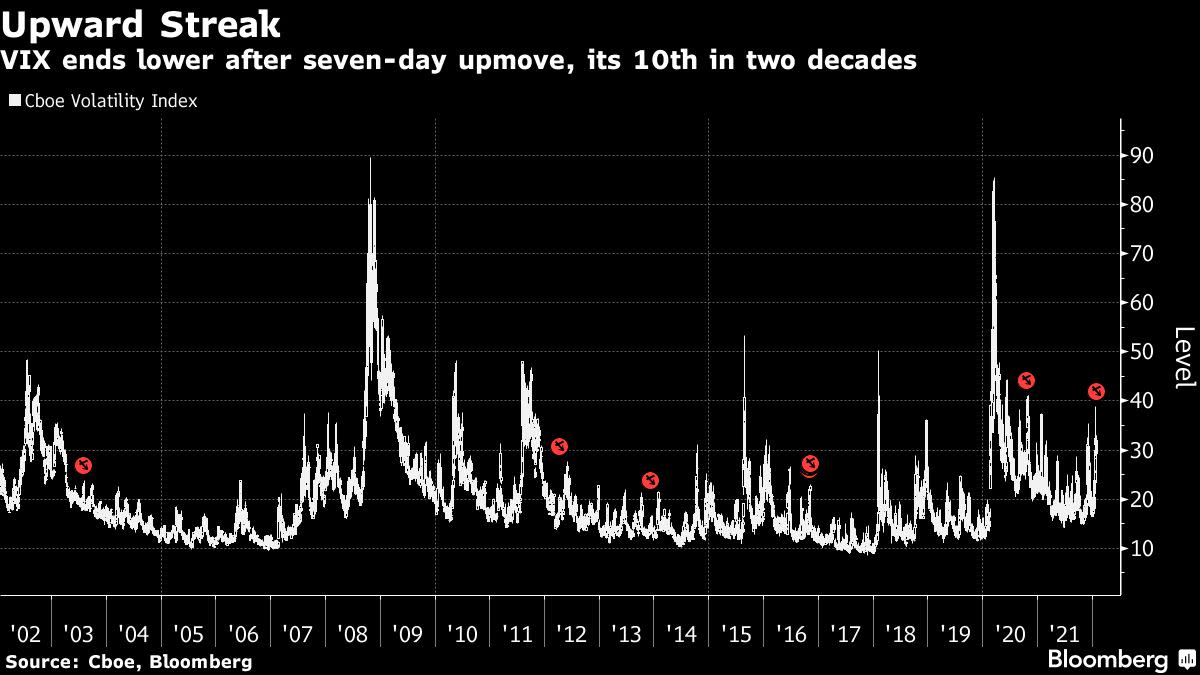

(Bloomberg) — Seven straight jumps in the so-called “fear gauge” for the S&P 500 is a signal that it may be time to wager against volatility, if history is any guide.

Only 10 times in the past two decades has the Cboe Volatility Index — better known as the VIX — risen for that many trading sessions in a row. Investors who shorted the gauge after the previous nine streaks of that length would have earned a return of nearly 19% after 20 days, according to data compiled by Bloomberg.

The most-recent round of stair-stepped volatility increases ran from Jan. 18 to Jan. 26, when the Federal Reserve had its latest policy meeting. The VIX fell the following day, signaling more clarity and, seemingly, less fear about interest rates and yields.

The Fed’s hawkish pivot to fight inflation has triggered a selloff in stocks on worries about receding stimulus and the risk of slower economic growth. Some Wall Street strategists now argue it’s time to buy the dip, which usually means volatility should ebb, too.

“The market may continue to slide, but we think so will volatility as volatility exhaustion is setting in,” Michael Purves, chief executive officer of Tallbacken Capital Advisors LLC, wrote in a note the day before the Fed meeting.

Another technical indicator comes up with a similar result: The VIX put/call ratio reached its highest level since October on Wednesday, according to Chris Murphy, derivatives strategist at Susquehanna International Group.

That gauge’s level could end up being a “peak,” he said, noting that similar readings were strongly bullish signals for the S&P 500. Among the 16 peaks that were higher than this week’s, the S&P 500 was higher a month later 13 times, with an average 4.2% gain, Murphy said.

©2022 Bloomberg L.P.