One of the most successful investors in the entire history of the U.S. stock market, and arguably the most famous of our era is Warren Buffett. His annual reports for Berkshire Hathaway have long been considered required reading for any serious fundamental or value-oriented investor because of the way he outlines his views of current conditions and where he is finding useful opportunities to keep his capital working for him. As a value investor, I’ve borrowed from the principles I’ve seen Mr. Buffett lay out in his annual reports to develop my own approach to value identification.

Snippets and quotes from Buffett’s writings and interviews can be found just about anywhere, but one of the most pertinent to a value-oriented investment approach is, “It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.” That concept is something that has reinforced my approach to both fundamental and value analysis over the years and helped me refine my own system to what it is today.

One of the things that the last few years – even before the global coronavirus health crisis became an everyday conversation topic – has made very clear, at least from an economic perspective, is the difference between “fair” companies and “wonderful” ones. It isn’t as simple as looking at the way a stock’s price has moved, no matter what talking heads and growth-oriented investors would have you believe, and right now it isn’t just about finding companies that have been shielded from the ongoing effects of the COVID-19 pandemic. It isn’t even about finding sectors or industries that may not be as exposed to downside from difficult conditions. The truth is that every sector of the economy has had to find ways to adjust to the current economic climate – and that is often where the difference between “wonderful” and “fair” lies.

One of the sectors that has been really interesting to watch over the past two years is the Industrial sector. This segment is interesting because when economic activity picks up, a comparable increase in demand for many of the companies in this space is generally anticipated. A healthy real estate market with persistently high demand in multiple areas of the country in 2021, for example, meant that home builders could keep new projects going. That is usually is good news for Machinery stocks like Paccar Inc. (PCAR). Real estate and construction is hardly the only place PCAR operates, of course; it is really just one example where continued high housing demand in a lot of areas of the country should give this company’s business a lift. PCAR’s leading position in the industry in battery-electric trucks has attracted the interest of analysts, many of whom expect the company to benefit from increasing attention from the public and the government in charging station infrastructure to facilitate wider adoption of electric vehicles, even in heavy equipment and machinery.

PCAR’s stock underperformed for most of 2021, falling from a January high at around $103 to a low in October at close to $78 per share. From that point, however the stock has picked up a lot of momentum, moving into a new short-term upward trend that peaked at the start of this year at around $96, and establishing a new, higher consolidation range between support and resistance. This is a company that has come through the last two years with a generally healthy balance sheet and operating profile, with a leading position in the U.S. trucking market. Could that also translate to a useful opportunity to work with it on a long-term, value-oriented basis? Let’s find out.

Fundamental and Value Profile

PACCAR Inc (PACCAR) is a technology company. The Company’s segments include Truck, Parts and Financial Services. The Truck segment includes the design, manufacture and distribution of light-, medium- and heavy-duty commercial trucks. The Company’s trucks are marketed under the Kenworth, Peterbilt and DAF nameplates. It also manufactures engines, primarily for use in the Company’s trucks, at its facilities in Columbus, Mississippi; Eindhoven, the Netherlands, and Ponta Grossa, Brazil. The Parts segment includes the distribution of aftermarket parts for trucks and related commercial vehicles. The Financial Services segment includes finance and leasing products and services provided to customers and dealers. Its Other business includes the manufacturing and marketing of industrial winches. The Company operates in Australia and Brazil and sells trucks and parts to customers in Asia, Africa, Middle East and South America. PCAR has a current market cap of about $32.8 billion.

Earnings and Sales Growth: Over the last twelve months, earnings increased by about 26.65%, while revenues increased a little more than 20%. In the last quarter, earnings grew by more than 36%, while revenues were nearly 30% higher. The company’s margin profile is stable; over the last twelve months, Net Income was 7.87% of Revenues, and weakened only slightly to 7.65% in the last quarter.

Free Cash Flow: PCAR’s free cash flow is healthy, at about $1.445 billion over the last year. That translates to a modest Free Cash Flow Yield of 4.41%. It also marks an increase from the last quarter, when Free Cash Flow was a little over $1.12 billion, but below the $2 billion mark from a year ago.

Debt/Equity: The company’s Debt/Equity ratio is .60, which is a pretty conservative number for stocks in this industry. PCAR’s balance sheet shows $3.77 billion in cash and liquid assets in the last quarter (up from $3.3 billion at the start of 2020) against $6.8 billion in long-term debt. Their operating profile indicates that profits are sufficient to service their debt, with healthy liquidity to provide additional flexibility.

Dividend: PCAR’s annual divided is $1.36 per share and translates to a yield of about 1.44% at the stock’s current price. Management increased the dividend payout from $1.28 per share at the beginning of 2021, which is a positive sign of confidence and strength.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target around $62 per share. That means the stock is overvalued at its current price, by about -35%, with a useful value price down at around $49 per share. It is also worth nothing that in the last quarter of 2021, this same analysis yielded a fair value target at around $71 per share and was around $87 a year ago.

Technical Profile

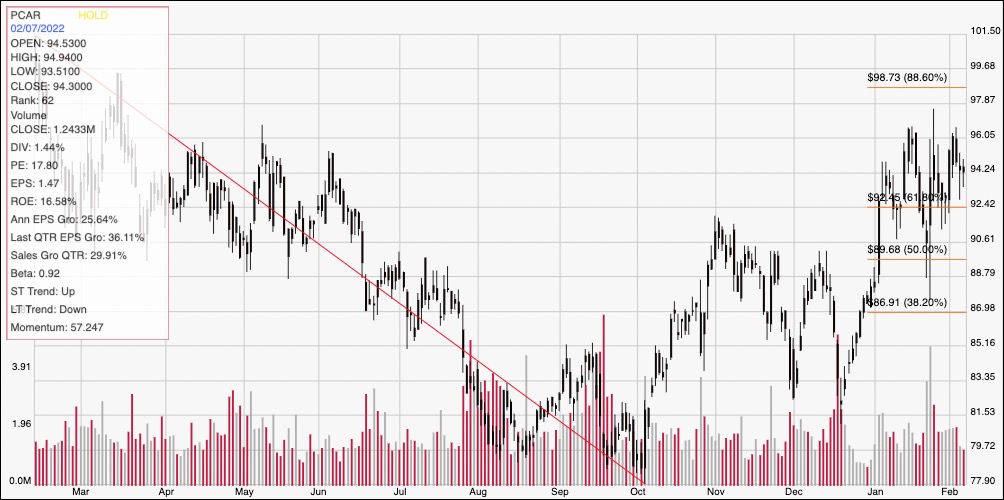

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The chart above shows the last year of price activity for PCAR. The red diagonal line traces the stock’s downward trend from its February 2021 peak at around $101.50 to its low in October at around $78. It also provides the baseline for the Fibonacci retracement lines shown on the right side of the chart. The stock has picked up a lot of bullish momentum since the bottom of that downward trend, peaking in mid-January at around $96. It has since started to settle into a new consolidation range, with immediate resistance sitting at $96 and current support at about $92.50, inline with the 61.8% retracement line. A push above $96 should find next resistance at around $99, around the 88.6% retracement line, while a drop below $92.50 could see the stock drop to about $89 before finding next support based on previous pivot activity in June, July and December of last year.

Near-term Keys: PCAR’s fundamentals are solid, but after improving for most of last year have slid back a bit in the last two quarters. That is a concern that is only partially offset by strength in their balance sheet. The real moral of the story from a valuation standpoint lies in the way the stock’s value proposition has shifted to the negative; the stock would need to reverse the current upward trend significantly before it can be taken seriously as a useful bargain. It also means that the best possibilities lie on the short-term side, via momentum-based trades. A push above $96 could offer an interesting opportunity to buy the stock or work with call options, with an eye on $99 as a useful, near-term profit target. If the stock drops below $92.50, consider shorting the stock or buying put options, using $89 as a practical exit target on a bearish trade.