An earlier version of this article misstated the average annual return of a 60%/40% portfolio mix. The article has been corrected.

The traditional portfolio mix of 60% stocks and 40% bonds, historically seen as the safest allocation for investors of moderate-risk tolerance, “is in danger” as the Federal Reserve gears up for its first interest rate hike campaign since 2015-2018, according to JPMorgan Chase & Co. analysts.

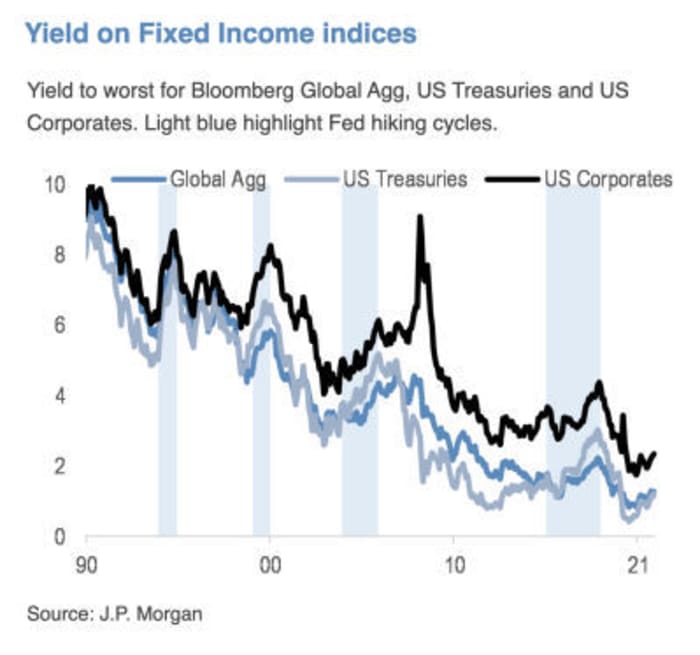

Treasurys, hammered by the prospect of rate hikes in coming months, are off to their worst start to a new year in the past three or four decades, based on Dow Jones Market Data. The aggressive selloff in bonds has pushed yields to two-year highs this week, which is exacting a toll on stocks. All three major stock indexes are down for 2022 — with the tech-heavy Nasdaq Composite COMP taking the biggest hit, falling more than 7%.

The broad-based selloff of both asset classes in 2022 has led to a year-to-date loss of 3.2%, as Tuesday, in portfolios made up of 60% in the S&P 500 index SPX and 40% in investment-grade bonds, including Treasurys. That’s a turnabout from the past, when bonds would act as a hedge against stock-market declines, rising in price and demand as investors flocked to safe havens during equity selloffs. The 60/40 mix has generated a historical average annual return of 9.1% from 1926 to 2020, according to Vanguard Group

“The market’s biggest worries seem to now be revolving around the Fed and the implications of rising rates,” JPMorgan strategist Thomas Salopek and others wrote in a note released Wednesday. In their view, there’s still “a substantial catch-up that needs to happen in rates markets.” Moreover, the market’s expectations for where the Fed’s rate-hike cycle ultimately ends up “have room to rise further.”

Futures markets are currently pricing in an almost 92% chance of a 25-basis-point hike in March, but also reflect a 5.4% likelihood the hike could turn out to be a 50-basis-point move, which would lift the fed-funds rate target to 0.5% to 0.75% from a current level of zero to 0.25%, based on the CME FedWatch Tool. By year-end, traders see a slight risk that the Fed’s policy-rate target could get to as high as 1.75% to 2% or even 2% to 2.25%.

That’s significant because Treasury yields, which partially reflect expectations for U.S. interest rates, would likely need to continue rising from current levels — which would have multiple knock-on effects. Beyond making the cost of borrowing more expensive on everything from mortgages to auto and student loans, higher yields also trigger selling pressure for technology and other growth stocks, as investors discount expectations for future cash flow far into the future.

Source: JPMorgan Chase & Co.

Jeff deGraaf, founder of Renaissance Macro Research, wrote in a Wednesday note that “the higher the level and the faster the surge in rates, the worse the returns” for the S&P 500 SPX in the next six months.

Read: Here’s the warning signal that surging bond yields are sending stock-market investors

Fixed-income investors face “one of the most challenging” backdrops in recent history, Salopek and the other JPMorgan strategists wrote. Meanwhile, “equities should be able to withstand policy normalization,” though “the impact on sectors will be far from uniform.”

They said they’re maintaining their longstanding preference for “Value/Cyclicals vs Growth/high-duration names.”

Salopek and his team aren’t alone in their views about the danger facing the 60/40 portfolio, even if nearly a decade of calls for its demise haven’t exactly panned out. BlackRock Inc., the world’s largest asset manager, says in a post on its website that “it’s time to rebalance the lopsided 60/40 portfolio with alternative sources of diversification and return.”

“Calls for the demise of the 60/40 portfolio have been correct for years,” said Phillip Toews, the New York-based chief executive of Toews Asset Management, which oversees $1.3 billion in assets. “The demise has just been delayed due to the availability of easy money from the Fed.”

“The Fed has propped up the bond and stock markets, and now may be in a position where it won’t do either,” Toews said via phone Wednesday. The Fed “put,” a term used to describe the market’s expectation of a Fed willing to intervene in a falling stock market, “is kaput, gone —- at least as it pertains to financial assets.”

Calls for the 60/40 mix’s demise began to re-emerge around August 2019, after trade tensions between the U.S. and China under the Trump administration led to worries about a slowdown in global growth.

The formula was called into question again in mid-2020 as the 10-year Treasury yield hovered just above zero, and seemed likely to stay there. At the time, Jan Loeys of JPMorgan suggested investors adopt a portfolio that’s 40% stocks, 20% bonds and 40% invested in securities with some characteristics of both. Those would include collateralized loan obligations, commercial mortgage-backed securities, real-estate investment trusts or utility stocks.

While the 2020 concerns were largely focused on how much cushion low yields could offer in a stock selloff, ““the current worries look in the other direction: with real rates still too low relative to economic conditions, and a Fed hiking cycle about to begin, it is very likely bonds will produce negative returns as yields rise in a bear flattening,” Salopek wrote in an email to MarketWatch. “So we look to be underweight duration in our asset allocation, with a target of 2.25% for the 10-year Treasury yield in 2022.”

Salopek says he and the other JPMorgan strategists aren’t calling for 60/40’s demise, “but we recognize it has shortcomings in certain market environments,” and “there are times when one of more of the asset classes will underperform.”