Traditional, growth-oriented investing puts most of its emphasis on stocks that have already started moving up. That makes sense when you consider the popular technical idiom that a “stock tends to follow the direction of its next longer trend.” That means that when you can clearly see a stock going up, it should continue to go up. It’s a forecast that often supports itself, as more and more growth-focused investors recognize the strength of a stock’s trend and start to jump on board themselves. That keeps the momentum going and can extend even long-term trends (9 months to 1 year) into multiyear patterns of growth.

My investing preference runs more than a little counter to the growth-oriented mindset, and is commonly called contrarian investing. Contrarian investing is often correlated in equal fashion with value investing, which is where I think my method actually fits best. In simplest terms, value investing means looking at a company’s book of business and trying to determine how closely it may be correlated to the stock’s current trading price. If a stock’s price is relatively low in comparison, it usually means the stock is trading at a useful discount. More often than not, that also means that the best set ups will be found at or near historical lows – which is why this approach also requires a “contrarian” mindset. Where most growth-oriented investors tend to dismiss stocks that have been dropping, contrarian, value-focused investors sit up and take notice.

Growth and value-focused investing are not always mutually exclusive; sometimes, a stock will draw a clear pattern of long-term growth in price while the company’s book of business also continues to grow. The extent to which the two keep pace with each other can ultimately mean that a company continues to offer an interesting, useful value proposition even as the stock price rises – but to be honest, this is something that doesn’t happen very often. More likely to happen is that growth-focused investors start to see the stock go up and begin to pile in, creating more and more bullish momentum that drives a stock’s price up faster the company’s business growth.

Newell Brands Inc. (NWL) is an interesting example. This is a stock that increased from a low point around $11 in May of 2020 to a peak at around $30 May, but has dropped back to around $24 as of this writing. This is a stock with a large footprint in the Household Durables industry, well-known brands in a portfolio lineup that includes Sharpie and Paper Mate writing utensils, Graco baby products, Rubbermaid, Elmer’s, Mr. Coffee, and much more. The business has been working for most of the last few years to implement a transformation plan that recent earnings reports suggest have started to positively impact the company’s bottom line, which gave the market justification to push the stock higher until the last few months. Now that the stock is dropping, the question for a value-focused investor like myself, is whether NWL’s fundamentals have improved enough, and the stock’s drop come far enough, to make it a useful point of reference for a value-based opportunity? Let’s take a look.

Fundamental and Value Profile

Newell Brands Inc. is a consumer goods company. The Company has a portfolio of brands, including Paper Mate, Sharpie, Dymo, EXPO, Parker, Elmer’s, Coleman, Marmot, Oster, Sunbeam, FoodSaver, Mr. Coffee, Graco, Baby Jogger, NUK, Calphalon, Rubbermaid, Contigo, First Alert and Yankee Candle. The Company operates under three segments: Food and Appliances (comprised of Appliances & Cookware and Food divisions), Home and Outdoor Living (comprised of Home Fragrance, Outdoor & Recreation and Connected Home & Security divisions), and Learning and Development (comprised of Writing and Baby & Parenting divisions). NWL has a current market cap of $10.3 billion.

Earnings and Sales Growth: Over the last twelve months, earnings declined by -35.71%, while sales increased 3.26%. In the last quarter, earnings dropped by -3.57% while sales were 2.88% higher. The company’s margin profile has stabilized from the pandemic-driven impacts of 2020; over the last twelve months Net Income was 5.76% of Revenues, and strengthened a bit to 6.82% in the last quarter.

Free Cash Flow: NWL has healthy free cash flow of $8.2 million over the last twelve months. This number was just $295 million at the beginning of 2019, making Free Cash Flow growth a useful benchmark for the success so far of the company’s transformation plan. Their current Free Cash Flow number translates to a useful Free Cash Flow Yield of 8%.

Debt to Equity: the company’s debt to equity ratio is 1.2, which is a bit high and is reflected in the company’s balance sheet. As of the last quarter, cash and liquid assets were $637 million (down from $981 two quarters ago) versus a little more than $4.8 billion in long-term debt. It is worth noting that in late 2018, long-term debt was about $9.3 billion, so this number has been declining steadily, which is a net positive. Considering the positive pattern of Free Cash Flow and their improving operating profile, debt service is not an issue.

Dividend: NWL pays an annual dividend of $.92 per share, which translates to a very attractive annual yield of 3.88% at the stock’s current price.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target at $21 per share. That means that at the stock’s current price, it is undervalued, with a practical bargain price is around $17.

Technical Profile

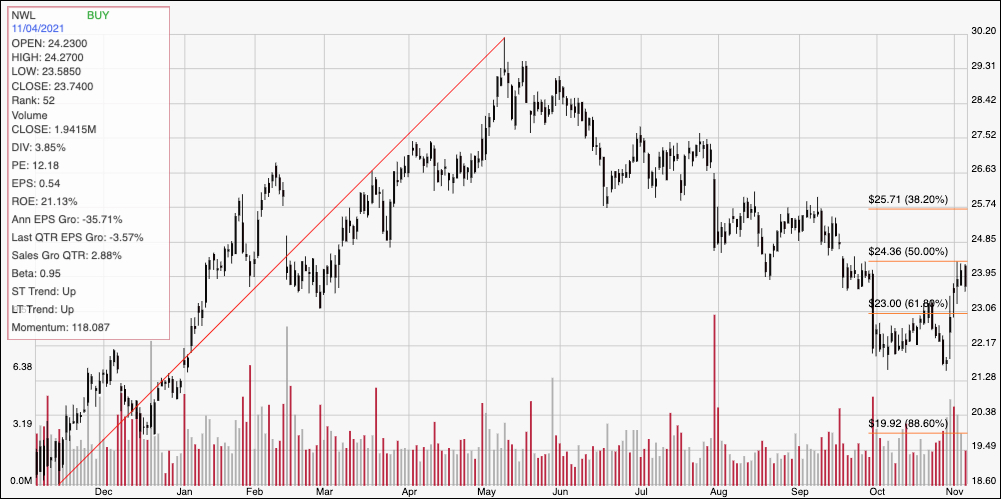

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The chart above displays the stock’s price performance over the last year. The diagonal red line traces the stock’s upward trend from its 52-week low in November 2020 at around $18.50 to its peak in May at around $30. It also informs the Fibonacci retracement lines shown on the right hand side of the chart. The stock has moved into a clear downward trend from that high, but found trend support in October at around $22, a little below the 61.8% retracement line. From that point, the stock started picking up bullish momentum in the last week, pushing to immediate resistance at the 50% retracement line at around $24. Current support is at the 61.8% retracement line at $23. Continued momentum above $24 should have upside to about $26, with limited downside below $23. A drop below $22, however should see the stock drop to about $20 where the 88.6% retracement line.

Near-term Keys: Overall, I like NWL’s fundamentals; management has been effective at executing its transformation strategy over the last year or so, and even with COVID-related pressures, those gains have helped to maintain, and in some cases even bolster its balance sheet and operating cash flow. While the stock’s drop since May is useful, it isn’t quite enough to make the stock practical as a value-based, long-term investment. A smarter approach is to wait and see if the stock drops to a more useful bargain price at around $17. If you prefer to work with short-term trading strategies, a push above resistance at around $24 could offer a useful opportunity to buy the stock or work with call options, using $26 as a quick-hit profit target. A drop below $22 could be a good time to consider shorting the stock or buying put options, using $20 as a useful profit target on a bearish trade.