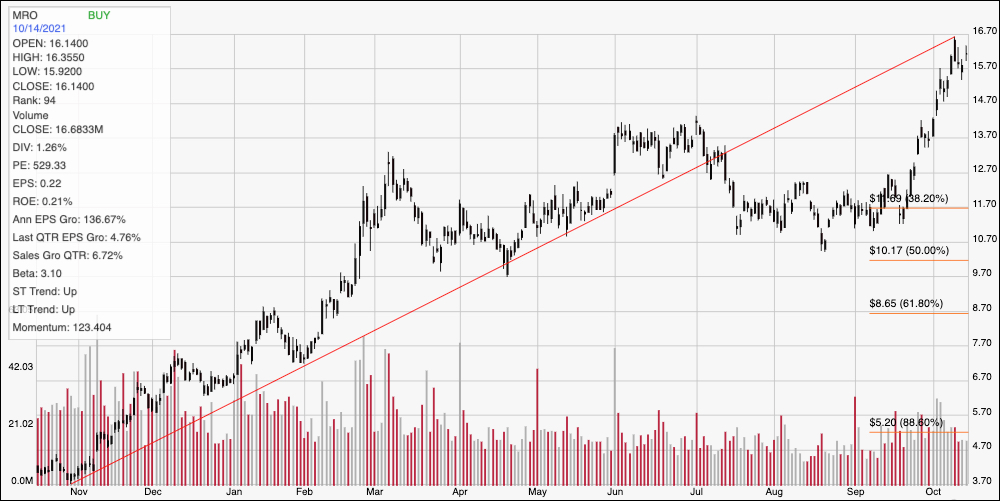

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The diagonal red line traces the stock’s upward trend over the past year; it also informs the Fibonacci retracement lines shown on the right side of the chart. The stock had been holding in a consolidation pattern between $11 and $12 through the summer, but picked up a lot of steam in mid-September, breaking out of that range and pushing above previous resistance at around $14 to hit a new high earlier this week at around $16.70 per share. That marks immediate resistance at around $17, with current support back at around $14. A push above $17 should find next resistance at around $19 to $20 – a price level the stock hasn’t seen since early 2019. A drop below $14 has additional downside to around $12 to next support.

Near-term Keys: MRO’s fundamentals have held up relatively well throughout the past year and a half, which is a strong endorsement of management’s ability to weather the health crisis and all of the economic pressures it has inflicted so far on the entire Energy sector. Even so, the stock’s price increase in the last month has pushed the stock only a little blow its long-term, fair value target, which means I can’t really call it a good value at this time. That means the best probabilities lie in short-term trading opportunities; use a push above $17 as a good signal to consider buying the stock or working with call options, with a near-term target price between $19 and $20 to share. If the stock reverses off of current support, and you want to be aggressive, you could also consider shorting the stock or buying put options, with an eye on the stock’s current support at around $14 as a useful, bearish profit target, and $12 possible if selling activity picks up.