(Bloomberg) — In the front-end of the U.S. rates curve, serious money is being put to work as traders position for the strong possibility that the Federal Reserve will hike interest rates at the March monetary policy meeting.

The move follows a number of bank strategists adjusting forecasts and calling for the Fed to raise interest rates four times this year, with the latest being Goldman Sachs’s strategy desk.

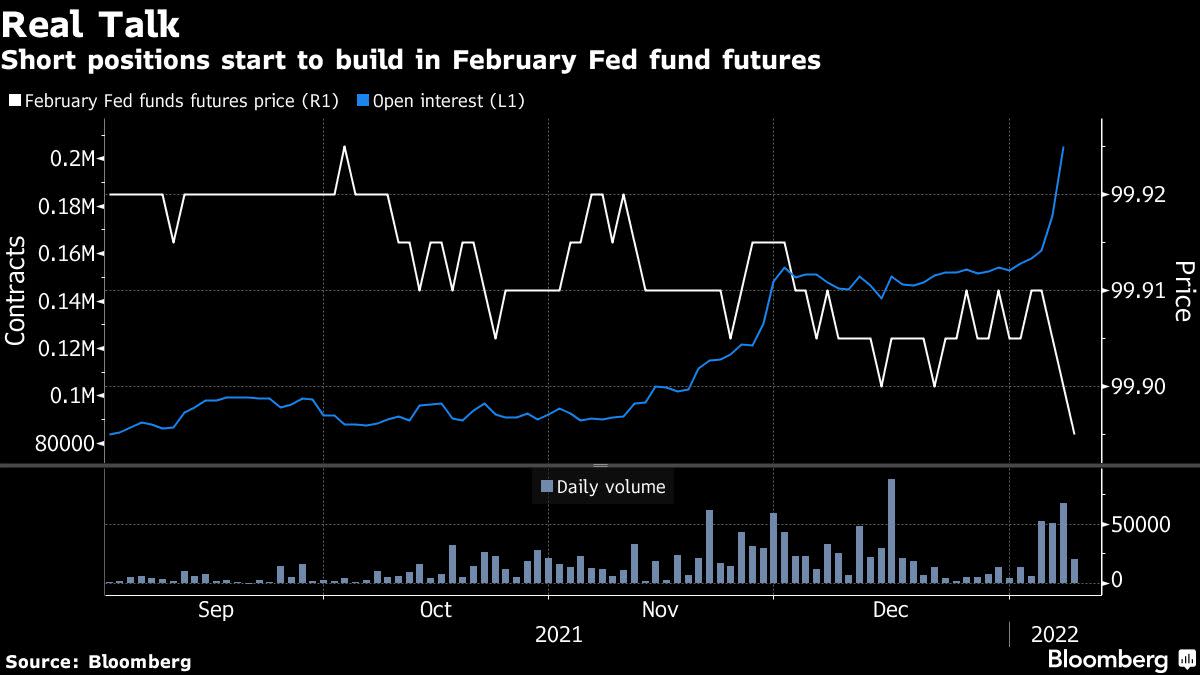

Traders are following these calls, putting cash to work in February Fed funds futures, driving an explosion in open interest. The amount of open positions — or open interest — in the contract now exceeds 200,000 futures as of Friday’s close, just north of $1 trillion in notional value. That’s the most out of all the tenors out to June 2023. The contract expires February 28 and is garnering interest because it is the last Fed funds futures that expires before the March 16 Federal Reserve rate decision.

Selling in the tenor was again evident in Monday’s early New York session, including one trade for a size of 15,588 holding a notional value of $78 billion. Last week most of the selling was seen Wednesday and Thursday after front-end swaps repriced a hike at the March meeting to 80% following the Dec. 14-15 meeting minutes release.

As of 10am New York, a March rate hike is priced at 86% chance. Despite the recent selling flurry, there still appears more downside room in the February Fed funds futures should March liftoff conviction grow.

©2022 Bloomberg L.P.