Over the last few months, the Energy sector has been one of the market leaders, as the price of oil, natural gas and other energy products have all increased. Many analysts are pointing to supply constraints that are being felt in multiple sectors and that are creating inflationary pressure all the way to the consumer level in areas that aren’t limited only the price of gas at the pump but also to basic goods like food and household items.

The upward pressure on energy prices has provided a pretty nice lift to a lot of Energy stocks, and since most of the inflationary questions I just mentioned don’t appear to have near-term solutions, it’s reasonable to suggest these stocks could offer a relative bright spot for growth and even value-oriented investors for the foreseeable future.

In the Oil and Natural Gas industries, companies are broken into additional categories depending on where in the supply chain they tend to operate. Downstream companies are those that are closer to the consumer – for example, refineries, local and regional utility providers, and filling stations – while upstream companies are those that operate closer to the extraction and production of raw energy materials. Between the two extremes are a lot of different processes and operations, and companies at every possible point along the way but that are usually called midstream. These are the companies that are usually involved in transportation and storage of raw materials.

Halliburton Company (HAL) is a pretty well-known name to even a casual observer of energy prices and dynamics. Most of the company’s operations lie in working with companies at the upstream stage of the energy supply chain; the companies that primarily reside at this end of the supply chain are also usually the most immediate benefactors of rising raw material prices. That helps explain why the stock has risen from a low at around $19 in mid-September to its latest price at around $26 – a big move in a month that makes most growth-oriented investors start to salivate. What about value? Has the stock moved faster, and further, than its fundamentals suggest it should? Let’s find out.

Fundamental and Value Profile

Halliburton Company provides services and products to the upstream oil and natural gas industry throughout the lifecycle of the reservoir, from locating hydrocarbons and managing geological data, to drilling and formation evaluation, well construction and completion, and optimizing production throughout the life of the field. It operates through two segments: the Completion and Production segment, and the Drilling and Evaluation segment. The Completion and Production segment delivers cementing, stimulation, intervention, pressure control, specialty chemicals, artificial lift and completion services. The Drilling and Evaluation segment provides field and reservoir modeling, drilling, evaluation and wellbore placement solutions that enable customers to model, measure, drill and optimize their well construction activities. It serves national and independent oil and natural gas companies. As of December 31, 2016, it had conducted business in approximately 70 countries around the world. HAL has a current market cap of about $23.1 billion.

Earnings and Sales Growth: Over the last twelve months, earnings increased by 154.55%, while revenues grew by 29.75%. In the last quarter, earnings rose about 7.7% while sales increased a little more than 4.1%. HAL’s margin profile is historically pretty narrow, but has been strengthening more recently. In the last twelve months, Net Income as a percentage of Revenues was 2.79%, but increased to 6.11% in the last quarter.

Free Cash Flow: HAL’s free cash flow is modest, but has been surprisingly stable over the last year, at nearly $1.4 billion in the last quarter versus about $1.44 billion a year ago. It is also worth noting this number was about $415 million in the last quarter of 2019. The current number translates to a modest, but still useful Free Cash Flow Yield of 6%.

Debt to Equity: HAL’s debt to equity is 1.6 – higher than I prefer to see, but also pretty characteristic for stocks in this industry. The company’s balance sheet shows a little over $2.6 billion in cash and liquid assets against about $9.1 billion in long-term debt. The company should have no problem servicing their debt for the time being, and have managed to maintain a healthy level of liquidity throughout the past year.

Dividend: HAL’s annual divided was $.72 per share prior to the onset of the COVID-19 pandemic, which prompted to reduce the dividend to about $.18 per share year. They have maintained that level since the first quarter of 2020. The current number translates to an annualized yield of about 0.69% at the stock’s current price.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to worth with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term target at about $24 per share. That suggests that the stock is a bit overvalue, by about -6% right now, with a practical discount price sitting at around $19.

Technical Profile

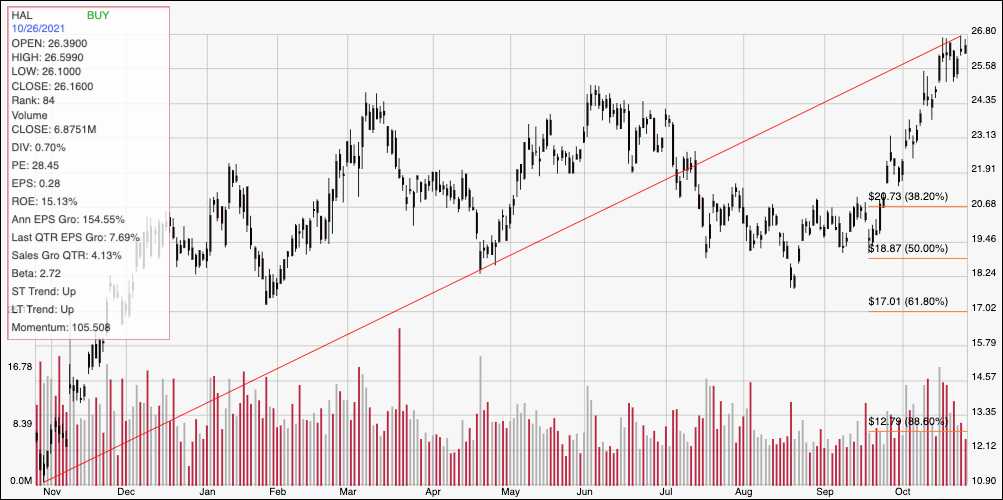

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The chart above covers the last year of price activity. The red diagonal line traces the stock’s upward trend from November of last year, at a low point around $11 to its high just this week at nearly $27. It also informs the Fibonacci retracement lines shown on the right side of the chart. The stock’s bullish momentum has really picked up in the last month, with the stock’s rise from about $19 marking an increase of almost 38% in a very short period of time. Current support is around $24.50 based on a pivot high in that price area back in early June, with immediate resistance at around $27 since the stock has hit this high point on a couple of different occasions in the last week. That also means that a push above $27 could have upside to about $29.50 before finding next resistance, while a drop below $24.50 could see the stock slide back to about $22 based on pivots in that area at multiple different points throughout 2021.

Near-term Keys: HAL is a company with a much stronger fundamental profile than it showed prior to the beginning of the pandemic, but current inflationary pressures have helped the stock rally past the point that a traditional, value-focused investor would consider to be useful. That means that the best probabilities with this stock lie in short-term trading strategies. Use a push above $27 as a signal to consider buying the stock or working with call options, with $29.50 offering a useful short-term profit target on a bullish trade. A drop below $24.50 would be a good signal to think about shorting the stock or buying put options, using $22 as a practical bearish profit target.