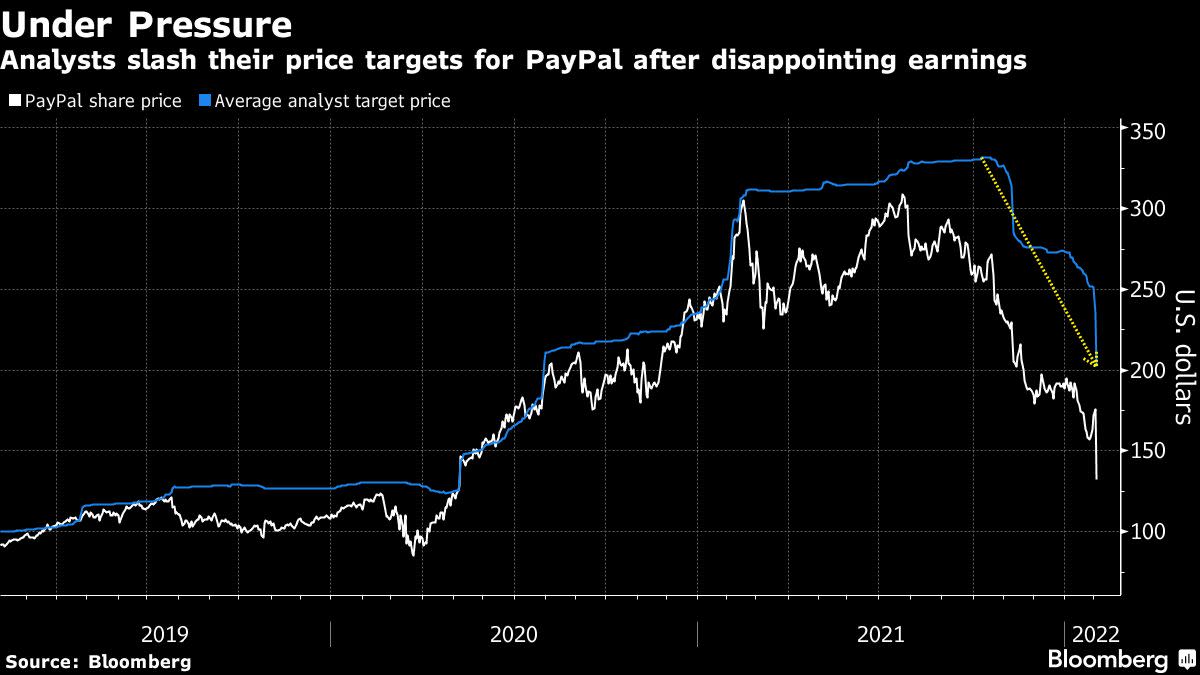

(Bloomberg) — There’s a disappointing earnings report and then there’s what PayPal Holdings Inc. just posted, which immediately prompted at least 27 Wall Street analysts to cut their price targets.

The digital payments company reported on Tuesday worse-than-expected growth and abandoned its 2025 expectations for active accounts — the sharp revision triggered a selloff in the stock that only got worse on Wednesday as a cascade of analysts adjusted their future price expectations. The stock fell nearly 30%, its biggest intraday decline ever, wiping out $53 billion in market value.

As per the new price-targets? PayPal’s average 12-month target now sits at roughly $202, down from the $276 it was cut to in late November following underwhelming third quarter results. The stock has lost 58% since reaching a record high of $309 in July, dragging it to its at lowest level since May 2020.

The main issue for Wall Street — outside of the surprising growth miss — was the fact that its outlook for the future was far less rosy than many had anticipated.

“While directionally the below consensus guide is not a surprise to us, the magnitude of the impacts are clearly more severe,” said Cowen analyst George Mihalos. He cut his target price on the stock to $174 from $221 previously but maintained his outperform rating.

Read more: PayPal Gets Stung by ‘Bad Actors,’ Shuts 4.5 Million Accounts

Other analysts took an even more bearish stance on the company, with at least three firms including Raymond James, BTIG and Oddo BHF downgrading the stock to a hold-equivalent rating.

“We struggle to see how the stock garners a higher multiple in the short to medium term,” wrote Raymond James analyst John Davis. “Estimates are heading significantly lower for the second consecutive quarter, and we believe the stock is fully valued,” he added.

To be sure, not everyone has adopted a negative outlook for the stock. D.A. Davidson analyst Chris Brendler slashed his target price for PayPal by 40% but maintained his buy rating and called some parts of the fourth quarter results encouraging. “While the dramatic fall from grace is unnerving, we take solace in several key positives beneath the surface that suggest better trends ahead,” Brendler said .

“Although we understand the temptation to give up, we continue to view PayPal as a long-term winner in an attractive sector.”

After touching a low of $129.01, PayPal shares were last trading at $130.59, down 26% on the day.

©2022 Bloomberg L.P.