(Bloomberg) — Slow progress on a plan by the biggest economies to help debt-ridden developing nations restructure what they owe is spurring concern from the International Monetary Fund and World Bank about vulnerabilities as a $35 billion bill comes due and U.S. interest-rate increases loom.

More than a year since the Group of 20 set up the so-called Common Framework to reorganize the debt of countries in danger of default, a lack of coordination and transparency has hampered the process. Chad, Zambia and Ethiopia — the only nations among about 70 eligible ones that have applied — remain mired in talks. And Ethiopia had its credit rating cut just for applying, prompting nations like Mauritania to avoid the process.

“The framework has yet to deliver on something that may act as a catalyst for others,” World Bank Chief Economist Carmen Reinhart said. Creditors have been too slow to accept that they’re going to earn less from their investments, she said.

The urgency to avert what IMF chief Kristalina Georgieva terms “economic collapse” for some countries is growing after the G-20’s reprieve on debt-service payments for about 70 struggling nations — in place since May 2020 — ended in December. The World Bank estimates that the world’s poorest countries, which comprised most of the nations eligible for the debt-service suspension, owe $35 billion in payments in 2022.

The framework requires private creditors to participate on comparable terms to government lenders. It connects the six-decade-old Paris Club of creditors in mostly western nations with China, now the biggest lender to low-income countries. The IMF and World Bank — which pledged to help with debt-sustainability analyses, policies and new lending — championed the initiative as a faster process that would reduce costs.

Suggested Fix

The institutions have suggested adjustments to the framework, including giving nations a debt standstill during their negotiation with creditors. World Bank President David Malpass last month called on China to participate more in the restructuring processes.

A meeting of G-20 finance chiefs in Indonesia this month presents an opportunity to make it more effective, said Susan Lund, the chief economist of the International Finance Corp., the World Bank’s private-sector lender. Too many creditors are holding out and waiting for others to accept losses, she said.

“It’s a classic free-rider problem,” Lund said. Creditors “need to step up to take a haircut. You don’t want this to worsen even more.”

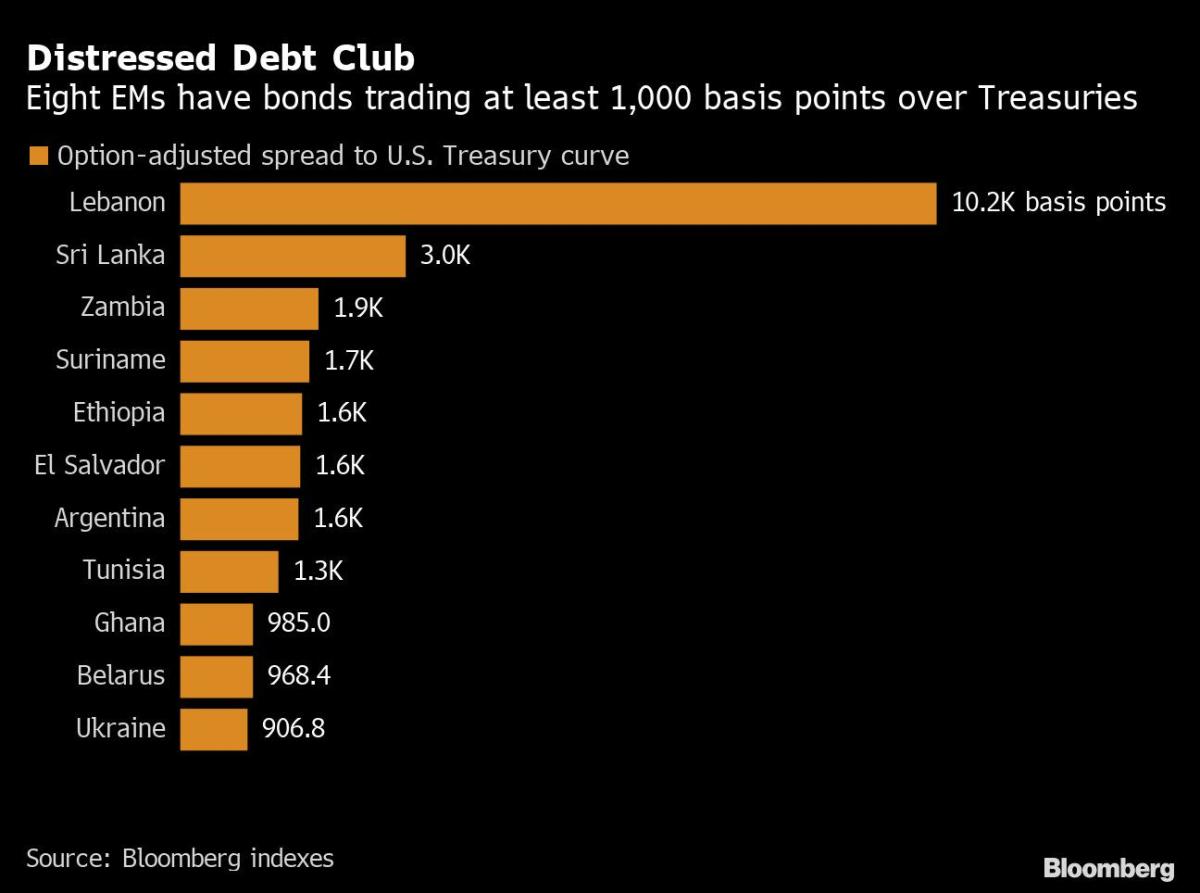

Meanwhile, the list of nations in trouble grows. About 60% of low-income countries are at high risk or already in debt distress, double 2015 levels, the IMF says. Eight developing economies have dollar-denominated government bonds that pay at least 1,000 basis points more than U.S. Treasuries, which is above the threshold for debt to be considered distressed, according to data compiled by Bloomberg.

Framework timelines need to be improved, and the formation of creditor committees and early engagement with the debtor country should go more quickly, said Guillaume Chabert, deputy director at the IMF’s strategy, policy and review department.

Private creditors aren’t having their perspective sufficiently taken into account in the IMF’s analysis of needed debt reductions, said Kevin Daly, investment director at Aberdeen Standard Investments, which holds Zambian bonds. That creates the risk of “a big gulf between what the IMF requires and what these creditors feel is necessary,” Daly said.

The IMF engages regularly with private creditors, including through the Institute of International Finance, which represents global financial companies, the fund’s Chabert said. Debt-restructuring negotiations are done directly between the debtor nation and its creditors, he said.

The Zambian finance ministry said that the nation is committed to transparency and treating creditors comparably.

Ethiopia’s State Minister for Finance Eyob Tekalign said the nation has been cooperative with the process and is disappointed that it hasn’t been completed, calling on all parties to intensify efforts.

A Chad finance ministry spokesperson declined to comment.

The process needs more urgency, said Masood Ahmed, president of the Center for Global Development, a Washington-based think tank.

Until now in the pandemic, the need to restructure debt has been “mostly a low-income country problem,” Ahmed said. “But if interest rates really move up and cause unexpected market surprises, you could also see some of the emerging markets that have high levels of debt feeling vulnerable.”

©2022 Bloomberg L.P.