Looking for value in the stock market is something that I have found can be done in any market condition, but it is something that tends to get dismissed by most pundits simply because it isn’t very sexy. Names like Tesla, Netflix, and Amazon practically never pass the value list because the massive amount of attention the market has given them for years has kept their stocks priced at levels that makes them impractical for an objective analysis based strictly on value. More often than not, looking for value means passing over the names and pockets of the market that get the most attention from media and the general investing public to dig into the industries that everyone else tends to overlook.

If you’ve been following me in this space at all, or participating in my weekly options trading webinar, you already know that CVS Health (CVS) is a good, old friend that I’ve followed for quite some time. Since my last review on this stock, the company has released a new earnings report, which shows continued stabilization of its operating profits based on Net Income after quite a bit of pressure throughout the pandemic, with impressive gains in other fundamental metrics like Free Cash Flow.

The last couple of weeks have reintroduced market uncertainty and volatility to the broad market, as questions about whether interest rates will increase. The last few days have also seen a fair amount of fear coming from the appearance of a new COVID strain, with its accompanying questions about how contagious and deadly it may be yet unanswered. The delta variant of the virus continues to weigh on U.S. health care systems, and so the obviously concern is whether omicron will only add to that as winter progresses. I think one of the takeaways investors can take is that the role CVS and other pharmacy companies will continue to be an important of the story for the foreseeable future. This is a company that was already gaining traction in its broad transformation from just a drugstore/specialty retailer to a health care company providing a variety of services locally and affordably, and it is hard not to take CVS seriously. The company is uniquely positioned for the current environment, not only in the pharmacy space but also with what I think is a big competitive advantage over the rest of its industry owing to its 2018 merger with insurer Aetna.

The stock has followed a pretty steady upward trend from most of the year, starting at around $67 in late December and climbing to a high at around $97 early November. Increased uncertainty about the pace and sustainability of economic growth, now exacerbated by the last few days’ worth of uncertainty have pushed the stock to a short-term low at around $90 as of this writing. Is the drop an opportunity to “buy the dip” and keep following the longer upward trend, and just as important, where is the stock’s value price right now? Let’s dig in to find out.

Fundamental and Value Profile

CVS Health Corporation, together with its subsidiaries, is an integrated pharmacy healthcare company. The Company provides pharmacy care for the senior community through Omnicare, Inc. (Omnicare) and Omnicare’s long-term care (LTC) operations, which include distribution of pharmaceuticals, related pharmacy consulting and other ancillary services to chronic care facilities and other care settings. It operates through three segments: Pharmacy Services, Retail/LTC and Corporate. The Pharmacy Services Segment provides a range of pharmacy benefit management (PBM) solutions to its clients. As of December 31, 2016, the Retail/LTC Segment included 9,709 retail locations (of which 7,980 were its stores that operated a pharmacy and 1,674 were its pharmacies located within Target Corporation (Target) stores), its online retail pharmacy Websites, CVS.com, Navarro.com and Onofre.com.br, 38 onsite pharmacy stores, its long-term care pharmacy operations and its retail healthcare clinics. CVS has a market cap of $81 billion. Aetna Inc. is a diversified healthcare benefits company. The Company operates through three segments: Health Care, Group Insurance and Large Case Pensions. It offers a range of traditional, voluntary and consumer-directed health insurance products and related services, including medical, pharmacy, dental, behavioral health, group life and disability plans, medical management capabilities, Medicaid healthcare management services, Medicare Advantage and Medicare Supplement plans, workers’ compensation administrative services and health information technology (HIT) products and services. The Health Care segment consists of medical, pharmacy benefit management services, dental, behavioral health and vision plans offered on both an Insured basis and an employer-funded basis, and emerging businesses products and services. The Group Insurance segment includes group life insurance and group disability products. Its products are offered on an Insured basis. CVS has a market cap of $119.6 billion.

Earnings and Sales Growth: Over the last twelve months, earnings increased by about 18.7%, while Revenues rose by a little over 10%. Earnings declined in the last quarter by -18.6% while sales were about 1.6% higher. The company’s margin profile is very narrow, and could be showing some cyclical weakness; over the last twelve months Net Income was 2.66% of Revenues, and 2.17% in the last quarter.

Free Cash Flow: CVS’s free cash flow is very healthy at nearly $15.2 billion. That marks an improvement from $13.4 billion a year ago, and $11.6 billion in the quarter prior. The current number still translates to an attractive Free Cash Flow Yield of about 12.92%.

Debt to Equity: CVS has a debt/equity ratio of .76. That is a generally conservative number that has dropped from 1 over the past year. In the last quarter Cash and liquid assets were about $12.8 billion (compared to $8.7 billion two quarters ago) versus $56.8 billion in long-term debt. The vast majority of that debt comes from the acquisition of health insurer Aetna, however the fact that long-term debt has dropped from about $65 billion since the beginning of 2020 is a good reflection of the company’s success so far (with plenty of work still to go) in transitioning these disparate organizations into a larger, productive company.

Dividend: CVS pays an annual dividend of $2.00 per share, and which translates to an annual yield that of about 2.25% at the stock’s current price. It is also noteworthy that, while dividend increases have been suspended (not because of COVID, but to give the company flexibility to reduce debt gradually from the Aetna merger), management has maintained the dividend at current levels.

Value Proposition: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target at about $92 per share. That suggests the stock is close to fairly valued, with 3% upside from its current price, and a practical discount price at $73.50.

Technical Profile

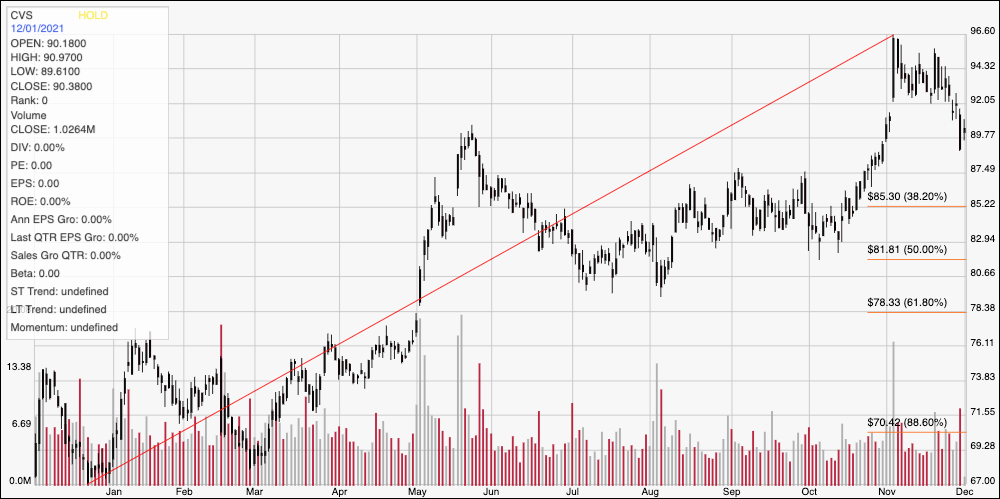

Here’s a look at CVS’ latest technical chart.

Current Price Action/Trends and Pivots: The diagonal red line marks the stock’s upward trend from December 2020 to its peak in November at around $97. It also provides the baseline for the Fibonacci retracement lines shown on the right side of the chart. After bottoming at around $80 in August, the stock hovered in a temporary range, but picked up a lot of bullish momentum in October. From its peak at $97, the stock has reversed that momentum, falling to around $90, which is where I see current support based on a temporary peak in May, with immediate resistance expected at around $92. A drop below $90 should find next support at around $87.50 based on pivot highs in September, but could fall to about $85 where the 38.2% retracement line sits if bearish momentum picks up. A break above $92 should give the stock room to test next resistance anywhere between $95 and $96.50 in the near term.

Near-term Keys: If you prefer to work with short-term trading strategies, the best opportunity on the bullish side would come from break above resistance at $92; that would be a good signal to buy the stock or work with call options with an eye on $95 to $96.50 as a useful exit point. A bearish signal would come from a drop below $90, with $87.50 providing a useful target no matter whether you choose to short the stock or buy put options. From the standpoint of value and long-term opportunity, the stock’s yearlong upward trend has outpaced the company’s fundamental strength, and the recent pullback hasn’t come back far enough to make the stock a useful value opportunity. For practical purposes, the stock would need to fall to around $73.50 before I think a compelling, value-based argument can be made.