(Bloomberg) — U.S. economic growth looks set to fuel inflation that’s even faster than most analysts anticipate in the first part of 2022, according to a trader who correctly picked this year’s jump in bond-market expectations for consumer-price gains.

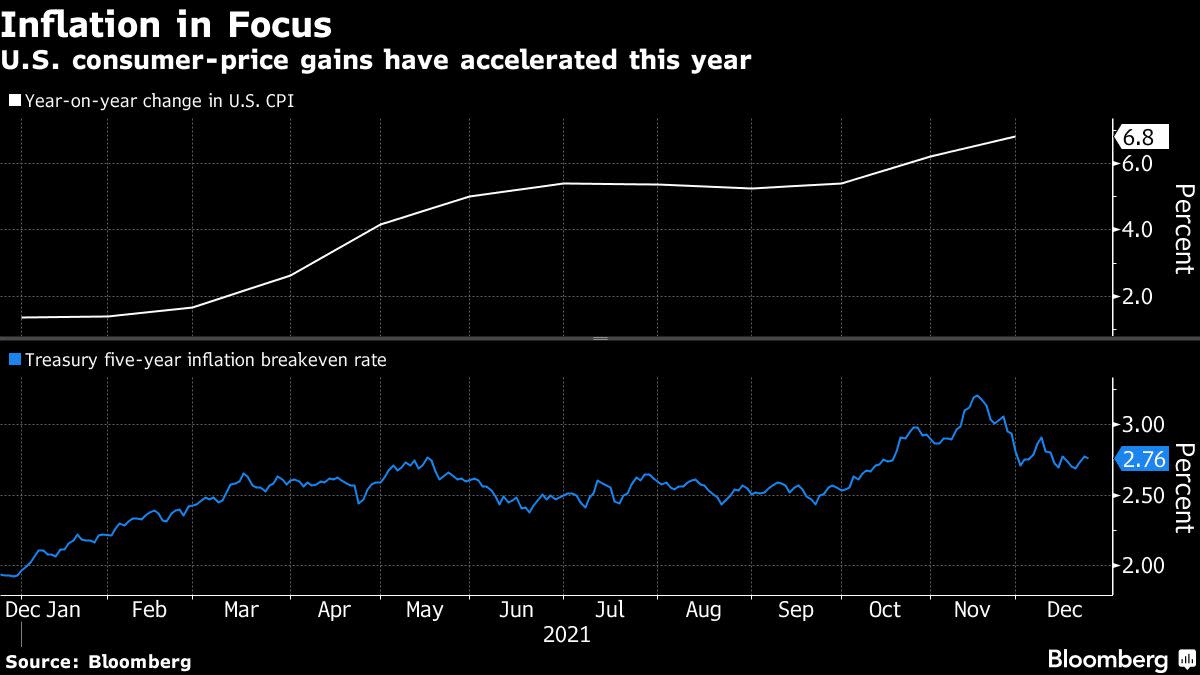

Semin Soher Power, who heads Bank of Ireland Group Plc’s inflation-trading desk in Dublin, is forecasting that the year-on-year rate of increase in the U.S. consumer-price index will move above 7% in the first quarter. That’s above the most recent reading of 6.8% for November and higher than the 6.3% median estimate of analysts surveyed by Bloomberg for the first part of 2022.

Inflation pressures “are much more growth-based right now” and not simply a result of higher energy prices or a reopening of economies from lockdown measures, she said in an interview with Bloomberg Television Thursday. And she says both markets and central banks are cognizant of that, pointing to the Federal Reserve’s decision to move past using the term “transitory” to describe inflation pressures.

Concern about inflation has prompted central banks around the world to adopt sterner policies to combat price pressures even as uncertainty around the Covid pandemic has picked up once again. Some have surprised markets with unexpected or larger-than-anticipated interest-rate increases, while the Federal Reserve — the world’s pre-eminent monetary authority — this month announced plans to speed its stimulus withdrawal, potentially paving the way for earlier hikes in America too.

Markets responded to the Fed’s hawkish pivot by bolstering the amount of tightening they expect, although the magnitude of rate increases they expect over the longer horizon is below the median forecast of Fed officials outlined alongside the most recent policy decision. Traders also appear to be showing some confidence that policy will help keep inflation in check, with so-called breakeven rates — bond market measures for the outlook that draw on the pricing of CPI-linked debt — pulling back in recent weeks.

The five-year breakeven rate on Treasuries is currently around 2.76%. And while that’s still above the Fed’s own target for inflation, it’s well below the multi-decade high of 3.25% it was at just over a month ago.

“Central banks are changing their reaction functions and prioritizing inflation risks over downside growth risks also coming from the omicron wave,” said Soher Power.

©2021 Bloomberg L.P.