The energy transition is driving the next commodity supercycle, with immense prospects for technology manufacturers, energy traders, and investors. Indeed, new energy research provider BloombergNEF estimates that the global transition will require ~$173 trillion in energy supply and infrastructure investment over the next three decades, with renewable energy expected to provide 85% of our energy needs by 2050.

The transition from ICEs to EVs has become a focal point of the global electrification drive. In 2020, global sales of EVs increased a robust 39% year on year to 3.1 million units, an impressive feat right in the midst of a major health crisis. Bloomberg New Energy Finance(BNEF), however, says 2021 is “yet another record year for EV sales globally,” with an estimated 5.6 million units sold, good for 83% Y/Y growth and a 168% increase over 2019 sales. BNEF has forecast that annual EV sales will approach 30 million units globally by 2030.

That means that the world will need a massive ramp up in electric battery production. Indeed, DOE says the worldwide lithium battery market is expected to grow by a factor of 5 to 10 in the next decade.

Luckily, the United States appears to be up to the task.

According to the U.S. Department of Energy, 13 new battery cell gigafactories are expected to come online in the U.S. by 2025.

Apart from Tesla Inc.‘s (NASDAQ:TSLA) new ‘Gigafactory Texas’ in Austin, Ford Motors (NYSEF) has lined up three gigafactories; one in Northeast of Memphis, TN, and two in Central KY, with the latter two being a joint venture between the company and South Korea’s energy holding conglomerate SK Innovations.

General Motors (NYSE:GM) plans to build no less than four gigafactories, with one being a JV with LG Chem (OTCPK:LGCLF) and the other three being JVs with LG Energy Solution (LGES). LGES is one of the world’s top electric vehicle battery makers, supplying the likes of Tesla and General Motors. LG Energy Solution has applied for preliminary approval of an IPO that publication IFR says could fetch $10 billion-$12 billion, easily South Korea’s biggest-ever listing. LGES has announced plans to invest more than $4.5 billion in its U.S. battery plant by 2025.

Meanwhile, SK Innovations plans to build two battery factories in Northeast of Atlanta, GA; Stellantis N.V. (NYSE:STLA) is teaming up with LG Energy Solution and Samsung SDI to build two factories in yet to be determined locations while Toyota Motor Corp. (NYSE:TM) and Volkswagen (OTCPK:VWAGY) plan to build a gigafactory apiece in Southeast of Greensboro, NC, and Chattanooga, TN, respectively.

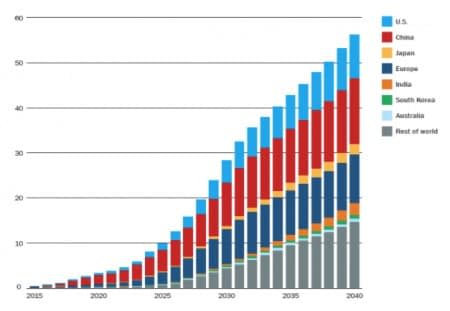

Annual Sales of Passenger EVs (Battery Electric Vehicles (BEVs) and Plug-in Hybrid Electric Vehicles (PHEVs))

Global Lithium-ion EV Battery Demand Projections

Source: U.S. Energy Department

Battery Investments

A host of energy experts, including the U.S. Energy Information Administration (EIA), UBS, BloombergNEF, S&P Market Intelligence, Wood Mackenzie and others are extremely bullish about the prospects of the battery storage industry– both over the near-and long-term–as the clean energy drive gains huge momentum.

At the center of our green energy drive are solar and wind power, both of which are expected to contribute nearly half of the global power mix by 2050 as per Bloomberg New Energy Finance. The intermittent nature of these renewable sources, however, means that large-scale storage is absolutely critical if the world is to successfully shift away from high dependence on fossil fuels.

The surge in lithium-ion battery production since 2010 can be chalked up to huge improvements in the technology from a cost and performance standpoint.

Over the past decade, an 85% decline in prices fueled a revolution in lithium-ion battery technology, making electric vehicles and large-scale commercial battery deployments a reality for the first time in history.

The next decade will be defined by a massive increase in utility-scale storage.

United States utilities are trying to cut down on emissions by implementing utility-scale battery storage units (one megawatt (MW) or greater power capacity).

In March 2019, NextEra Energy (NYSE:NEE) announced plans to build a 409-MW energy storage project in Florida that will be powered by utility-scale solar.

Xcel Energy (NASDAQ:XEL) plans to replace its Comanche coal units with a $2.5-billion investment in renewables and battery storage, including 707 MW of solar PV, 1,131 megawatts (MW) of wind, and 275 MW of battery storage in the State of Colorado.

In October, Duke Energy (NYSE:DUK) announced plans to build an energy storage project at the Anderson Civic Center, Carolina, including investments to the tune of $500 million in battery storage projects for electricity generation capacity of 300 MW.

It’s interesting to note that these utilities that are investing heavily in renewable energy have outperformed their peers, returning 33.7%, 31.1%, and 17.6%, respectively, compared to the industry’s 13.3% return in the past year.

The outlook for the battery storage industry is as rosy as they get.

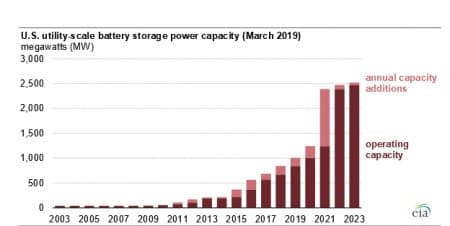

According to the EIA, operating utility-scale battery storage power capacity in the United States more than quadrupled from 2014 (214 MW) through March 2019 (899 MW). The organization projects that utility-scale battery storage power capacity could exceed 2,500 MW by 2023, or a 180% increase, assuming currently planned additions are completed with no current operating capacity being retired.

UBS estimates that the United States energy storage market could grow to $426 billion over the next decade.

Source: EIA

Battery Metals Demand Explodes

BloombergNEF estimates that the global transition will require ~$173 trillion in energy supply and infrastructure investment over the next three decades with renewable energy expected to provide 85% of our energy needs by 2050.

BNEF projects that by 2030, consumption of lithium and nickel by the battery sector will be at least 5x current levels while demand for cobalt, used in many battery types, will jump by about 70%. Meanwhile, diverse EV and battery commodities such as copper, manganese, iron, phosphorus, and graphite—all needed in clean energy technologies and to expand electricity grids—will see sharp spikes in demand.

Other energy experts are equally bullish.

According to a recent Eurasia Review analysis, prices for copper, nickel, cobalt, and lithium could reach historical peaks for an unprecedented, sustained period in a net-zero emissions scenario, with the total value of production rising more than four-fold for the period 2021-2040, and even rivaling the total value of crude oil production.

According to the analysts, in a net-zero emissions scenario, the metals demand boom could lead to a more than fourfold increase in the value of metals production–totaling $13 trillion accumulated over the next two decades for the four metals alone. This could rival the estimated value of oil production in a net-zero emissions scenario over that same period, making the four metals macro-relevant for inflation, trade, and output, and provide significant windfalls to commodity producers.

Estimated cumulative real revenue for the global production of selected energy transition metals, 2021-40 (billions of 2020 US dollars)