As we move into the last few months of the year, the sad and simple truth is that, no matter how much we might want to be able stop including COVID-19 and its impact on every aspect of life in our daily discussions, the health crisis hasn’t gone away, but instead is showing more persistence than any of us would have ever wanted to deal with. There are still a lot of areas of the economy that are seeing impressive signs of growth; but it also means that there remains plenty of risks that have to be considered and factored into the economic picture. For example, unemployment remains high enough – and has even seen higher numbers over the last several weeks – that labor shortages in a number of industries that were forced to lay off or furlough employees in the early stages of the pandemic are exacerbating supply chain problems. Those are increasing costs for a number of goods in a number of industries, including one of the industries I tend to emphasize the most when the economy is uncertain: Food Products.

The Food Products industry is a pocket of the economy that I think makes sense to focus on when market conditions become more uncertain and broad volatility starts to increase. That’s because while the industry itself can hardly be described as disruptive – in fact, I’ve seen analysts throughout the past couple of years dismiss the industry as “boring” – the truth is that demand for food doesn’t go away. Consumer trends during periods of economic expansion and extended bull markets often tend to pull away from the established, “traditional” names and brands we’ve all grown up with, but when unemployment is high, a lot of households gravitate back to those familiar brands. A big reason they have been long-established brands is due to the fact that they offer good value. They may not be disruptive in their industry, or all that exciting, but they do make it easier for parents to keep their pantries stocked and their kids fed.

The earliest phases of the pandemic saw a big shift to some of these stocks, like Campbell Soup Co. (CPB), as families responded to initial shutdown and shelter-in-place orders by stockpiling and building up food storage in their homes. That meant that prepackaged, easy-to-prepare food products that can be stored for extended periods and stay good were immediately more attractive than they had been in some time. More recent earnings reports show that most of the momentum from that early surge has faded and been replaced by pricing pressures from supply chain issues and rising prices – costs that over the past couple of months have finally trickled into consumer prices.

In late 2018, CPB finalized the acquisition of snack food company Snyder’s-Lance, bringing into their brand portfolio some of the products that we can think of as “comfort foods” for social isolation, like Kettle brand potato chips, Goldfish crackers, and Pepperidge Farm cookies. That has helped them broaden their appeal away from just the soup aisle to other areas of your grocery store that is likely to keep them relevant and important. I think it’s also a reason that, while most analysts would still call CPB’s stock “boring,” the price increased from around $40 in July of 2019 to a peak in at the beginning of 2021 at around $54. From that point, the stock has dropped into a downward trend that appeared to have finally found a bottom in September at around $40. After a temporary rally to about $44, the stock has dropped back again, nearing that 52-week low as of this writing. Given the pressures I just mentioned, the question that remains is whether the stock’s decline is driven by poor fundamentals, or is it possible that the stock’s value proposition has only gotten better? Let’s find out.

Fundamental and Value Profile

Campbell Soup Company (CPB) is a food company, which manufactures and markets food products. The Company’s segments include Americas Simple Meals and Beverages; Global Biscuits and Snacks, and Campbell Fresh. The Americas Simple Meals and Beverages segment includes the retail and food service channel businesses. The segment includes the products, such as Campbell’s condensed and ready-to-serve soups; Swanson broth and stocks; Prego pasta sauces; Pace Mexican sauces; Campbell’s gravies, pasta, beans and dinner sauces; Plum food and snacks; V8 juices and beverages, and Campbell’s tomato juice. The Global Biscuits and Snacks segment includes Pepperidge Farm cookies, crackers, bakery and frozen products; Arnott’s biscuits, and Kelsen cookies. The Campbell Fresh segment includes Bolthouse Farms fresh carrots, carrot ingredients, refrigerated beverages and refrigerated salad dressings; Garden Fresh Gourmet salsa, hummus, dips and tortilla chips, and the United States refrigerated soup business. CPB’s current market cap is $12.3 billion.

Earnings and Sales Growth: Over the last twelve months, earnings declined -12.7%, while revenues dropped -11.15%. In the last quarter, earnings were -3.5% lower, while sales slid about -5.6% lower. Both declines can be attributed to inflationary conditions that have arisen in the company’s supply chain, as companies throughout the industry have been hampered by labor shortages (started by pandemic-driven restrictions on capacity). As demand increases, companies in this industry are finding it difficult adding personnel to keep up, which limits productivity and further restricts supply. CPB’s operating profile is healthy, and counters the challenges I just described, suggesting that while the company isn’t immune to supply chain headwinds, it is aggressively managing its costs. In the last twelve months, Net Income was 11.82% of Revenues, and increased to 15.38% in the last quarter. Most analysts are predicting the company’s cost-saving measures will show even more positive impact in the quarters ahead.

Free Cash Flow: CPB’s free cash flow is $760 million over the last twelve months. This is a big decline from the last quarter of 2020, when Free Cash Flow was about $1.1 billion, and from about $875 million in the quarter prior. The current number translates to a Free Cash Flow yield of 6.14%.

Debt to Equity: CPB has a debt/equity ratio of 1.59. which indicates the company is highly leveraged. This isn’t especially unusual for the industry, and most of the company’s debt load is attributable to the 2018 Snyder’s-Lance acquisition. Cash and liquid assets were $69 million versus $859 million six months ago. Long-term debt is around $5 billion – a number that has dropped significantly since the Snyder’s-Lance deal closed and long-term debt stood at around $8 billion.

Dividend: CPB pays an annual dividend of $1.48 per year, which at its current price translates to an annual yield of about 3.62%. Management also increased the dividend from $1.40 per year at the beginning of 2021, reflecting their confidence in the business in the months and years ahead.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target around $55 per share. That means the stock is significantly undervalued, with about 34% upside from its current price; however, it should also be noted that as recently as a month ago, this same analysis offered a target price at around $60 per share.

Technical Profile

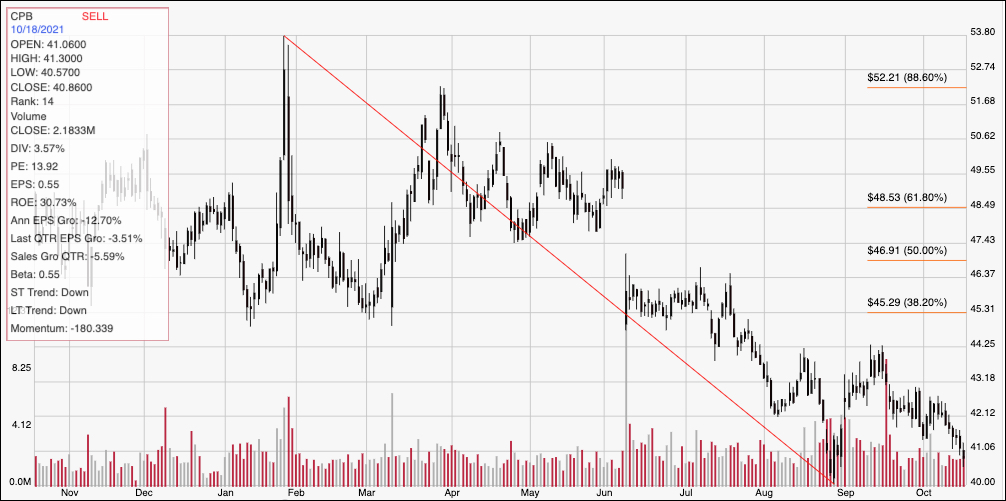

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The red diagonal line traces the stock’s downward trend from a January peak at around $54 to its September low at around $40 per share. After rallying temporarily in the first part of September to a high at around $44, the stock has dropped back and is nearing that 52-week low. Immediate resistance is around $42, with current support expected at $40. A drop below $40 could see the stock fall to between $38 and $37 – levels the stock hasn’t seen since the second quarter of 2019. A push above $42 should find next support at around $44 where the most recent peak a month ago occurred.

Near-term Keys: CPB’s current downward trend has most bullish-minded investors keeping the stock at arm’s length right now, while it has value-oriented investors like me taking notice. The problem is that there are some fundamental concerns that make the value proposition look a bit like a trap. I would prefer to see Free Cash Flow as well as cash and liquid assets increasing, along with continued strength in Net Income to Revenue to justify the stock’s current value proposition. CPB is a stock that is a bit difficult to use for short-term trading strategies like swing or momentum trades; even so, a push above resistance at $42 could offer a bullish opportunity by either buying the stock or working with call options, using $44 as an initial profit target, and with additional upside to about $46 if bullish strength remains healthy. A drop below $40 could act as a signal to consider shorting the stock or working with put options, with $37 to $38 offering a practical bearish target point.