The market pushed to a new, all-time high to start finish last week, as the most recent earnings reports seem to have given investors hope that some of the questions about inflation, interest rates, and other issues that have weighed on the market since early September may not carry a long-term impact. Economic indicators suggest that the economy is still healthy even as pressures from the supply chain continue to ripple through to consumer prices. That also means that a lot of stocks that had been pulling back from their own highs are starting to pick up momentum as well. While a new push of bullish momentum is a good thing in the short-term, another extension of the market’s long-term trend also carries with it the built-in, constant question of whether the fundamentals of the companies that make up the different sectors of the economy are also improving enough to justify the increase – or whether the rally has pushed so far as to once again start to increase risk to dangerous levels.

Increasing risk is something that most investors don’t recognize until it’s too late, which turns caution to fear, and possibly even panic; that is why fear tends to drive average investors away from the markets. If you can take a longer-term view, or even take a contrarian perspective of things, however, you can usually find terrific opportunities even as the market keeps pushing to new highs. An example of what I mean is to look at the reality that most businesses that rely on face-to-face interaction continue to be forced to operate in pretty modified terms for safety purposes, even as economic activity increases. That means that recovery on the consumer side of many business operations has been slow going, and that it could take longer than most people want to admit.

The wireless telecommunications industry is an interesting case in point. Shelter-in-place orders, work-at-home arrangements, and the continued need to maintain social distancing measures for the past year have increased just about everybody’s reliance on their mobile devices, which is generally good news for the companies that provide those products and the services that come with them; but it also means that demand for new devices, including upgraded smartphones, tablets, wearables, and so on, has been pretty muted, and is expected to continue to follow that pattern through the rest of the year. That is likely to keep pressure on those companies to manage their operations as efficiently as possible – which could be a challenge, as leverage in this industry was already very high before the pandemic hit, even among the largest and most established companies, like AT&T and Verizon Communications Inc. (VZ). Continued pressure on revenues through the rest of the year is likely to challenge these company’s existing operating models and force liquidity, which was already a red flag for most of the industry, to deteriorate.

That’s the bad news – but I also think that there is quite a bit of good news to consider, as well. Over the last few years, VZ has been one of the biggest investors in acquiring 5G spectrum, and are the first major provider to start rolling out 5G connectivity in their network. The implementation has seen slow, but steady going so far, with only a small portion of its nationwide network having access to 5G towers, and the truth is that 5G-level bandwidth has proven to be spotty so far at best. Even so, this is an area that VZ continues to invest in heavily, and as one of two dominant players in the telecomm industry and building out the infrastructure for 5G service, it should be expected that in the long run, these issues will be resolved. That is why 5G still represents a long-term growth opportunity. Soon or late, consumer trends will shift back in the favor of the tools that enable faster wireless connectivity, and that means that companies that have been at the front of the pack will still be the winners in this game.

VZ’s tock price surged into the latter part of 2020 to a high at around $62, but has fallen back by about -10% from that high over the past year. That performance can be attributed to some of the short-term concerns I just described, but also runs counter to an overall strong fundamental profile that includes a bargain proposition that puts its target price more than 50% above its current price. VZ has borrowed heavily to finance its capital investments, including its 5G buildout, but that is also countered by healthy, stable free cash flow and operating margins that have held up better than expected in the current economic environment and a higher-than-average dividend. Altogether, that makes VZ a stock that i think is worth paying attention to.

Fundamental and Value Profile

Verizon Communications Inc. is a holding company. The Company, through its subsidiaries, provides communications, information and entertainment products and services to consumers, businesses and governmental agencies. Its reportable segments are Verizon Consumer Group and Verizon Business Group. Its Consumer segment provides wireless and wireline communications services. Its wireless services are provided across wireless networks in the United States under the Verizon Wireless brand. Its wireline services are provided in nine states in the Mid-Atlantic and Northeastern United States, over its 100% fiber-optic network under the Fios brand and via traditional copper-based network. Its Business segment provides wireless and wireline communications services and products, video and data services, corporate networking solutions, security and managed network services, local and long-distance voice services and network access to deliver various Internet of Things (IoT) services and products. VZ has a current market cap of about $219.1 billion.

Earnings and Sales Growth: Over the last twelve months, earnings grew by about 13%, while revenues increased by 4.35%. In the last quarter, earnings declined by -2.9%, while revenues improved were -2.5% lower. VZ operates with a healthy operating profile that saw margins strengthen in the last quarter. Over the last twelve months, Net Income was almost 16.42% of Revenues, and grew to 19.47% in the last quarter.

Free Cash Flow: VZ’s free cash flow is very strong, at more than $22.57 billion, and translates to a useful Free Cash Flow Yield of 10.3%. Compared to the last year, Free Cash Flow is a bit lower, From $23.5 billion, but also increased from the quarter prior, at $21.5 billion.

Dividend: VZ’s annual divided is $2.56 per share (increased from $2.46 in the middle of 2020, and $2.51 earlier this year), and which translates to an impressive yield of 4.84% at the stock’s current price. An interesting note I picked up from one economic report recognized the general fundamental strength of the Telecom Services sector, T and VZ in particular, with dividend payout levels well above bond yields, and limited currency or global macroeconomic risks. That supports the notion that this sector could be viewed as an “equity bond” in a continued, low interest rate environment.

Debt/Equity: VZ carries a Debt/Equity ratio of 1.83, which is generally considered a high number that isn’t unusual for stocks in this industry. Their balance sheet shows about $4.6 billion in cash and liquid assets versus more than $143 billion in long-term debt. Their operating profile indicates that servicing their debt, even though it is high, shouldn’t be a problem, even though liquidity remains a concern – cash and liquid assets were more than $22 billion two quarters ago.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target around $80 per share, which suggests that the stock is significantly undervalued right now, with about 51% upside from its current price.

Technical Profile

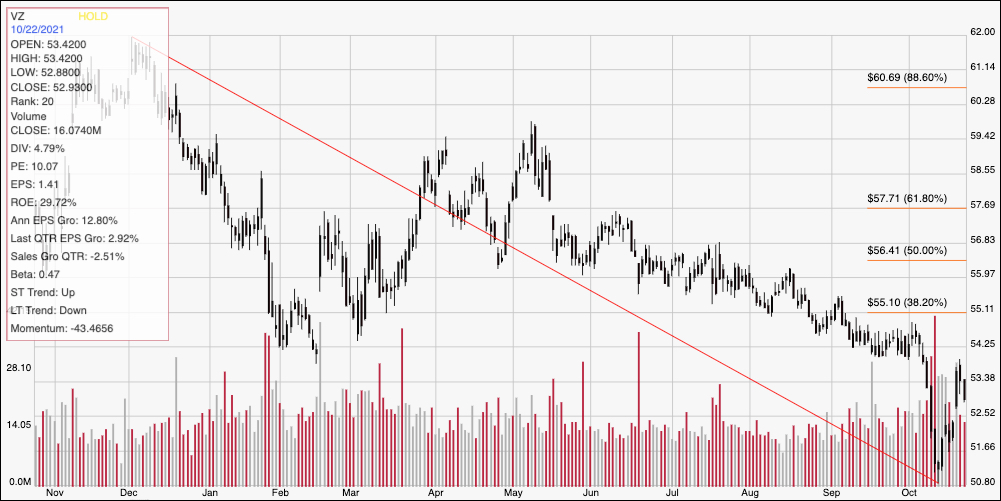

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The red diagonal line measures the length of the stock’s downward trend from its late 2020 high at around $62 to its low at around $51 that occurred earlier this month; it also informs the Fibonacci retracement lines shown on the right side of the chart. The stock rallied quite a bit from that $51 low, pushing close to $54 last week to mark immediate resistance before dropping back to start this week. Current support is around the stock’s 52-week low at about $51. A push above $54 has limited upside, to about $55 where the 38.2% retracement line waits; but a break above that level could see the stock reverse its downward trend, with near-term upside to about $58 where the 61.8% retracement line waits. A push below $51 would mark a new 52-week low, extending the long-term downward trend, and that could drive the stock to about $49, which coincides with the its pandemic-driven, bear market low, with additional downside to about $46 (a level not seen in about three years) if bearish momentum accelerates.

Near-term Keys: VZ offers a compelling value proposition, with a higher-than-average dividend that makes for tempting bait for both value and fundamental-oriented investors. If you prefer to focus on short-term trades, you could use a push above $54 as a signal to buy the stock or work with call options, with an eye on $58 as a useful bullish, short-term profit target. A drop below $51 should be taken as a signal to consider shorting the stock or buying put options, with $49 providing a first, quick-hit profit target or $46 if the stock’s bearish momentum increases.