(Bloomberg) — Over a span of four decades, Colombia’s Jaime Gilinski has quietly amassed a fortune exceeding $4 billion by expanding his family’s group of companies and pushing into new areas like banking, finance and real estate.

At 63, he’s embarking on his biggest gamble yet: a $2.2 billion bid to buy a majority stake in foodmaker Grupo Nutresa SA with the royal family of Abu Dhabi. For the deal to succeed, he’ll need to convince a complex cross-holding of investors known as Grupo Empresarial Antioqueno, or GEA, and multiple pension funds that the 38% premium is too sweet to pass up.

The offer to buy as much as 62.6% of the Medellin-based company has thrust the usually reclusive Gilinski into the limelight in his native Colombia and sent shock waves through the normally sleepy local capital markets where M&A deals of relevant size are rare.

But the move has been two years in the making, he said in a rare exclusive interview from Miami, next to his son Gabriel, who is involved in family businesses. To maintain absolute discretion, he gathered a group of independent investment bankers and used his own experience as an M&A banker at Morgan Stanley in the 1980s to prepare the bid.

“It’s not something that happened just overnight,” Gilinski said. “I have a tendency to be very, very focused on detail. I do a lot of research.”

Should he manage to convince shareholders to sell a majority stake in Nutresa, the move may just be “the first of hopefully many investments together” with the royal family through its investment vehicle, the Royal Group. As part of the deal, the Gilinskis would hold a 50.1% stake of what they purchase in the food company and the royal family would hold the remaining 49.9%.

‘Keen Interest’

“They have a very keen interest to grow in Colombia, to grow in Latin America, and we have decided to be partners for the long-term,” Gilinski said.

The joint venture is focused on winning the Nutresa bid and growing it into a global food business before targeting acquisitions.

“We have to first crawl and then walk and then run,” he said.

After graduating from Harvard Business School, Gilinski returned to Colombia in the 1980s. Along with his father, who had a financial company, he bought the local branches of international bank BCCI in 1991.

Three years later, the family, along with a group of more than 80 institutional investors, bought Banco de Colombia from the government, which at the time was the largest bank in the country and became the biggest privatization. They later sold the stake in the lender that’s now Bancolombia SA.

In 2003, he bought Banco Sudameris and through other acquisitions now operates as Banco GNB Sudameris with a presence also in Peru and Paraguay. In 2019 he bought a stake in U.K. lender Metro Bank Plc.

His multibillion dollar empire also spans media and real estate sectors, including ownership of a Bogota news magazine, Four Seasons hotels in Colombia and a massive development on a former air force base near the Panama Canal. The family also has experience in the food industry after starting snack company Yupi which has a large presence in the region.

Proceeds he collected from private equity investments in finance and banking he’s been making since the 1990s made up the bulk of his $4.3 billion net worth, according to the Bloomberg Billionaires Index.

Focus on Bid

For now, all eyes will be on the offer to pay $7.71 a share of Nutresa that will close Dec. 17. Shares are expected to resume trading Monday in Colombia.

Key to the bid’s success will be the participation of conglomerates Grupo de Inversiones Suramericana SA, or Sura, and Grupo Argos SA, which hold a combined 45.3% of Nutresa. Along with pension fund manager Proteccion SA, which overseas funds that hold an additional 5.2% stake and are all part of GEA.

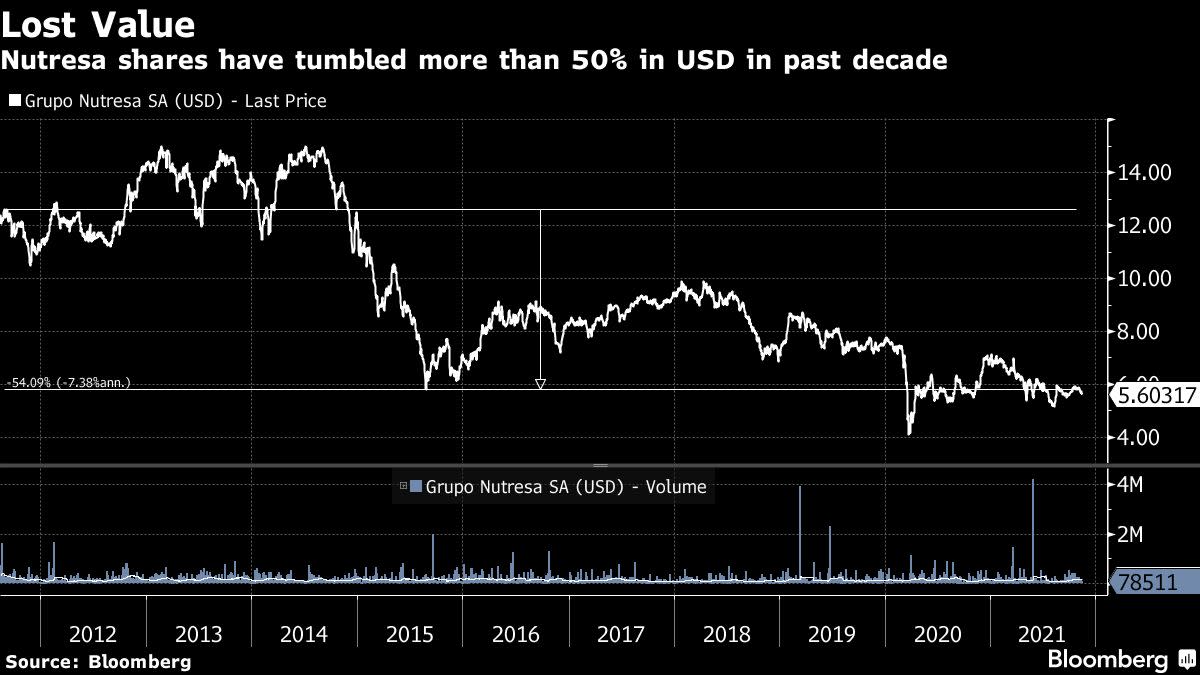

The cross holdings structure of GEA companies is causing shares to underperform and hurting liquidity in the local market, according to Gilinski. Nutresa’s shares have lost more than half their value in dollar terms over the past decade, according to data compiled by Bloomberg.

The structure “has not allowed the market to really understand and bring value to these assets because it’s really involving too many things,” he said.

The size of the transaction not only shows confidence in Colombia but it brings a major world investor into the Andean country, says Gilinski.

“I believe we will be successful,” said Gilinski. And “it will be a breakthrough in the capital markets of Colombia to allow for a change, which I think is needed.”©2021 Bloomberg L.P.