(Bloomberg) — Who will survive in China’s property sector is becoming a key question for investors as the country’s credit market undergoes its biggest shakeout in years.

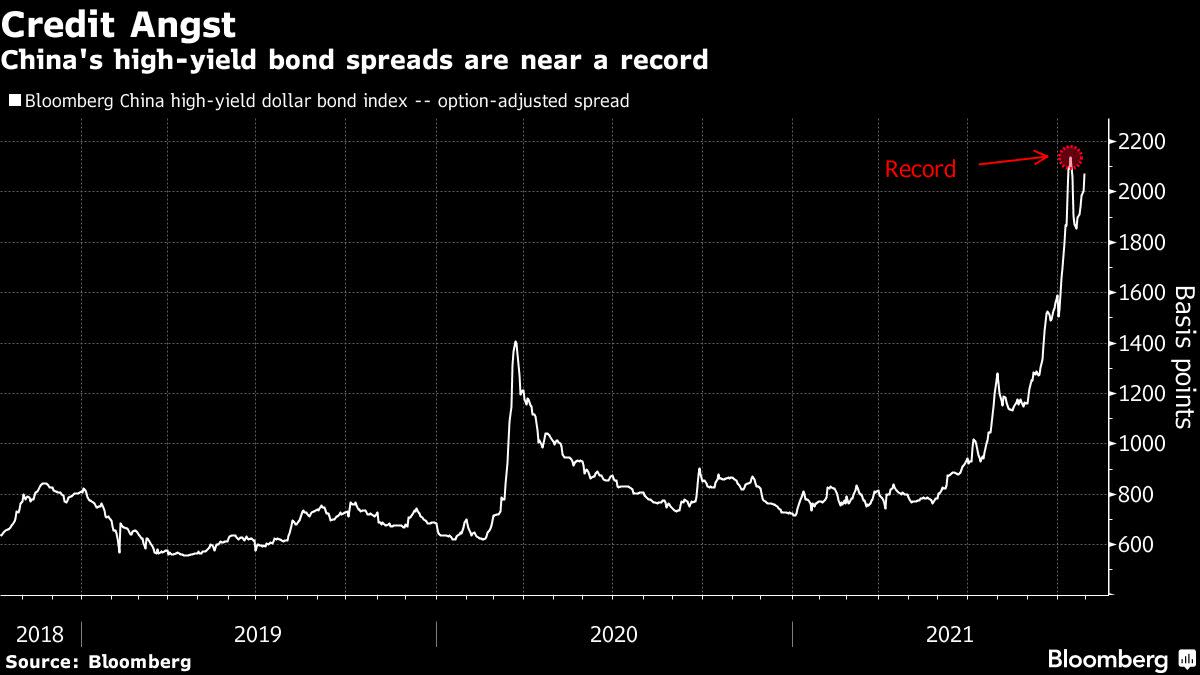

A surge in Chinese junk dollar bond yields in October, briefly reaching 20%, has made it all but impossible for stressed developers to refinance their maturing debt. Such firms have just over $2 billion of onshore and dollar-bond payments due in November, according to data compiled by Bloomberg. At least four builders defaulted last month, while China Evergrande Group twice averted that fate by paying overdue coupons at the 11th hour.

Grace periods end this month for the developer on another $148 million of dollar bond interest payments, while $82.5 million comes due at Evergrande unit Scenery Journey Ltd.

Below is a week-by-week calendar for interest and principal payments due on dollar and yuan bonds for most of the top 16 developers whose debt offers the worst year-to-date returns on a Bloomberg index of China high-yield dollar bonds. Some coupons may have grace periods unless otherwise stated, and the data excludes defaulted firms and those with less than $500 million of dollar bonds outstanding.

Week 1 (Nov. 1-7) – $104 million

- Scenery Journey $41.9 million coupon on note due 2022, first deadline Nov. 6

- Scenery Journey $40.6 million coupon on note due 2023, first deadline Nov. 6

- Zhenro Properties Group Ltd. $13.7 million coupon on note due 2023, first deadline Nov. 6

- Central China Real Estate Ltd. $7.79 million coupon on note due 2023, first deadline Nov. 7

Week 2 (Nov. 8-14) – $1.15 billion including puttables

- Central China Real Estate $363.2 million note due Nov. 8, plus $12.3 million in interest (Firm says it’s started repayment process)

- Evergrande $68.9 million coupon on note due 2022, grace period expires Nov. 10

- Evergrande $42.5 million coupon on note due 2023, grace period expires Nov. 10

- Evergrande $36.75 million coupon on note due 2024, grace period expires Nov. 10

- Yango (Cayman) Investment Ltd. $17.8 million coupon on note due 2023, first deadline Nov. 10

- Kaisa Group Holdings Ltd. $58.5 million coupon on note due 2025, first deadline Nov. 11

- Kaisa $29.9 million coupon on note due 2023, first deadline Nov. 12

- Yango Justice International Ltd. $247 million note due 2023 is puttable and first deadline for $12.35 million coupon is Nov. 12

- Rongxin (Fujian) Investment Group Co. 1.5 billion yuan ($235 million) note due 2023 is puttable and first deadline for 108 million yuan coupon is Nov. 12

- Xinyuan Real Estate Co. 75.15 million yuan coupon on note due 2025, first deadline Nov. 13

Week 3 (Nov. 15-21) – $594 million

- Yango Justice $9.9 million coupon on note due 2025, first deadline Nov. 17

- Agile Group Holdings Ltd. $12.4 million coupon on note due 2026, first deadline Nov. 17

- Easy Tactic Ltd. $17.2 million coupon on note due 2023, first deadline Nov. 17

- Easy Tactic $22.3 million coupon on note due 2022, first deadline Nov. 18

- Agile $200 million note and $3.83 million of interest due Nov. 18

- Zhenro $192.5 million note and $5.66 million of interest due Nov. 18

- Yango Group Co. 603 million yuan note and 35 million yuan of interest due Nov. 19

- China South City Holdings Ltd. $10 million coupon on note due 2022, first deadline Nov. 20

- Zhongliang Holdings Group Co. $12.75 million coupon on note due 2022, first deadline Nov. 20

- Redsun Properties Group Ltd. $7.67 million coupon on note due 2024, first deadline Nov. 21

Week 4 (Nov. 22-28) – $243 million

- Zhongliang $200 million note and $8.83 million of interest due Nov. 22

- Central China Real Estate $11.5 million coupon on note due 2024, first deadline Nov. 24

- Yuzhou Group Holdings Co. $17 million coupon on note due 2025, first deadline Nov. 27

- Rongxin 39 million yuan coupon on note due 2024, deadline Nov. 28

Week 5 (Nov. 29-Dec. 5)

- No scheduled payments

(Adds further list criteria in the fourth paragraph.)

©2021 Bloomberg L.P.