(Bloomberg) — Panasonic Corp. is renovating a facility in Japan to start testing mass production of a new type of lithium-ion battery that’s championed by Tesla Inc. as the key to unlocking cheaper electric vehicles.

Panasonic will start test production of a next-generation “4680” battery at a facility in Japan’s western Wakayama Prefecture, Chief Financial Officer Hirokazu Umeda said Wednesday at a briefing on the company’s quarterly financial results. The company will also set up a prototype production line for the batteries early this year in Japan.

After the testing, a new mass production line will be set up, likely also in Wakayama, Umeda said.

The CFO made the comments after Panasonic reported earnings, posting an operating profit of 73 billion yen ($640 million) for the recently ended quarter. That fell short of analysts’ average forecast for 107 billion yen as its consumer electronics business was hit by increased material prices.

Shares fell as much as 6.7% in Tokyo trading on Thursday.

The 4680 batteries — named after their dimensions of a 46-millimeter diameter and 80-millimeter height — hold more than five times the capacity of the smaller 1865 and 2170 cells Panasonic currently supplies to Tesla. This means that fewer cells and related parts are needed in an EV, which in turn has the potential to lower its overall cost.

The 4680 battery was first unveiled by Elon Musk, Tesla’s chief executive officer, at an event in 2020. Musk touted the batteries as a “massive breakthrough” in cell technology that will make it possible for his company to produce EVs that sell for $25,000.

While Tesla plans to make the cells in-house, it has asked Panasonic to begin producing them as well. The Japanese company has said it will seek to sell the batteries to EV makers other than just Tesla.

For now, with regard to 4680 batteries Panasonic is “receiving strong requests from Tesla,” Umeda said Wednesday. “We’ll first prioritize supplying Tesla once the verifications are complete,” he said.

Analysts had cautioned that the new 4680 cells could prove difficult to mass-produce given that their size can lead to safety issues such as overheating. Umeda said Wednesday the company’s initial tests resulted in a “performance-satisfying prototype” of the new cell.

The electronics maker’s decision to designate a domestic site for its 4680 cell production comes after it struggled to expand production at the Gigafactory plant it jointly operates with Tesla in Nevada. The 4680 production site is close to Panasonic’s corporate headquarters in Osaka, allowing it to easily dispatch veteran engineers to fine-tune its machinery.

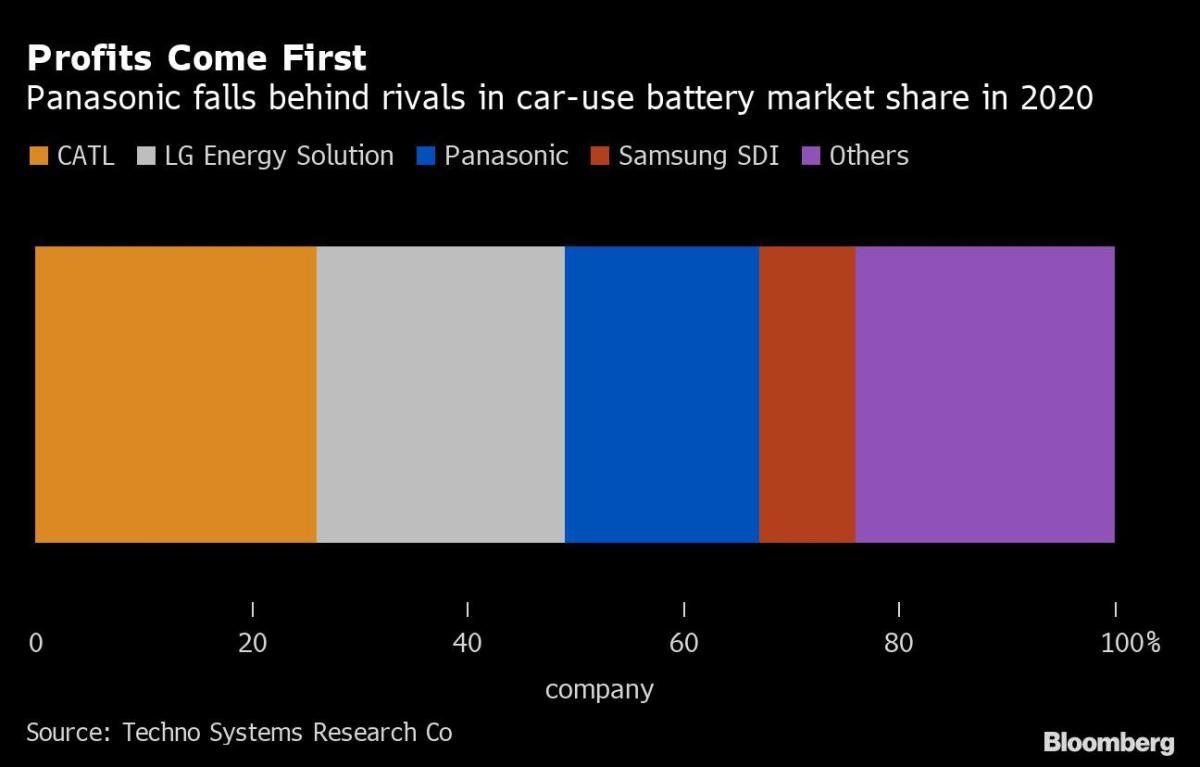

Battery rivals such as LG Energy Solution and Contemporary Amperex Technology Co. are also stepping up investment to beef up their capacity. Compared with other EV battery heavyweights, Panasonic has been slow to build scale, instead touting the safety advantage of its batteries and stressing that it prioritizes profit over market share.

©2022 Bloomberg L.P.