Among the interesting trends I have been watching for most of the last two years, and that have emerged at least in part as a practical response to the global health crisis we continue to struggle with has been a shift in consumer focus towards health, wellness and fitness. Given the constant messaging about personal cleanliness, to encourage vaccinations and so on, it isn’t that surprising to see people focus more on what they can individually do to boost their own immune systems to stay healthy. I also think the fitness aspect of this shift presents interesting opportunities for a value-oriented investor.

For most of us, exercise usually means going to the gym where we can find all of the equipment needed to pick and choose what to do in any given day. Based on my own personal observation in my own little corner of the world, that seems to mean that even as the economy reopens and community gyms are picking up capacity, people are also working out at home, and going outside to run, walk or ride. Some of this shift is being seen in the sales numbers over the last few months for many apparel and shoe manufacturers, and even in sales at retailers, including big-box stores and specialty shops like Foot Locker (FL).

That doesn’t mean that these businesses are out of the woods; foot traffic at most brick-and-mortar stores and malls, which had been challenged by an increasing emphasis on e-commerce and direct-to consumer initiatives, generally remains significantly below pre-pandemic levels, which has put a lot of emphasis on these companies’ ability to rely on omnichannel marketing and distribution systems.

E-commerce has been one of a few different headwinds FL has been dealing with for a few years and has been lagging its competitors and even its suppliers. That includes big names like Nike Inc. (NKE) who are publicly working to drive direct-to-consumer relationships over traditional retail partners. FL’s intense capital investments in omnichannel marketing, sales and delivery have finally started to show positive growth in e-commerce in the past year, while management also put a lot of effort (and investment) into leveraging inventory management systems and supply chain management to increase productivity and efficiency.

While many of FL’s difficulties that pre-date the pandemic – decreasing mall foot traffic, supplier investments in direct-to-consumer marketing channels – continue to present challenges, management’s efforts to develop their own omnichannel marketing programme and improve inventory and supply chain systems have helped FL improve a very solid fundamental profile consistently throughout the past year and a half. The stock itself more than doubled in value over the past year, driving from around $31 in October 2020 to a peak in May at nearly $67. Since then, the stock has faded into a downward trend that has picked up momentum in the last week or so, with the stock now just a little above $50 per share. The increase in selling pressure is something that tends to prompt growth-oriented investors to stay away; but for a fundamentally-focused investor looking for good value, the drop prompts a different kind of question: where is its bargain price compared to where it is now? Let’s find out.

Fundamental and Value Profile

Foot Locker, Inc. is a retailer of shoes and apparel. The Company operates through two segments: Athletic Stores and Direct-to-Customers. The Company is an athletic footwear and apparel retailer, which include businesses, such as include Foot Locker, Kids Foot Locker, Lady Foot Locker, Champs Sports, Footaction, Runners Point, Sidestep and SIX:02. The Direct-to-Customers segment is multi-branded and sells directly to customers through Internet and mobile sites and catalogs. The Direct-to-Customers segment operates the Websites for eastbay.com, final-score.com, eastbayteamsales.com and sp24.com. Additionally, this segment includes the Websites, both desktop and mobile, aligned with the brand names of its store banners (footlocker.com, ladyfootlocker.com, six02.com kidsfootlocker.com, champssports.com, footaction.com, footlocker.ca, footlocker.eu, runnerspoint.com and sidestep-shoes.com). FL has a current market cap of about $5.0 billion.

Earnings and Sales Growth: Over the last twelve months, earnings increased more than 211% (not a typo), while revenues increased by about 9.5%. In the last quarter, earnings were 12.75% higher, while sales grew by 5.67%. The company’s margin profile has been improving throughout the past year, and continues to get stronger; Net Income as a percentage of Revenues over the last twelve months was 11.69%, and 18.9% in the last quarter. While many analysts dismiss FL (primarily due to its reliance on traditional stores and mall traffic) I think the consistent improvement in its Net Income pattern under difficult conditions through most of 2020 and all of this year is strong confirmation that the company’s investments in digital channels and improved internal systems are bearing fruit.

Free Cash Flow: FL’s free cash flow is very healthy, at $701 billion over the last twelve months and which translates to a Free Cash Flow Yield of 13.85%. This number does mark a big decline over the last quarter, from $1.4 billion, and a little lower over the past year, from about $796 million.

Debt to Equity: FL’s debt/equity ratio is .0, which is very low and marks a conservative approach to leverage. The balance sheet shows $10 million in long-term debt in the last quarter, which is significantly below the more than $2.8 billion they reported for the last quarter of 2019. Cash and liquid assets are very healthy, at over $1.845 billion. Their robust balance sheet, with next to no debt is a big indication of strength and marks a very interesting, positive shift under current market and economic conditions.

Dividend: FL’s annual divided was $.60 per share at the end of 2020, but was increased to $.80 per share earlier this year, and $1.20 after their latest earnings report. That translates to a yield of 2.45% at the stock’s current price. It is worth noting that FL cut their dividend at the beginning of the pandemic from $1.52 per share in an effort to help preserve cash and boost their balance sheet; but the fact they continued to pay a dividend where many companies chose to eliminate it altogether, along with the recent increases is also a sign of strength.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to worth with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term target at about $63 per share. That suggests that the stock is undervalued by about 29% right now.

Technical Profile

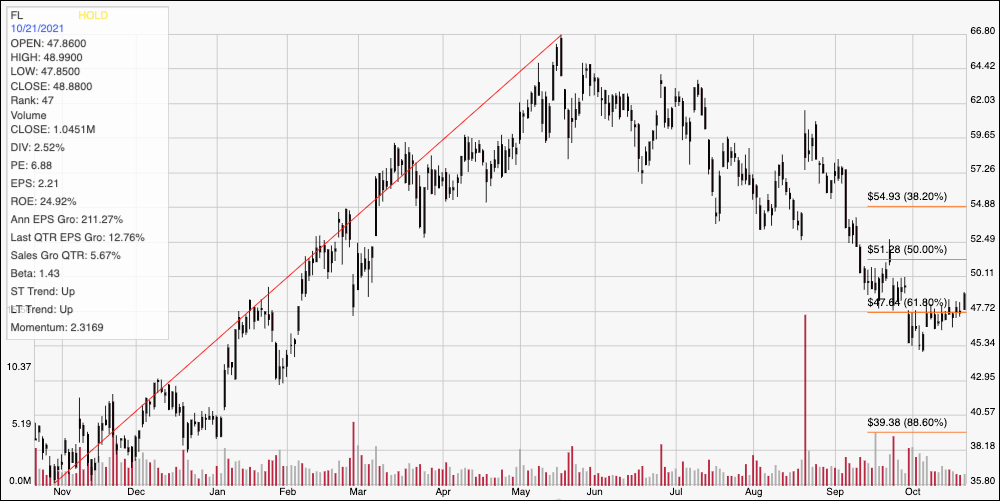

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The chart above displays FL’s price performance over the last year. The diagonal red line traces the stock’s rise from $36 in November of last year to its May peak at around $67; it also serves as the baseline for the Fibonacci retracement lines on the right side of the chart. The stock’s decline from May continues until the beginning of this month, when the stock finally found a bottom at around $45. It has stabilized, and even begun to rally from that point, pushing above the 61.8% retracement line at around $48 this week. That puts current support at $48, and immediate resistance at the 50% retracement line, around $51. A push above $51 should have upside to the 38.2% retracement line, at about $55 per share, while a drop below $48 should find next support at the stock’s recent pivot low around $45.

Near-term Keys: FL’s current bearish momentum appears to have stabilized, and could be reversing right now; that could mean that the timing is just about right for a useful, value-based entry for a good stock with a nice price. If you prefer to focus on short-term trading strategies, The stock’s current break above last resistance at $48 could be a signal to consider buying the stock or working with call options, using immediate resistance at $51 as a good initial profit target, and $55 possible if buying momentum picks up enough to actually reverse the stock’s intermediate-term downward trend. if the stock drops below $48, you could consider shorting the stock or buying put options, with $45 offering a useful, quick-hit profit target on a bearish trade.