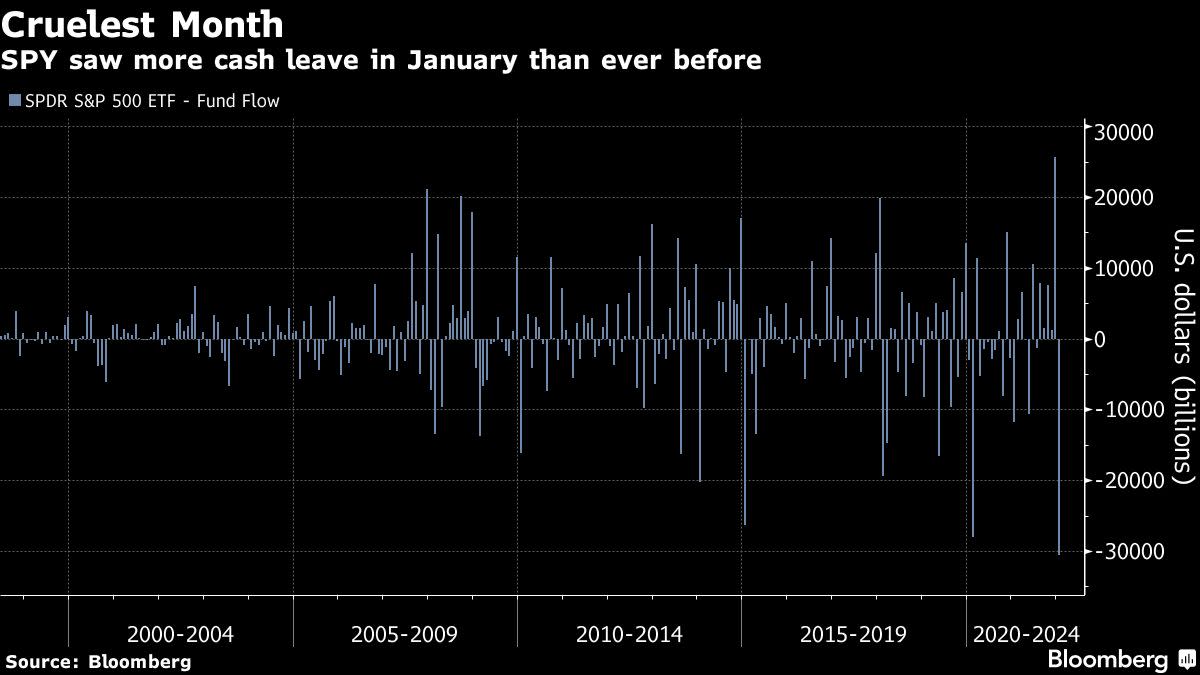

(Bloomberg) — The world’s biggest exchange-traded fund posted its worst monthly outflow in its near three-decade history with investors selling the Monday stock rebound en masse.

The $407 billion SPDR S&P 500 ETF Trust, known by its ticker SPY, in January saw its biggest redemption since launching in 1993, according to data compiled by Bloomberg, underscoring weeks of turmoil in U.S. large-cap companies.

Some $6.96 billion exited Monday alone — the largest daily outflow in almost four years — as the S&P 500 jumped 1.9%.

The January exits were not contained to the S&P 500 fund. The $191 billion Invesco QQQ Trust Series 1 (QQQ), which follows the Nasdaq 100 Index of tech names, posted its largest investor exodus since the dot-com collapse as about $6.2 billion fled.

The Monday SPY flow is a sign that a cohort of traders may be taking advantage of the recent stock bounce to pare broad-market positions via liquid trading vehicles. Futures for the main U.S. equity gauges were fluctuating on Tuesday morning in New York.

“Investors are worried the rally could be a head fake,” said Athanasios Psarofagis, an ETF analyst with Bloomberg Intelligence. “These feel like sell-into-strength flows.”

U.S. stocks have endured a volatile start to the year, as investors adjust expectations for inflation and the pace of monetary tightening in the world’s largest economy. Rising bond yields have spurred traders to re-evaluate shares at near-record prices.

Despite a late bounce, the S&P 500 closed the month down 5.3%. In turn, trading volumes have surged to a record by value in the ETF market. The biggest vehicles like SPY have become ever-more prized for their liquidity, which means short-term inflows and outflows can be elevated.

Even as investors soured on large-cap funds, equity ETFs overall in the U.S. recorded net inflows in January of about $23 billion, the data show. Much of that cash went toward funds with international exposure, as well as more targeted trades.

The Financial Select Sector SPDR ETF (XLF) and Vanguard Value ETF (VTV) were among the flow leaders with $3.9 billion and $2.3 billion, respectively.

“People are being more targeted,” said Psarofagis. “For instance, energy has been one of the best sectors since the top and you won’t get much of that in broad-based indexes.”

©2022 Bloomberg L.P.