(Bloomberg) — A potential escalation of the standoff at Ukraine’s border risks hitting economies and companies around the world, and catching a number of investors off guard.

The long-simmering tensions over Russia’s troop buildup in the region has the potential to trigger a new bout of market volatility, just as equity markets struggle to digest a less favorable macroeconomic backdrop, which sparked the recent rout.

Amid fears over a hawkish shift from the Federal Reserve, risk assessments by investors have focused mainly on concerns around central banks tightening policy, eclipsing other risks such as the potential for military conflict on Europe’s eastern fringe, according to UBS strategists led by Bhanu Baweja.

“Little or no Russia-Ukraine risk appears to be priced in,” they said in a note earlier this week.

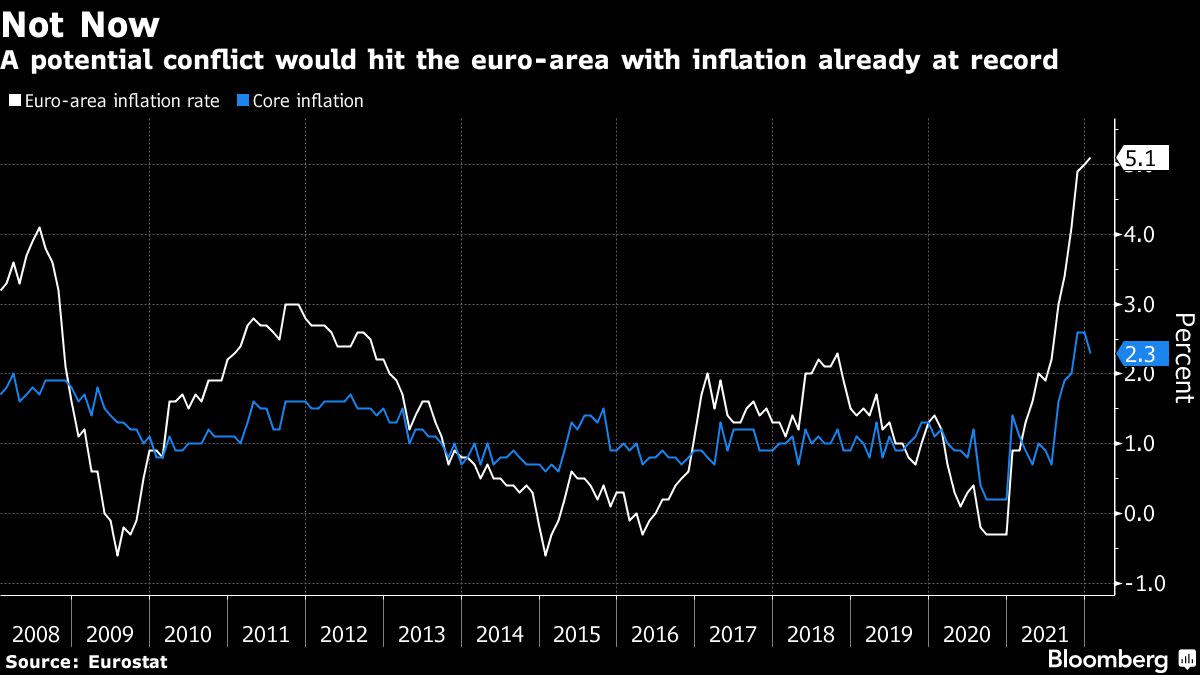

Europe is already battling surging living costs and a rocky recovery from the coronavirus pandemic. Adding uncertainty from a potential Russian invasion — which the Kremlin has denied it’s planning — could plunge the region into stagflation, according to Amundi SA, Europe’s biggest asset manager.

Investors should “be ready to reduce risk should the situation materially deteriorate,” Amundi strategists led by Alessia Berardi said.

With the prospect for energy disruptions and punitive sanctions, German and Eastern European companies, Russia-focused banks and companies with significant sales in the country look exposed. While the fallout isn’t expected to last long, the impact could be sharp.

Here’s how the crisis is expected to affect markets:

German, East European Fallout

Russia is Europe’s main energy supplier, and any disruption to gas deliveries would be a particular issue for German manufacturers such as Volkswagen AG, Siemens AG and BASF SE. Europe’s largest economy has become even more reliant on Russia gas as it turns off nuclear power plants.

Germany’s equity markets look more vulnerable than other country indexes, Goldman Sachs Group Inc. strategists led by Lilia Peytavin wrote in a note.

Amundi’s strategists said a blow from military conflict would be hard for Eastern Europe, especially markets like Warsaw.

“Some regional companies have business exposure to Ukraine and some Ukrainian stocks, especially in the agricultural sector,” they said in a note.

Wider Ripple Effects

Goldman strategists said European firms such as tiremaker Pirelli & C. SpA would suffer from a rise in prices of oil derivatives.

JPMorgan Chase & Co.’s own list of stocks with high exposure to Russia includes German packaging company Verallia Deutschland AG, London-based Eurasia Mining Plc and Austrian oil services company Petro Welt Technologies AG.

Over in Asia, companies ranging from Singapore’s Food Empire Holdings Ltd. to Japan Petroleum Exploration Co. and coffee maker CCL Products India Ltd. appear vulnerable due to their high ratio of sales in Russia. That’s also an issue for Swiss-based drinks bottler Coca-Cola HBC AG, according to Morgan Stanley strategists.

Banking Blow

Morgan Stanley’s strategists said Sberbank, Russia’s largest bank, is the well-owned stock most exposed to geopolitical risk.

Raiffeisen Bank International AG became the first large European lender to say it’s setting aside money to deal with potential fallout from the crisis this week. The Austrian lender depends on Russia for 19% of its revenue, according to Goldman.

“Business is running normally despite the geopolitical tensions,” Chief Executive Officer Johann Strobl said in a statement. “Nevertheless, we are monitoring developments very closely.”

Already Hit

Russian stocks have underperformed over the past few months amid heightened tensions with the West and the prospect of sanctions.

VanEck Russia ETF, the largest exchange-traded fund tracking Russian equities, continues to be a vehicle to bet against the market. In early January, short interest climbed to more that 30%, the highest in at least a year. The level slipped to 26% as of Friday, according to data from S3 Partners.

How Russia Risks New Wave of Sanctions Over Ukraine: QuickTake

Safe Havens?

Despite the widespread risk, some companies could be better positioned. European oil and gas companies — such as France’s TotalEnergies SE and Norway’s Equinor ASA — would benefit from a spike in energy prices, while health-care stocks also tend to outperform when risks rise, according to Goldman’s strategists.

Meanwhile, Morgan Stanley strategists led by Marina Zavolock said Russian food retailer Magnit PJSC and digital bank TCS Group could benefit from de-escalation, while Lukoil PJSC offers a 23% spot dividend yield.

Short-Lived Turbulence

Despite the risk of conflict, equity strategists have yet to change their broader outlook for European markets. Expectations are that even a military incursion would spark a short-lived rout resembling the turbulence following Russia’s 2014 annexation of Crimea.

In that case, Goldman estimates a negligible negative impact on the European economy. Any costs in terms of a slowdown would be compensated by a weaker euro, which would be expected to boost profits of the continent’s companies.

“Historically, military conflicts — as long as they were relatively localized — haven’t tended to derail financial markets for too long,” JPMorgan strategists said in a note in January.

©2022 Bloomberg L.P.