(Bloomberg) — The U.S. economy will spend 2022 learning to live with the coronavirus without much in the way of help from the Federal Reserve or the federal government — especially with the derailing of President Joe Biden’s $1.75 trillion spending plan.

The Fed’s pivot last week toward tighter credit — ending its emergency bond-buying program in March to pave the way for higher interest rates — comes on top of a rollback in government spending programs put in place at the height of the pandemic. The fiscal squeeze will be even bigger if Democrats cannot salvage Biden’s social-spending package in the face of opposition from a key moderate senator.

The result, economists say: A policy-induced slowdown in a hard-charging economy that’s ending 2021 on a very strong note, with fourth-quarter growth that could clock in at 7% or more.

The good news is that should help take the edge off inflation running at a multi-decade high. The bad news: It will leave the economy more vulnerable to shocks such as the highly transmissible omicron variant that’s already prompting some pullback in U.S. economic activity.

Omicron “is going to wreak some havoc with the economy” as consumers hold back on spending on travel, restaurants and other face-to-face services, said Wendy Edelberg, director of the Brookings Institution’s Hamilton Project. She stressed, though, that she doesn’t expect the expansion to stall out.

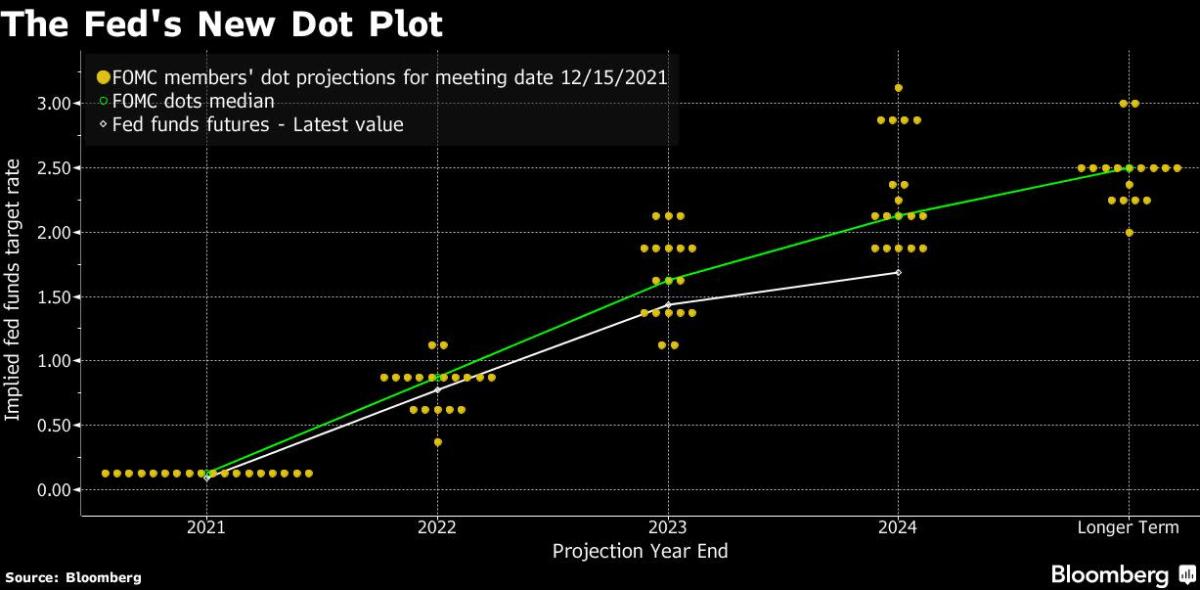

That will all put a premium on Fed Chair Jerome Powell and his colleagues being nimble and not necessarily sticking with their projections of three interest-rate hikes next year as they seek to engineer a soft landing of the economy.

“There are so many variables and uncertainties,” said Mark Zandi, chief economist at Moody’s Analytics. “It’s like landing the economic plane on the tarmac in a storm that at points has a 100-mile-an-hour headwind and at other points a 100-mile-an-hour tailwind.”

In a research note on Sunday, Goldman Sachs Group Inc. economists said a failure to pass Biden’s social and environmental spending program “would introduce some risk” to their forecast that the Fed will deliver its first rate increase in March.

With passage of the plan looking increasingly unlikely, the Goldman economists lowered their forecasts for growth in the coming months, including chopping their first quarter estimate to 2% from 3%.

Equity futures dropped on the weaker outlook for fiscal support, along with concerns about omicron. Contracts on the S&P 500 Index were down 1% as of 7:32 a.m. Monday. Ten-year Treasury yields ticked down about two basis points to 1.39%.

The inability of Democrats to coalesce around Build Back Better will crimp consumer spending because the government will have to stop making expanded and advanceable child tax-credit disbursements to families. The fate of the package was left in limbo with West Virginia Senator Joe Manchin Sunday saying he couldn’t support it.

Read More: Manchin Leaves Democrats Hanging With Biden Bill Rejection

That headwind would come on top of a fiscal drag of more than 3% of gross domestic product in 2022 from the expiration of temporary pandemic-relief measures, according to Goldman economist Alec Phillips.

One potential silver lining for financial markets: The demise of Biden’s spending plan would also scuttle the higher levies on corporations that investors had expected as part of the package.

Some economists point to a build-up in household savings as another bright spot. Thanks in part to stimulus payments from the government, consumers have socked away some $2 trillion to $3 trillion.

What Bloomberg Economics Says…

“The fiscal taper is not as daunting as it may appear. With so much saved in household bank accounts, it simply will be a rotation from fiscal to private demand. There is also some pent-up demand for firms to invest on the back of their profits.”

— Anna Wong (chief U.S. economist)

There is “all this liquidity piled up in consumers’ bank accounts,” said Alan Blinder, a former Fed vice chairman who’s now a Princeton University professor. That will act as “kind of insurance against a recession” as the central bank raises rates and fiscal policy is tightened, he said.

What’s more, Edelberg said, lower-income workers are benefiting from hefty wage gains as restaurants, warehouses and other employers are forced to bid up salaries to get the help they need in a tight labor market.

Still, a failure by Democrats to pass any additional spending measures would have a meaningful impact on the economy next year. Zandi sees a sharp slowdown to less than 1.5% in the fourth quarter of 2022 if Biden’s $1.75 trillion program isn’t approved.

“It would make us vulnerable late next year,” he said. “At that growth rate, you threaten to stall out if anything else goes wrong.”

©2021 Bloomberg L.P.