“Supply chain” seems to be a stock answer to everything that’s wrong with the world these days. That’s because supply chain is shorthand for how the world is connected — from idea to product to consumer.

This supply-chain disaster is real. Thank goodness.

Human psychology, along with all those systems we designed, recognizes meaningful alerts when they’re persistent and personal.

Then what? Then we can channel our attention into fixing those problems. Here’s how we can do it.

Move from cost-optimized supply chains to regional networks

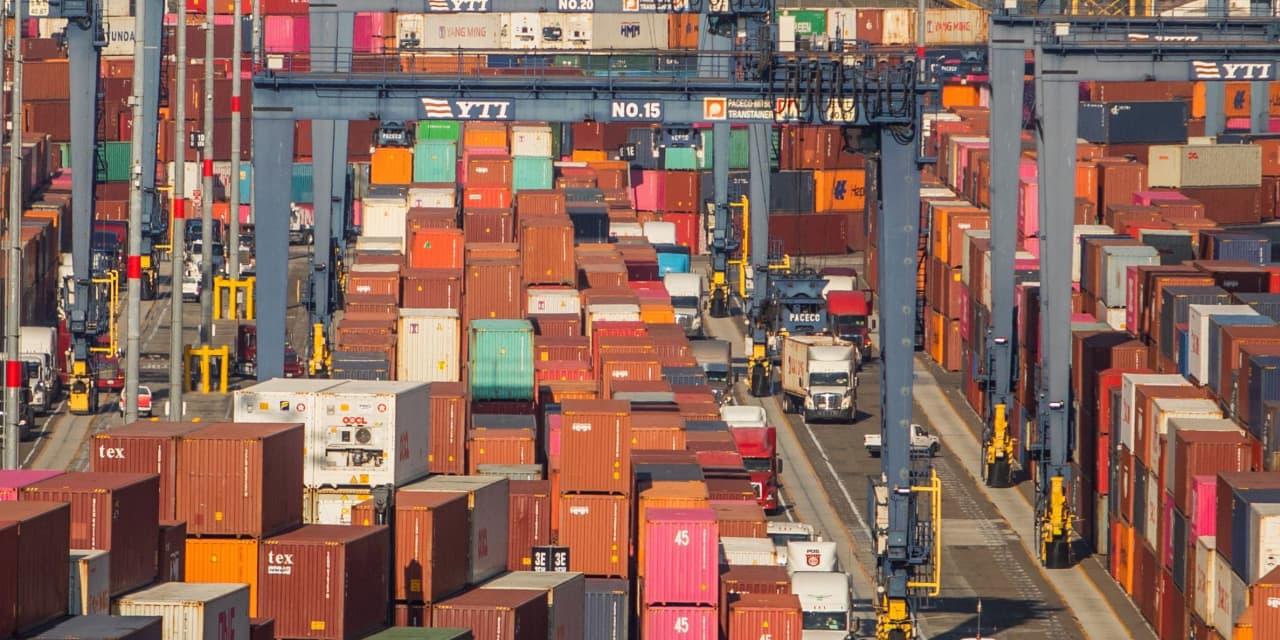

Getting goods from Asia is tough these days. Never mind the container ships waiting to get into the ports of Los Angeles and Long Beach, or the truckers queued up for containers to be unloaded in the yard. Tariffs and rolling manufacturing stoppages for government energy rationing have added cost and uncertainty to shipments from China. Countries in South Asia have struggled to fill the gap as waves of workers have been infected with COVID.

Dating back to Deloitte’s 2016 Manufacturing Competitiveness Index, the increased importance of technology was projected to tilt manufacturing away from low-labor-cost countries in favor of locations with digital-savvy workforces. COVID has accelerated digital adoption.

COVID has also rewarded companies with alternatives built into their supply networks. Air transportation was a costly substitute for water, as a U.S. company learned in 2021 when it needed to get fiberglass bath enclosures from Asian manufacturing locations to building and remodeling customers in the U.S. In contrast, a consumer products company found the combination of wage rates in Mexico and digital skills to support manufacturing in the U.S. and Canada allowed it to restructure production to supply the Americas market while keeping costs in line. It also toggled across a range of land and water transportation options to optimize product finishing, packaging and storage alternatives.

In the future, expect companies to rely more on suppliers in nearby low-cost countries and to explore shorter and more flexible transportation options as they seek to reduce both risks and costs.

Companies are also changing the way they work together. Aviat Networks AVNW, +0.94%, a communications technology company, outsourced its manufacturing to a supplier with a footprint on multiple continents. Over the last several years, this flexible partnership enabled movement of supply in response to extreme weather, imposition of tariffs and labor supply dynamics.

Expect buyers and suppliers to increasingly partner across physical and digital expertise to more seamlessly serve markets, moving away from high-volume, low-cost supply contracts with restrictive terms.

Moving from low-cost suppliers to regional partner networks has another benefit: it’s environmentally friendly. Yale Climate Connections reported in August that international shipping is responsible for 3% of global greenhouse gasses – that’s more than airplanes. Moves to regional supply networks let companies switch between trucks, rail and shorter on-water transport.

With up to 85% of a company’s environmental impact in its supply chain, companies are responding to investor interest in ESG by tracking the impact of their suppliers and customers as part of their environmental posture. Logitech International LOGI, announced on Sept. 9 that it is adopting a climate-positive approach, addressing its carbon footprint across their entire value chain, including indirect emissions. The goal is to achieve carbon neutrality this year, to set the company on a path to net zero emissions by 2030, and beyond that, to be climate positive.

Businesses elevate supply-chain oversight

Looking back to March 2020, Accenture reported that 71% of companies it surveyed didn’t have business operations contingency plans beyond three weeks long. It took a global pandemic to show us the problems with the tightly tuned connections across our worldwide manufacturing infrastructure.

Our integrated, cost-optimized supply chains worked so well that management of these business-critical activities could be two levels down from the CEO, and well out of sight of the boardroom.

The supply-chain drama and business disruption of the pandemic has shown boards that understanding supply chain is integral to monitoring enterprise risk. Boards have begun to include supply-chain expertise as well as cybersecurity and digital transformation in their modern recruitment matrices. Audit and Risk committees are working supply chain into their review cycles.

But a board’s oversight of supply chain is more than risk reduction for the transformation of goods from components of production to customer value. Supply chains offer valuable business insights – from the levers on a firm’s profitability to the needs of its customers.

As options for sensor, camera and IoT data become increasingly available, supply chain’s integrative information about a business rises above management’s functional key performance indicators (KPIs). With increasingly granular, transparent and timely information on the cost elements of serving different customer segments, boards’ Compensation and Human Capital committees will consider how to encourage rapid communication across a company’s sales, marketing, production and logistic domains as well as performance incentives within them. Strategic plan reviews will incorporate the integrative data from a company’s supply chain, as boards reconsider implications on topics from technology to talent management.

A consumer wake-up call

In March of 2020, consumers quickly distorted functioning grocery supply chains, hoarding toilet paper, nonperishable foods and hand sanitizer. We created home offices in spare bedrooms, driving up lumber prices dramatically. We learned that there were semiconductors in our cars, and we started to panic about holiday toy shortfalls way back in August.

It’s time for consumers to begin realizing that we’re causing supply-chain distortion as well as suffering from it.

Consumer engagement is a powerful force for reshaping supply chains.

Conscious consumerism joined the lexicon of the fashion industry in the wake of the Rana Plaza collapse in Bangladesh in 2013. Consumer outrage at the safety practices and working conditions that killed over 1,100 garment workers led to the Alliance for Bangladesh Work Safety (mostly U.S. brands) which reported half of all 650-plus factories had completed all safety remediations within five years, with the remainder over 80% complete. A further 220 mostly EU brands reported similar results with their oversight of over 1,600 factories through the Accord on Fire and Building Safety in Bangladesh.

Beyond impacting workplace safety and wages, consumer awareness fueled innovation in the fashion sector and its supply chains. Traditional retailers experimented with upcycled merchandise, platforms like Tradesy staked out online markets for selling used luxury soft goods, and businesses like Rent the Runway emerged with upscale clothing ownership alternatives.

COVID-19 has already changed consumer buying behavior. It’s fueled business innovation in last-mile delivery. Will 2022 be the year in which we consumers not only get more stuff faster, but ask ourselves how much we really need?