For the sake of transparency, this is a tough column to write, for me, anyway. Coming up with a single best idea for next year is a bit of a crapshoot, especially in this wacky environment, and that’s just being honest.

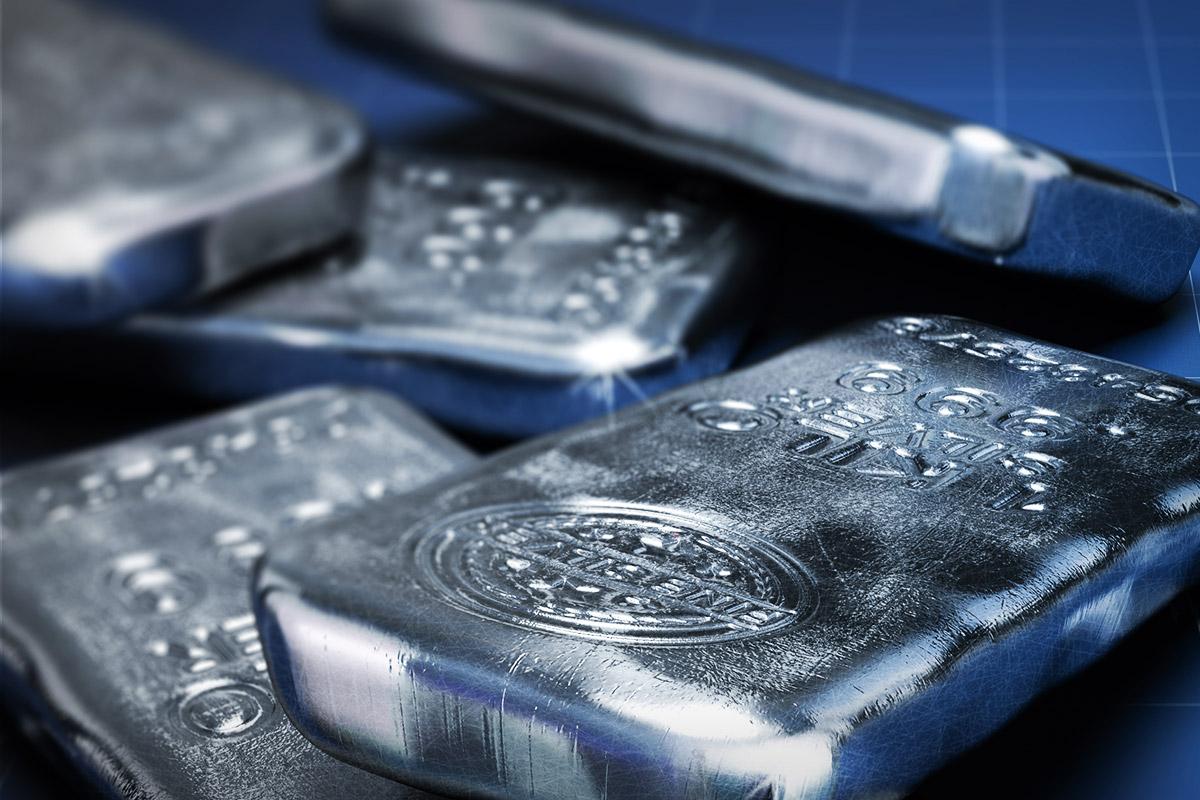

That said, I am a bit surprised by the way silver performed in 2021. The spot price is down about 13.5% year to date, and that’s in an inflationary environment. There evidently is still investor demand for physical silver, especially given the premiums for so-called “junk” silver (non-numismatic silver coins minted in 1964 and prior). While the spot price of silver hovers just under $23 an ounce, a $100 bag (face value, which contains about 71.5 ounces) of junk silver will cost you about $2,100. That’s equates to around $29.37 an ounce, a 29% premium to the spot price.

Why would investors pay such a premium? That’s due to the desire to hold actual metal, as opposed to a paper version. While that’s a substantial premium, it pales in comparison to what we saw at the outset of the pandemic. The bottom line is that silver is not an investment per se, but rather a hedge against uncertainty. Uncertainty can include a range of issues, inflation being one of them.

I believe there will be plenty of uncertainty in 2022, the extent and duration of inflation being one of the contributors. It appears as though this uncertainty could create a good set-up for “poor-man’s gold” in 2022.

One interesting way to get exposure to silver is via the Sprott Physical Silver Trust (PSLV). Each unit of PSLV represents 0.3567 ounces of silver, and the silver bars that fully back the trust are stored at the Royal Canadian Mint. As of last Thursday, PSLV traded at a 3.08% discount to net asset value (NAV).

While owning PSLV is not the same as owning physical metal that you can hold in your hand, there is an interesting kicker here. Unit holders can redeem their shares for silver bars. Now, the minimum redemption is for 10 1,000-ounce bars, which would equate to about 28,035 shares of PSLV, so redemption is off the table for most investors. However, the notion that redemption is an option, along with the current discount to NAV, makes PSLV an interesting way to obtain silver exposure without buying the physical metal.