(Bloomberg) — Calm has finally come to a stock market that for weeks had been swinging violently. Bulls who hung tough are ending the year on firm footing after a frenzied off-loading of risk by professional speculators.

December’s big sellers were hedge funds, which, chastened by wrong-way bets on high-flying software firms, spent the month slashing high-momentum trades. It helped make this one of the most volatile year-ends for big-cap tech in the past decade, with the absolute size of close-to-close moves in the Nasdaq 100 clocking in around 1.4%.

While a three-day rally restored order in the S&P 500 now higher by 26% in 2021, doubts remain about the path of omicron and how central banks will fight inflation. The bounce that took the index to an all-time high followed a period where cash was building and retail investors, the die-hards who once flocked to bullish options for quick profits, became worried about the downside.

“With risk having been significantly reduced and investors now looking past omicron, there is now a lack of selling supply as momentum has changed,” said Eric Johnston, head of equity derivatives & cross-asset products at Cantor Fitzgerald. Still, he reckons, the rally is apt to be short.

“The bull market as we knew it, I think, is over,” Johnston said. “The liquidity drain from the system and overall tighter Fed policy will be a headwind for risk taking.”

Surprisingly strong earnings and optimism about the economy powered the S&P 500 to almost 70 all-time highs this year, on course for the second-best annual tally ever. Signs that omicron may not be as lethal as other virus strains clashed with steady news of business closures and travel restrictions around the world that threaten growth.

A newly hawkish Federal Reserve is also adding to the lack of conviction that characterized December. The S&P 500 has alternated between gains and losses every week, each with moves exceeding 1%.

For those who watched the S&P 500 double in 20 months and worried about bubble valuations, rising skepticism is perhaps a welcome development, putting the market on healthy footing. To contrarians, all the caution suggests that doubters may have been washed out and a little bit of good news could trigger market gains. JPMorgan Chase & Co. thinks so. Strategists led by Marko Kolanovic predicted a strong rally into the new year, as bears reverse positions.

Read more: Wilder Swings Are the Only Reliable Trend in the Stock Market

Shunning risk now could be a mistake, says Andrew Slimmon, senior portfolio manager at Morgan Stanley Investment Management.

“It’s too early to get bearish, to think the market is going down, because corporate fundamentals are going to continue to come in strong,” Slimmon said in an interview with Kailey Leinz on Bloomberg TV. “There will be opportunities to take advantage of what the market offers, but you have to be willing to go against the grain, and that means taking more risk right here today.”

Despite this week’s rebound, the risk-taking spirit has taken repeated lumps of late. While the S&P 500 has managed to post all-time highs in December, the pain below the surface is brutal. Over the past few weeks, the Russell 2000 of small-caps fell into a 10% correction, newly minted shares sank into a bear-market decline of 20%, and a group of profitless technology firms plunged almost 30%.

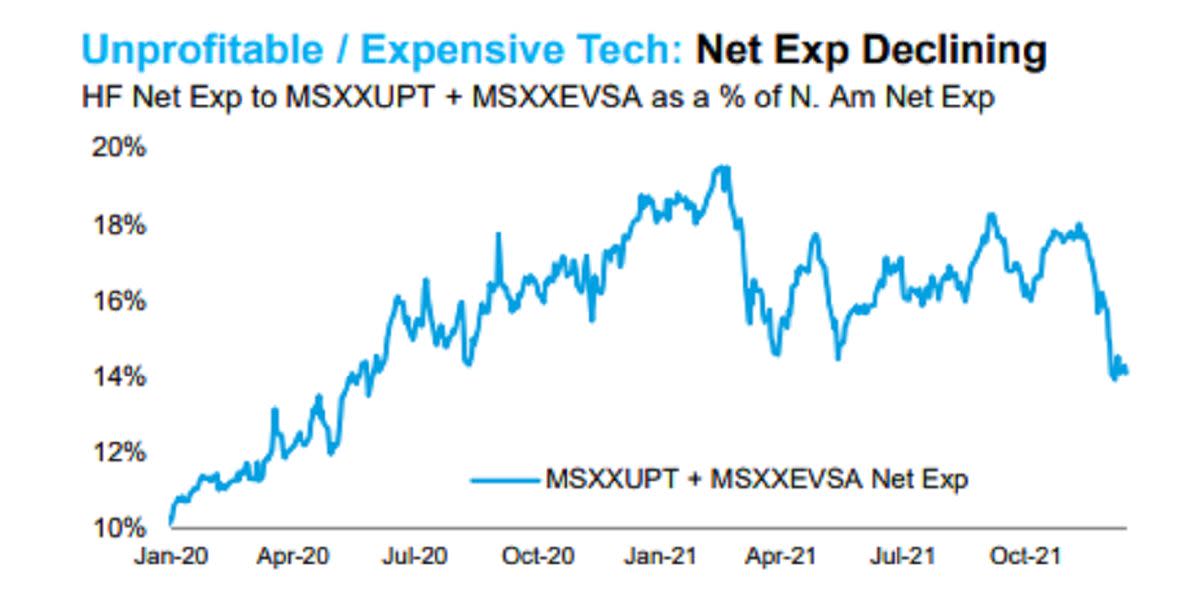

Carnage in the riskiest corners dealt a particularly harsh blow to hedge funds who had piled into to high-growth, high-valuation stocks, prompting a swift unwinding. Over the past few weeks, their net exposure in expensive technology shares and those that have yet to make money dropped by roughly 4 percentage points to about 14%, the lowest level since mid-2020, according to data compiled by Morgan Stanley’s prime broker.

The risk-off sentiment was echoed by Bank of America Corp.’s latest survey. In that poll, global money managers this month boosted their cash holdings to the highest level since May 2020 while trimming their stock exposure to a 13-month low.

Among amateur investors, the once-raging gaming spirits are ebbing. Tracking data on small-lot options trading, a proxy for retail activity, Susquehanna International Group found that their participation has been ticking lower on the call side while ramping up on the put side.

To be sure, belief persists. A week ago, when the S&P 500 fell on all but one day, investors poured $30 billion into exchange-traded funds focusing on U.S. equities, the largest inflow since March.

A closer look at stock performance revealed a clear preference for safety. Companies with stable income and dividends, such as utilities, health-care and consumer staples, have led December’s leaderboard, each rising roughly 7% as a group.

“Investor confidence is in somewhat short supply,” said Nicholas Colas, co-founder of DataTrek Research. His firm just conducted a survey on the market outlook for 2022 and found the majority thought the S&P 500 would be up less than 10%. “No wonder December is proving difficult, for if an investor thinks next year’s gains will be limited then selling ahead of a so-so year is a solid strategy.”

©2021 Bloomberg L.P.