(Bloomberg) — Federal Reserve Chair Jerome Powell said the central bank will prevent higher inflation from becoming entrenched while cautioning that the post-pandemic economy might look different than the previous expansion.

“We will use our tools to support the economy and a strong labor market and to prevent higher inflation from becoming entrenched,” Powell said in a brief opening statement prepared for delivery at his confirmation hearing before the Senate Banking Committee. “We can begin to see that the post-pandemic economy is likely to be different in some respects. The pursuit of our goals will need to take these differences into account,” he said in the remarks, released Monday ahead of Tuesday’s hearing.

Powell was nominated by President Joe Biden to serve a second four-year term as head of the nation’s central bank. Governor Lael Brainard was picked to serve as vice chair and will go before the committee Thursday. She succeeds Richard Clarida, who said Monday he will leave office on Jan. 14. Clarida’s investment activities in 2020 — as the Fed was preparing to signal to markets that it was prepared to take action to buffer the economy from the coronavirus — have drawn scrutiny.

His departure will leave three remaining vacancies on the Fed board in Washington and the White House is expected to soon announce a slate of candidates to fill those seats.

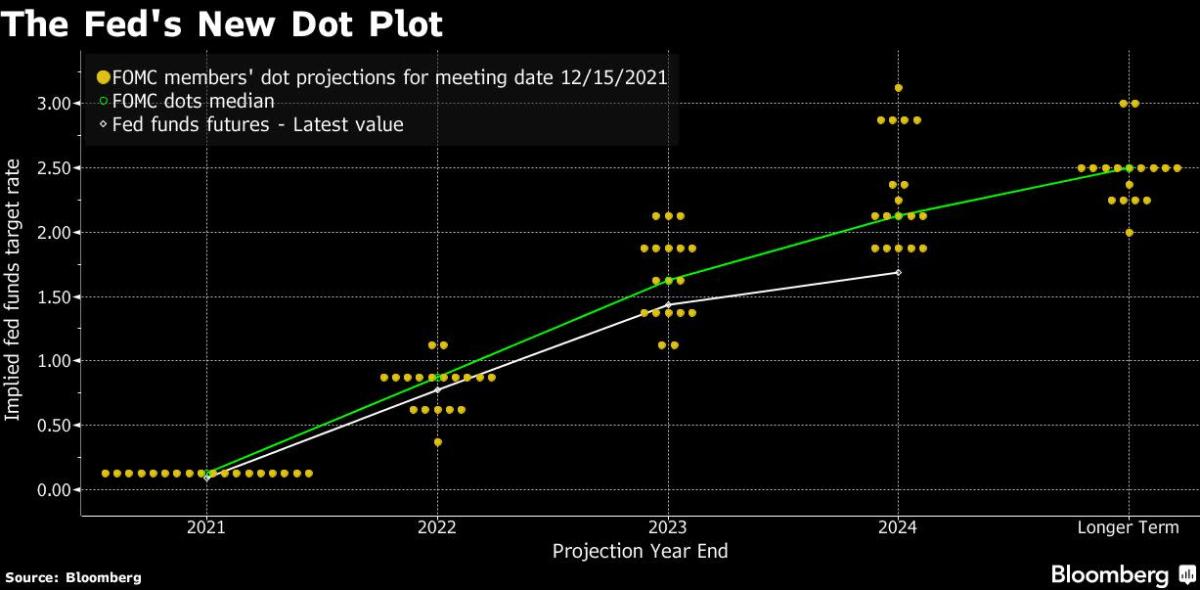

U.S. central bankers, responding to the hottest inflation in a generation, are hurrying to end pandemic policy support while signaling they’ll raise interest rates sooner than expected. All officials in December indicated they backed raising rates from near zero this year, with a median estimate showing three hikes, compared with nine of 18 officials in September who sought no increase at all in 2022.

Policy makers worry that price pressures will take root in the U.S. economy. They forecast strong labor markets even while the economy struggles with the omicron variant, which could prolong the pandemic’s disruption to the supply of goods, services and workers.

As Covid-19 spread in early 2020, Powell rapidly cut rates to zero, launched quantitative easing and began rolling out the biggest financial safety net in U.S. history to stem panic in markets and keep credit flowing to U.S. companies.

In the midst of this, Powell also launched a new policy framework that committed the Fed to not preemptively raise rates as unemployment fell, in order to allow the benefits of a tight labor market to reach minority communities that have missed out in the past. U.S. unemployment fell to 3.9% in December, but the jobless rate for Black Americans rose to 7.1%.

Powell in his remarks lauded the Fed’s supervisory and financial oversight work over the past four years. “We worked to improve the public’s access to instant payments, intensified our focus and supervisory efforts on evolving threats such as climate change and cyberattacks, and expanded our analysis and monitoring of financial stability,” he said.

©2022 Bloomberg L.P.