As a conservative-minded, value and fundamental-driven investor, my natural tendency is to shy away from stocks that market experts and popular market media analysts tend to talk to the most about. That means that my investments rarely look very sexy – but I’m far more interested in being able to keep my money working for me in any market condition than I am in “chasing the herd.” That’s one of the biggest reasons that throughout the course of the last few years I’ve found the Consumer Staples sector, and specifically the Food Products industry a good place to find useful investing opportunities.

Consumer Staples are products and goods that you and I need everyday – food, household goods, and the things that we aren’t going to stop buying even when economic conditions prompt us to reign in personal spending budgets and tighten our belts. In 2018 and 2019, international trade concerns increased uncertainty in the marketplace, which made this industry a smart place to incorporate into a diversified investment portfolio. 2020 reaffirmed the industry’s usefulness as the pandemic prompted a massive, albeit unexpected consumer shift back towards value-based packaged foods. Social distancing requirements and dine-in restrictions around the country put a massive amount of pressure on the restaurants, bars, and clubs that we normally associate with enjoyable social activities, and even if many of these activities have resumed in a modified fashion, inflationary pressures have been pushing costs higher in these areas to only add an additional layer of complexity to the puzzle, with the Fed even publicly stating its intention to begin raising interest rates at least three times in 2022.

Economic and industry analysts all predicted that the consumer trends I just described would show “stickiness” in 2021, but begin to fade as economic recovery continues into 2022 and 2023. The extended effect of a pandemic that just refuses to go away, along with the spectre of rising interest rates to curb inflationary pressures are elements that I think could continue to be a tailwind for the Food Products industry. There are risks and headwinds, to be sure, including supply chain pressures that are another, persistent side effect of the pandemic. Even so, a lot of the companies in this industry have shown improving fundamental profiles throughout the last year, including material improvements in cash flows, debt reduction, and overall balance sheet strength. Contrast those positives to the current downward pressure on the industry, and I think that means that Consumer Staples will still have its place as a smart place to keep in mind as we move into a new year.

You still have to be careful, though; it’s pretty easy to gravitate to well-known, established names like GIS, CPB, and KR, to name just a few, but just because a company has a great name and brand, it doesn’t mean the stock is a good opportunity right now. It is still important to pay attention to a company’s underlying business – in fact, I would argue that it may be more important than ever, because even with strong relative price performance since March 2020, a number of Food Products stocks continue to reflect very attractive valuation levels.

Kraft-Heinz Co. (KHC) is an example of what I mean. Look in your pantry or fridge, and you’ll probably find a lot of this company’s products on your shelves. In terms of recognizability, there aren’t too many food brands that can claim the brand recognition this company has. Heinz condiments including ketchup, mustard, and mayonnaise have been a mainstay of my fridge for years, and Kraft brands like Oscar Meyer are regulars as well. Despite that easy, name-brand recognition, one of the big struggles a lot of traditional names in the Food Products business have been fighting is the trend away from pre-packaged products and into healthier, organic options. While some, like CPB and GIS, seem to finding ways to stay relevant, KHC has struggled. They’re in the midst of a multiyear, long-term transformation strategy, and the pandemic prompted a stock-your-pantry mindset that gave a lot of companies in this industry, including KHC an opportunity to recapture lost customer and gain new ones. The question that remains, however is whether those positives have translated as expected to the company’s bottom line? Let’s dive in to the numbers so you can decide if this is a company that is worth putting to work for you.

Fundamental and Value Profile

The Kraft Heinz Company is a food and beverage company. The Company is engaged in the manufacturing and marketing of food and beverage products, including condiments and sauces, cheese and dairy, meals, meats, refreshment beverages, coffee and other grocery products. The Company’s segments include the United States, Canada and Europe. The Company’s remaining businesses are combined as Rest of World. The Rest of World consists of Latin America and Asia, Middle East and Africa (AMEA). The Company provides products for various occasions whether at home, in restaurants or on the go. The Company’s brands include Heinz, Kraft, Oscar Mayer, Philadelphia, Planters, Velveeta, Lunchables, Maxwell House, Capri Sun, and Ore-Ida. The Company’s products are sold through its own sales organizations and through independent brokers, agents and distributors to chain, wholesale, cooperative and independent grocery accounts, convenience stores, drug stores, value stores, bakeries and pharmacies. KHC’s market cap is about $44.2 billion.

Earnings and Sales Growth: Over the last twelve months, earnings declined by -7.14%, while sales dropped by -1.82%. In the last quarter, earnings dropped by -16.67% while sales were -4.4% lower. Despite the negative earnings pattern, KHC’s margin profile is a sign of strength; Net Income as a percentage of Revenues was 8.76% over the last twelve months, and strengthened in the last quarter to 11.59%.

Free Cash Flow: KHC’s free cash flow was almost $3.2 billion (a sizable improvement from $560 million in mid-2019) over the past twelve months and translates to a useful Free Cash Flow Yield of 7.23%. It is worth noting that this number declined from almost $6.2 billion in the last quarter of 2020 and $4.8 billion two quarters ago. That more recent, downward sloping trend in Free Cash Flow is a confirmation of the weakness being shown by the earnings per share pattern.

Dividend Yield: KHC’s dividend is $1.60 per share, and translate to an above-average yield of 4.43% at its current price.

Debt to Equity: KHC has a debt/equity ratio of .46. This is a low number that I think is a bit misleading given a high proportional level of debt versus cash and liquid assets. Their balance sheet shows $2.2 billion in cash and liquid assets (down from $3.9 billion in the quarter prior) against almost $23 billion in long-term debt. While debt is below the $31 billion mark it saw in mid-2020, cash has also declined from about $5.4 billion at the beginning of 2020.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target just little under $50 per share, a little below the $53 this same analysis yielded before the latest earnings report. Even with the drop in fair value, that means the stock is trading at a big discount, with about 38% upside from the stock’s current price.

Technical Profile

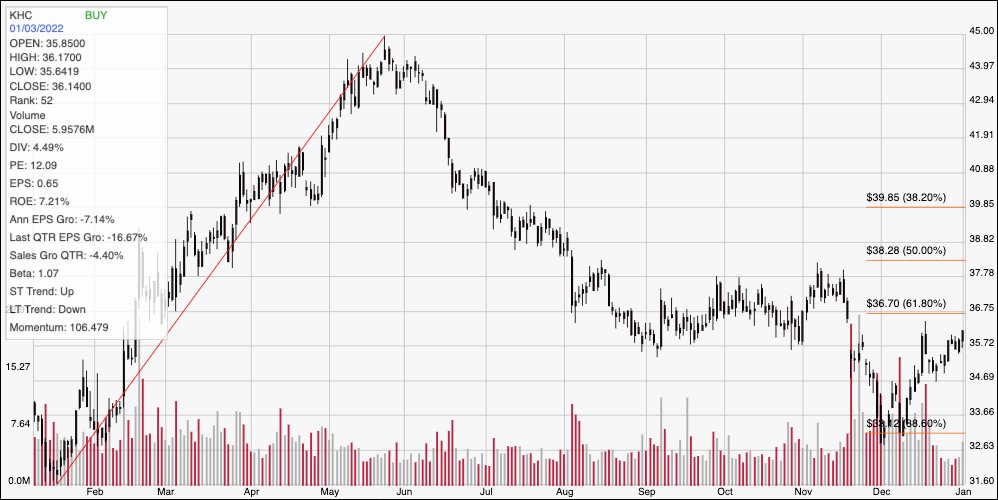

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: This chart displays the stock’s movement over the last year. The diagonal red line traces the stock’s upward trend from a January low at around $31.50 to its high point in late May at about $45 per share. It also provides the baseline for the Fibonacci retracement lines shown on the right side of the chart. After dropping to a low at around $35.50 in early September, the stock began consolidating in a pretty narrow range, between $37.50 and $35.50. The stock fell out of that range in late November and found a new bottom at around $33 at the beginning of December, and has picked up bullish momentum again from that point. Immediate resistance appears to be at around $36.50, inline with the 61.8% retracement line, while current support is around $34.50 based on the most recent pivot low a couple of weeks ago. A push above $36.50 should give the stock room to rally to about $38 based on the top end of the stock consolidation range from August to November, while a drop below $34.50 should find next support at around $33.

Near-term Keys: KHC has been picking up bullish momentum for the past month and appears to be in position to reverse the downward trend that has persisted over the past eight months. The good news about that downward trend is that it has also helped improve the stock’s value proposition to useful levels that I think make KHC worth paying attention to. If you prefer to work with short-term trading strategies, a good bullish signal to think about buying the stock or working with call options would come from a push above $36.50 per share, using $38 as a useful, bullish short-term exit target. A drop below support at around $34.50 could offer a signal to consider shorting the stock or buying put options, using $33 per share as a practical initial target.