It’s a good bet that a forthcoming exchange-traded fund that invests in “B.A.D.” stocks will outperform the U.S. market.

The new ETF, which has yet to be launched and doesn’t have a ticker, will be benchmarked to an index of betting, alcohol and drugs companies. The formal registration papers for the “B.A.D. ETF” were filed with the SEC in late September.

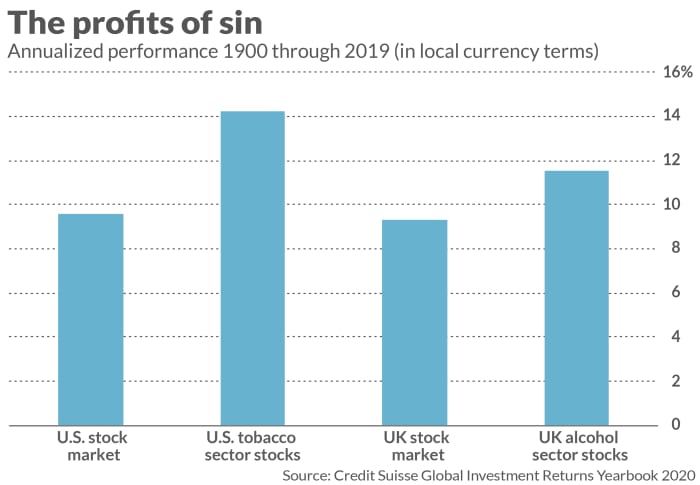

One of several reasons I have for betting that the fund will outperform the S&P 500 is the historical outperformance of so-called sin stocks. Consider the results of a study conducted by Elroy Dimson, a finance professor at Cambridge University, Paul Marsh, a finance professor at the London Business School, and Mike Staunton, director of that institution’s London Share Price Database. The chart below shows what they found for alcohol and tobacco stocks’ performance over the past 120 years.

In the U.S. market, tobacco stocks on average outperformed the overall market by 4.6 annualized percentage points. In the U.K. market, alcohol stocks beat the overall market by 2.2 annualized percentage points. The researchers didn’t have full 120-year data for alcohol stocks in the U.S. or tobacco stocks in the U.K., but the partial-period returns for those two sectors in those countries show market outperformance of similar magnitudes.

Even more dramatic market-beating returns were reported by another study that focused on the 37-year period from 1970 to 2007 across 21 different countries. To average returns across these different countries, the researchers calculated how much each stock outperformed the stock market index of its home country (its alpha). The table below reports the average of these alphas.

| Sector | Average annualized alpha relative to home country stock market |

| Adult Services | 9.96 annualized percentage points |

| Alcohol | 5.57 |

| Gaming | 26.35 |

| Tobacco | 14.71 |

Why sin stocks outperform

There are theoretical reasons to expect sin stocks to beat the market. The standard Finance 101 explanation is that a sin company’s cost of capital will go up if a significant group of investors actively shun it. As Dimson, Marsh, and Staunton put it: “A heightened cost of capital represents an elevated expected return. Choosing to exit ‘sinful’ stocks can cause them to offer higher returns to those less troubled by ethical considerations.”

Cliff Asness, founder of AQR Capital Management, put it more bluntly: “Frankly, it sucks that the virtuous have to accept a lower expected return to do good, and perhaps sucks even more that they have to accept the sinful getting a higher one. Well, embrace the suck as without it there is no effect on the world, no good deed done at all. Perhaps this necessary sacrifice is why it’s called ‘virtue’.”

There may also be a risk-based explanation for sin company stocks’ outperformance. That’s because these companies probably face greater risks than non-sinful companies because of possible regulatory actions or litigation. To the extent that is the case, their stocks’ alphas could represent the compensation investors demand to incur that greater risk.

More research is no doubt needed. In the meantime, note carefully that the alphas documented by past studies are averages across many years and decades. By no means is it the case that sin stocks have beaten the market in each and every year.

Nevertheless, if the future is like the past, such stocks will outperform the broad market over the long term.