(Bloomberg) — Emerging-market central banks were the first in the world to raise interest rates from their pandemic lows last year. That proactive tightening is starting to pay off big time in boosting returns from their local bonds.

An index of debt issued by developing nations denominated in their own currencies has returned about 1% over the past three months, while a similar gauge of hard currency bonds has tumbled 2.9%, according to data compiled by Bloomberg.

The outperformance has come amid optimism the proactive central-bank policy was enough to get ahead of inflation, and should mean that further tightening is now less necessary into 2022. Improving economic conditions as the global recovery gets underway are also attracting investors to local debt.

“We have been gradually adding back to our local-currency bond exposure as valuations have become more attractive, current accounts have continued to improve, and many emerging central banks pre-emptively tightened monetary policy,” said Pierre Chartres, a fixed-income investment director at M&G Investments in Singapore. At the same time, “EM local currency bonds are often more volatile than hard currency EM bonds so it’s important to stay diversified,” he said.

Policy makers across emerging markets have gone on a tightening spree over the past 12 months to help contain inflation, most notably in Latin America. No fewer than 12 of the 20 biggest developing-nation central banks raised interest rates in 2021, tightening by a combined 2,300 basis points, according to a Bloomberg Intelligence analysis.

That beefed up rate premiums across the developing world and bolstered the appeal of emerging-market assets. In Brazil, for instance, the central bank has boosted its Selic rate by 725 basis points to 9.25%, while Chilean policy makers have increased their benchmark by 350 basis points to 4%. The Fed, meanwhile, has kept its target rate at a record-low 0.25% since March 2020.

“EM central banks have already reacted to the run up in inflation post the Covid growth slump, and the tightening of monetary policy conditions have almost run its course, particularly in Latin America,” said Anders Faergemann, a manager for emerging-market fixed income at PineBridge Investments in London. “On a forward-looking basis, we foresee inflation to decline and converge toward official central bank inflation targets, meaning the justification for further monetary policy tightening may cease.”

Read More: Once Underdog of Emerging Markets, Local Bonds Get Their Day

The rally in emerging-market local bonds has nevertheless been somewhat uneven, with relative performance driven by individual country dynamics. The biggest gainer among the 19 nations in the Bloomberg EM Local Currency Government Bond Index has been Chile with a return of 4.6% over the past three months, followed by Israel with 3.2% and China with 3%.

While local-currency bonds has largely prospered, their dollar-denominated cousins have been put under pressure by looming Fed tightening. The U.S. central bank has sounded increasingly hawkish in recent weeks with markets now pricing for a first rate hike as soon as March. Quickening inflation in the world’s biggest economy is also sapping demand for dollar debt. The U.S. consumer-price index jumped to 7% in December, the highest level in almost four decades.

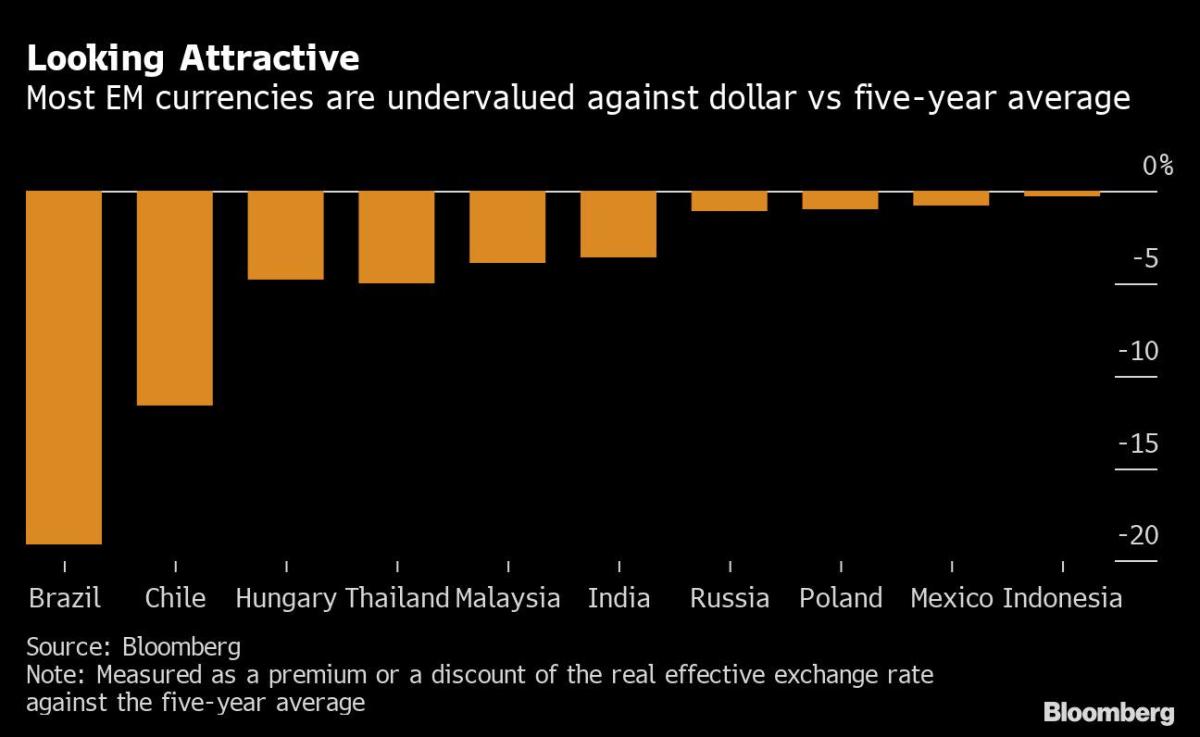

Local-currency bonds also look to have further room to gain if currency valuations are taken into account. The Brazilian real’s real effective exchange rate is 19% undervalued compared with its five-year average, while Chilean peso is undervalued by 12% and Hungary’s forint by 5%, according to data compiled by Bloomberg.

In the week ahead, there are plenty of items on the economic calendar to help determine the immediate direction of emerging-market local and dollar debt. Among them will be Chinese economic growth data, South African inflation and rate decisions from Malaysia, Indonesia and Turkey.

Here are some of the major events and data in emerging markets this week:

-

China will publish fourth-quarter GDP numbers on Monday, along with industrial-production and retail-sales figures. Any disappointments in the data may add to speculation the authorities will ease policy in coming months to support the economy

-

South Africa will release December CPI figures on Wednesday after inflation surged in November to the highest level in almost five years

-

Central banks in Malaysia and Indonesia will both announce policy decisions on Thursday, with economists projecting they will keep rates at their current record lows. Malaysia will also release December CPI on Friday

-

Turkey’s central bank will meet Thursday, after cutting policy rates by a cumulative 500 basis points over its four meetings since September

©2022 Bloomberg L.P.